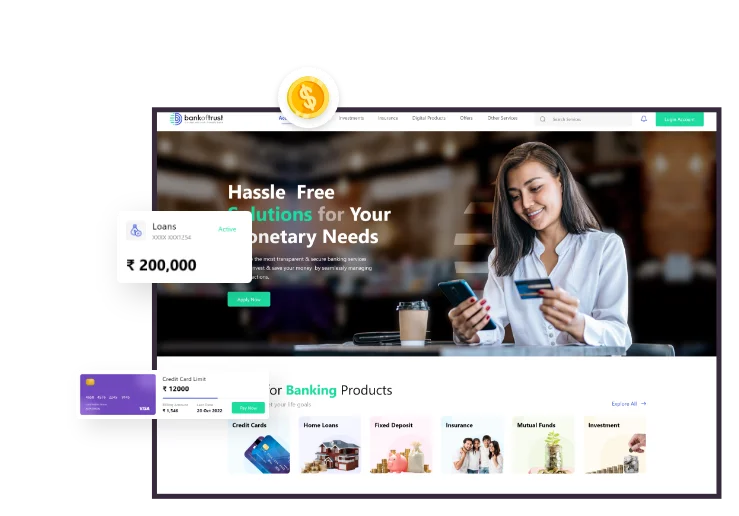

Custom BFSI Software Development Solutions for Banking, Finance & Insurance

Secure new opportunities to outsmart your competitors with our custom Banking, Finance and Insurance (BFSI) solutions development services.

Hire Industry ExpertsOur BFSI Service Offerings

We deliver secure, scalable BFSI digital solutions that streamline operations, enhance customer experiences and drive financial growth.

Policy Management Systems

We build robust digital platforms to simplify end-to-end policy lifecycle-creation, issuance, renewals, endorsements and cancellations-ensuring seamless operations for insurers and agents.

Claims Management Solutions

Our custom claims apps streamline FNOL (First Notice of Loss), automate approvals, track claim status and improve settlement accuracy with AI-driven analytics.

Underwriting Automation

We develop AI-enabled underwriting tools to assess risk, calculate premiums & reduce manual bottlenecks-improving decision accuracy and processing speed.

Insurance Customer Apps

Engage policyholders with mobile apps that enable easy policy viewing, premium payments, claim filing and 24/7 customer support through chatbots.

Fraud Detection Systems

We design intelligent fraud prevention solutions that monitor user behavior, detect anomalies & flag suspicious claims in real-time with predictive analytics.

Agent & Broker Portals

Custom web and mobile portals for agents and brokers to manage customer portfolios, track renewals & deliver personalized insurance products efficiently.

Regulatory & Compliance Tools

We build compliance-driven apps ensuring insurers meet regulatory standards, with automated reporting, KYC, data privacy & audit trail features.

Insurance Analytics Platforms

Our analytics dashboards empower insurers with insights into claim ratios, customer churn, risk exposure and operational efficiency to drive informed decisions.

Reinsurance & Risk Management Apps

We create specialized tools to support reinsurance contracts, risk sharing and exposure modeling-helping insurers strengthen financial resilience.

Our Customizable Solutions

Are Claim Delays Draining Your Profits?

Manual inefficiencies are expensive. Use our Insurance Claims ROI Calculator to uncover losses and project your AI-driven savings.

Essential Features of BFSI Solutions

We add smart features to banking, finance and insurance apps that make them safer, faster, and easier for people and businesses to use every day.

Easily handle many accounts in one place. See balances in real time, organize money better and move funds quickly with simple dashboards and clear controls.

Keep users safe with fingerprint or face login, extra password checks and AI tools that catch fraud fast, sending instant alerts to stop suspicious activity.

Use apps smoothly on iOS, Android or web. Customers can bank, pay or manage insurance anytime, anywhere, with the same look and reliable performance.

Smart tools powered by AI help calculate loans, taxes or investments. They study user data, predict results, and guide people to make better money choices.

AI studies big data to spot patterns, track customer behavior and predict future trends. Businesses get easy reports that help them decide faster and smarter.

Apps follow global rules like PCI DSS, GDPR and RBI standards. This keeps customer data safe and lowers risks for banks and financial companies.

With AI-based KYC, face scans and e-signatures, users get verified in seconds. It stops fraud while making onboarding smooth, fast and stress-free.

Why Choose Codiant as your Banking & Finance Company?

We offer tech-advanced customized banking, finance services & insurance solutions to help you stay competitive. Our varied services make Codiant the best development partner.

Customer-Centric

At Codiant, we adopt a customer-centric approach to prioritize your business-oriented requirements with custom designing & development.

Regulatory Compliance

We build solutions by following standard industry practices and guidelines to ensure that data security and privacy remain intact.

Credible Performance

Our developers are highly experienced and well-equipped to consistently deliver the best results that suit the business idea accurately.

Transparent Approach

From the initial stage till the deployment, we ensure to follow a transparent approach with our clients to keep them updated with every progress.

Segments We Serve in Capital Market Solutions

We work across all business areas, sectors and solutions to modernize your operating models and adaptable to market trends.

Improve assets visibility, reduce IT costs, and ensure optimum utilization of assets and compliance with regulatory requirements.

Leverage Codiant’s scalable and high-performance digital asset exchange solution for Cryptocurrencies, security tokens, FX, equities, margin trading, tokenization and more.

Mitigate threats & manage risks with Codiant’s (GRC) technology solution designed to deliver actionable data intelligence, advanced reporting, insights & aligned with your business objectives.

Our frameworks and product-based investment banking solutions are designed to address all your technology requirements related to the front, middle, and back offices.

Accelerate time to market, maximize the value of cloud and address complexities with Codiant’s investment management solution for financial services organizations.

Aiming for A Feature-Loaded Custom BFSI Solution!

We have an experienced and tech-advanced banking, finance & insurance web and app development expert team.

Contact Us

Proven Impact in the Insurance Sector

Delivering measurable outcomes that transform customer experiences, optimize operations, and unlock business growth for leading insurance enterprises.

18% faster claims resolution

Through AI-driven automation, insurers cut down manual processing time and accelerate payouts, boosting customer satisfaction.

25% reduction in operational costs

Streamlined workflows and paperless policy management significantly lower administrative overheads and improve efficiency.

40% increase in digital policy purchases

Omnichannel insurance platforms drive higher adoption rates, engaging customers where they are most active.

Frequently Asked Questions

The Banking, Finance Services, and Insurance solutions are developed to include system automation with an aim to enhance the overall organization’s productivity by supporting employees to raise their productivity and promoting the automation of financial operations.

A banking, finance & insurance app promotes high performance with sophisticated features and boosts the user experience that helps to engage with end-users and deliver an advanced application. The BFSI apps also provide insightful information with enhanced performance, compatibility with browsers, responsiveness to multiple screen sizes, easy installation, and so on.

We integrate our decades of learning and experiences in building tech-advanced and highly secure custom web and app solutions for various financial service providers.

For advanced security, we leverage cutting-edge technologies like Machine Learning, Artificial Intelligence, Blockchain, Cyber Security, Big Data, etc. to ensure all the transactions are highly secure and encrypted.

Yes, we use high-level data encryption algorithms to keep the data secure and provide a secure and reliable transaction process.