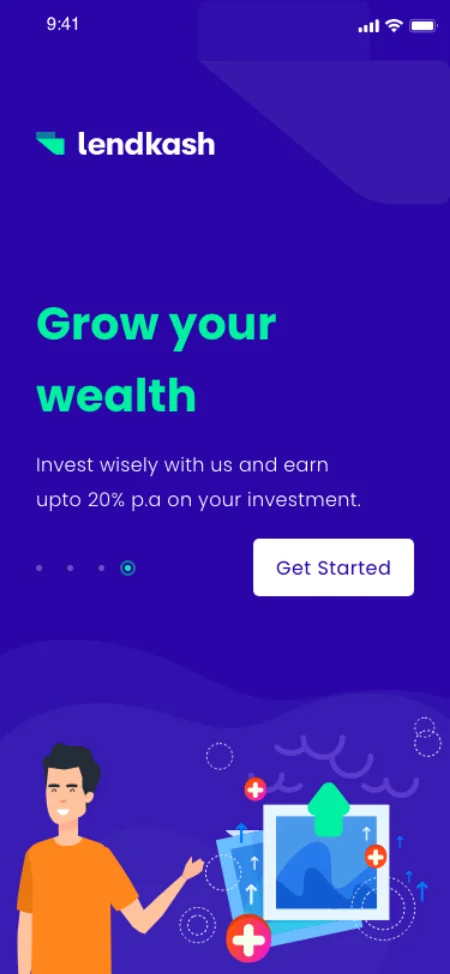

About LendKash

Lendkash is an online money lending platform based in Nigeria. The platform is designed with the aim of supporting people with a sufficient amount of cash. By integrating a secured and hassle-free cash-lending method, it has successfully narrowed down the struggle of consulting traditional banks for the purpose of processing personal loans. The borrowers can easily connect with the lenders to request the loan amount. Moreover, the repayment of the loan amount is done according to the EMI calculations and interest fixed. The platform is enhancing daily borrowers’ experience by charging lower interest rates as compared to usual rates in the market.

-

Client’s Location

Nigeria

-

Development Time

10 to 12 weeks

-

Target Users

Lenders, Borrowers and Investors

Technologies Leveraged

We leveraged the strength of robust and secure technologies, tools, and frameworks used in the app/web to escalate the creation of new features and functionalities.

-

MySQL

-

Laravel

-

iOS

-

Android

-

React Native

-

Firebase

Identifying the Client Needs

Turning around the traditional face of money lending was the major idea behind the development of the Lendkash. People used to suffer a lot as these maddening elements were the part of money lending process like continuous follow-ups and lining up long queues which were utterly frustrating. Our client closely witnessed this gap and thought of eliminating this common issue from the market.

He came up with the idea of building a user-friendly app connecting lenders and borrowers, simplifying the process for easy financial assistance and improved investment choices.

Client Goals

With a keen focus on addressing the diverse money-lending needs of the Nigerian people, the client sought to develop a comprehensive platform. The following features and functionalities have been effectively infused to ensure a seamless financial flow between lenders and borrowers.

-

App Objectives

- The flexibility of getting desired loan & choosing the suitable tenure

- Ensuring the safe and secure money lending process

- Providing instant access to cash and quick approval

- Track loan updates and other related information

- Infusing loan calculator to calculate EMIs, tenure, and interest rates

- Allowing lenders and borrowers to connect and discuss via chat

Mobile Visual Designs

Our UI/UX team developed hi-fi prototype after low-fi approval, through intuitive interfaces and aesthetically appealing layouts.

Development

The quick confirmation of the high-fi prototypes was enough to move ahead in the development phase. There are majorly two stakeholders in the app i.e. users and admin. The developers ensured to put important features and functionalities in the app for all the pre-define stakeholders.

Sign Up/Login

The user can signup/log in using details like name, email, mobile number, and password.

Loan Request

Users can raise the loan request including these details like loan amount, interest, EMI, terms, etc.

Complete KYC

Users can enter all the details to complete the KYC process.

View Loan Request Status

Users can check the loan request status including amount details.

Loan Calculator

The user can calculate the loan amount, loan duration, and the overall interest.

Transactions

The user can track all the performed transactions including essential details & info.

Sign Up/Login

The admin can signup/log in using details like name, email, mobile number, and password.

Manage Users

Admin can track/update user profiles and their personal details.

Manage Loan Applications

Admin can track loan requests received including details like interest, EMI, etc.

Manage Customer KYC

Admin can verify the user’s KYC details and provide approval.

Manage Notifications

Admin can manage notifications that must be shared by the app.

Generate Reports

The admin can generate various reports summarizing user activities.

Project Outcomes: Evaluating the Impact

Lendkash’s mobile app revolutionizes money lending in Nigeria, offering quick, low-rate loans. The platform eliminates tedious processes, providing instant funds with paperless documentation and easy approval. It’s a game-changer for users seeking flexible and efficient financial solutions.

- Lendkash fosters financial inclusion in Nigeria through a user friendly platform, empowering individuals with quick loan access.

- The platform’s streamlined approach, from low-fi wireframes to high-fi prototypes and eventual development, has resulted in an efficient and convenient lending process.

- Lendkash’s lower interest rates make borrowing affordable, enhancing financial wellbeing by reducing overall loan costs.

- With features like loan calculators, tracking, and reports, Lendkash prioritized data-driven decision-making ensuring transparency and sustainability.

Read More Case Studies

We extended our services to scale operations & services of our global clients. Team Codiant received much appreciation for quality solution offerings and successfully build a trustable relationship with each client.

24/7 Fitness- A Subscription-Based Fitness App

24/7 Fitness is an online fitness website and mobile fitness application for Android and iOS platforms that offers fitness enthusiasts reasonable, no-contract 24-hour gym memberships. Users can purchase memberships and gift memberships to other users. Users can contact Personal trainers through email/mobile number.

Equoto- A Web Portal Enhancing Insurance Agents & Customer Interaction

Equoto is a perfect solution for all insurance-related events, to simplify the interaction between insurance agents and users without any middlemen. Schedule or book an appointment from the available slots of insurance agents. Communicate hassle-free with agents through text messages, calls, or emails.

An Micro Insurance Platform For Securing Little Things

Toffee Insurance is one of the best platforms to insure things you are close with, making all the complicated paperwork hassle-free without visiting any bank physically. The app users can explore a variety of micro-insurance products to secure things. Allows users to buy insurance at minimal prices with a quick & efficient claiming process.