About Zulupay

Zulupay is an instant loan-taking online app platform that allows salaried individuals to get easy approvals for instant personal loans. It removes the barrier of getting a sufficient amount of cash anywhere anytime in a hassle-free manner. Individuals need not hustle into the long funding process, any paperwork, or documentation process. Zulupay makes common life easier by just transferring the required amount directly to the individual’s account within minutes.

-

Client’s Location

India

-

Development Time

07 Months

-

Target Users

Quick loan applicants, immediate fund requesters, instant cash aid recipients

Technologies Leveraged

We leveraged the strength of robust and secure technologies, tools, and frameworks used in the app/web to escalate the creation of new features and functionalities.

-

JavaScript

-

React Native

-

NodeJS

-

HTML5

-

CSS

-

Bootstrap

Identifying the Client Needs

In this fast-moving world, people usually run low on cash and face a bunch of difficulties like paperwork when approaching private banks for immediate loan approvals. These financial gaps and emergency fund requirements often fence their requirements.

Our client developed an online app to solve this problem. It offers instant approval and convenient money transfers to individual bank accounts, eliminating bulky paperwork and minimizing processing fees.

Client Goals

Our client wanted to bring up the power of new-age technology by providing an easy process to get instant loan approvals via smartphones. He aimed to create an online money lending app equipped with smart key features and functionalities like:

-

App Objectives

- Easy and convenient access to loan approvals

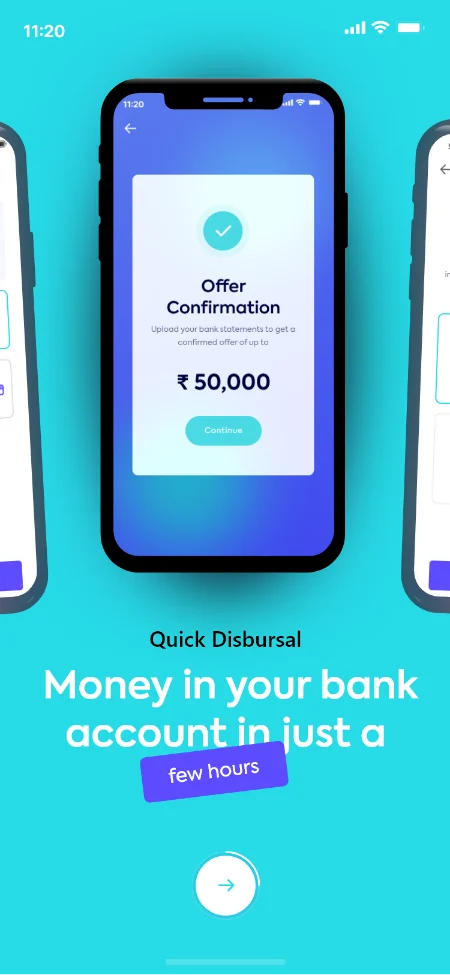

- Fast and secured disbursal of the loan amount

- Easy search for the personalized loan options

- Flexible loan repayment tenure through easy EMIs

- Robust data security and privacy measures

Mobile Visual Designs

Our UI/UX team developed hi-fi prototype after low-fi approval, through intuitive interfaces and aesthetically appealing layouts.

Development

Our highly experienced development team kickstarted the process by creating a loan lending app for the major stakeholders like Customer and Admin. Check-in detail about all the major features that cover Zulupay and make it one of the best apps to be discovered in the instant loan industry.

Registration

Users can log in using personal details like email, phone number, social media handles, etc.

Profile Management

Users can create a profile using their basic details to manage their account.

Eligibility Calculator

Users can check their eligibility to apply for a loan as per their credit score and financial eligibility.

Apply Loan

Apply for a personal loan by uploading their personal documents like income details, address proofs, loan amount, etc.

Customer Support

Users can connect with the customer care specialist to get solutions for their queries via chat, call or email.

Push Notifications

Users can receive regular updates in the form of notifications like EMI due, application status change, and loan offers.

User Management

Admin can manage multiple user accounts including details like personal info, borrower profile, loan histories, and more.

Review Loan Applications

Admin can review all the loan applications and approve them based on pre-decided criteria.

Loan Approval Setting

Admin can set multiple loan parameters like loan amount, interest rates, repayment terms, etc.

Project Outcomes: Evaluating the Impact

Zulupay has got remarkable success in the money lending market industry. The app has attracted a huge user base by just infusing smart features, a streamlined loan process, and an interactive user interface.

- Zulupay’s simplicity in navigating through various features has received positive feedback from users.

- Zulupay's accessibility feature has been well-received by users, as they can apply for loans from the comfort of their homes or on the go.

- The app’s positive customer reviews boosted revenue and expanded their user base.

- Users have also built a strong trust because of strong data security and compliance.

Read More Case Studies

We extended our services to scale operations & services of our global clients. Team Codiant received much appreciation for quality solution offerings and successfully build a trustable relationship with each client.

Midas- An Ultimate OTT Entertainment Platform Destination

Midas is an OTT entertainment platform that facilitates content creator to upload any movie, web series, daily soaps, etc., on the platform, and the subscribers can directly online stream or download the content for instant or later view. Offer diverse content options – movies, series, shows, etc. User-friendly interface for creators & subscribers. Smooth browsing, […]

An IoT Based Home Activity Monitoring System

Just Checking is an innovative activity monitoring system leveraging the Internet of Things (IoT) designed to support individuals with dementia, learning difficulties, and other disabilities. The system is designed to help people remain in their homes longer by providing the right level of support based on their actual needs and routines. The core components of […]

A Professional Networking App for Interns to Match Internships

UnTAPDT is designed to assist interns in finding suitable internships with employers or companies. Interns receive support from guidance counselors or case managers who help them navigate the internship search process. These counselors actively monitor conversations between interns and employers, helping and intervening as needed to ensure a successful match.