How to Speed Up FinTech App Development? Tips to Reduce Dev Time

Table of Contents

Subscribe To Our Newsletter

Being the first to launch a new digital product often determines success. To disrupt the banking industry or an established institution upgrading legacy systems, speed matters. Speed helps you test, learn, and grow. But launching fintech apps fast doesn’t mean building out shaky app services – it’s about working smarter, planning better to save fintech startups fail, to better understand how to create a fintech app and use the right technologies and strategies that make sense.

The market moves at breakneck pace, powered by rapid innovation, changing compliance requirements, and users who demand great real-time experiences. Consumers are not going to be patient waiting for a “perfect app”; they will turn to whoever gets there first with a “good enough” solution meeting their need today.

But it’s not just about staying ahead of the market — it’s also about meeting investor expectations. Stakeholders often operate on tight timelines, especially in early-stage funding rounds. A delay of even 2–3 months can put your next round at risk or let a competitor capture your market share.

Take Chime, for example. Their ability to launch quickly with a strong MVP gave them a first-mover advantage in the neobank space, allowing them to scale user acquisition before big banks caught up. Similarly, early rollout of commission-free trading by Robinhood helped it dominate Gen Z and Millennial investors long before incumbents reacted.

In this blog, we’ll guide you through everything from the average development time to the key factors influencing delays and the actionable strategies to bring your product to market — faster.

Average Development Time for a FinTech App

Typically, building a FinTech application takes anywhere from 4 to 12 months, depending on the scope. A basic P2P payment app might take 4–6 months, whereas a fully-loaded investment or banking platform could take up to a year.

Here’s a quick breakdown:

- Basic App (MVP): 3–4 months

- Mid-Level App: 5–8 months

- Enterprise-Grade App: 9–12+ months

But the real challenge lies not just in building fast — it’s in building securely, and with the right user experience. So, let’s look at what’s really affecting your timeline.

Challenges That Slow Down Development Time for a Fintech App

Even the best ideas can get stuck in development purgatory. Why? Because FinTech isn’t just about writing code — it’s about navigating an ecosystem of complexity.

1. Feature Scope & Complexity

Want a simple money transfer tool or a full-blown robo-advisory service? More features mean more modules, APIs, and logic to build — from KYC verification, digital wallets, budget planners, and multi-currency support to complex risk management algorithms.

2. UI/UX Design & Product Clarity

Another common bottleneck? Poorly defined user journeys and unclear product scope. If your UX designers doesn’t know exactly what AI tools to use for better interaction in 2025 and beyond, who they’re building fintech app for or what the core value proposition is, expect delays and scope creep.

3. Team Skillset & FinTech Domain Knowledge

A senior team with prior FinTech experience will always work faster than a generic dev team. Domain knowledge reduces learning curves, improves solutioning, and ensures best practices are applied from day one.

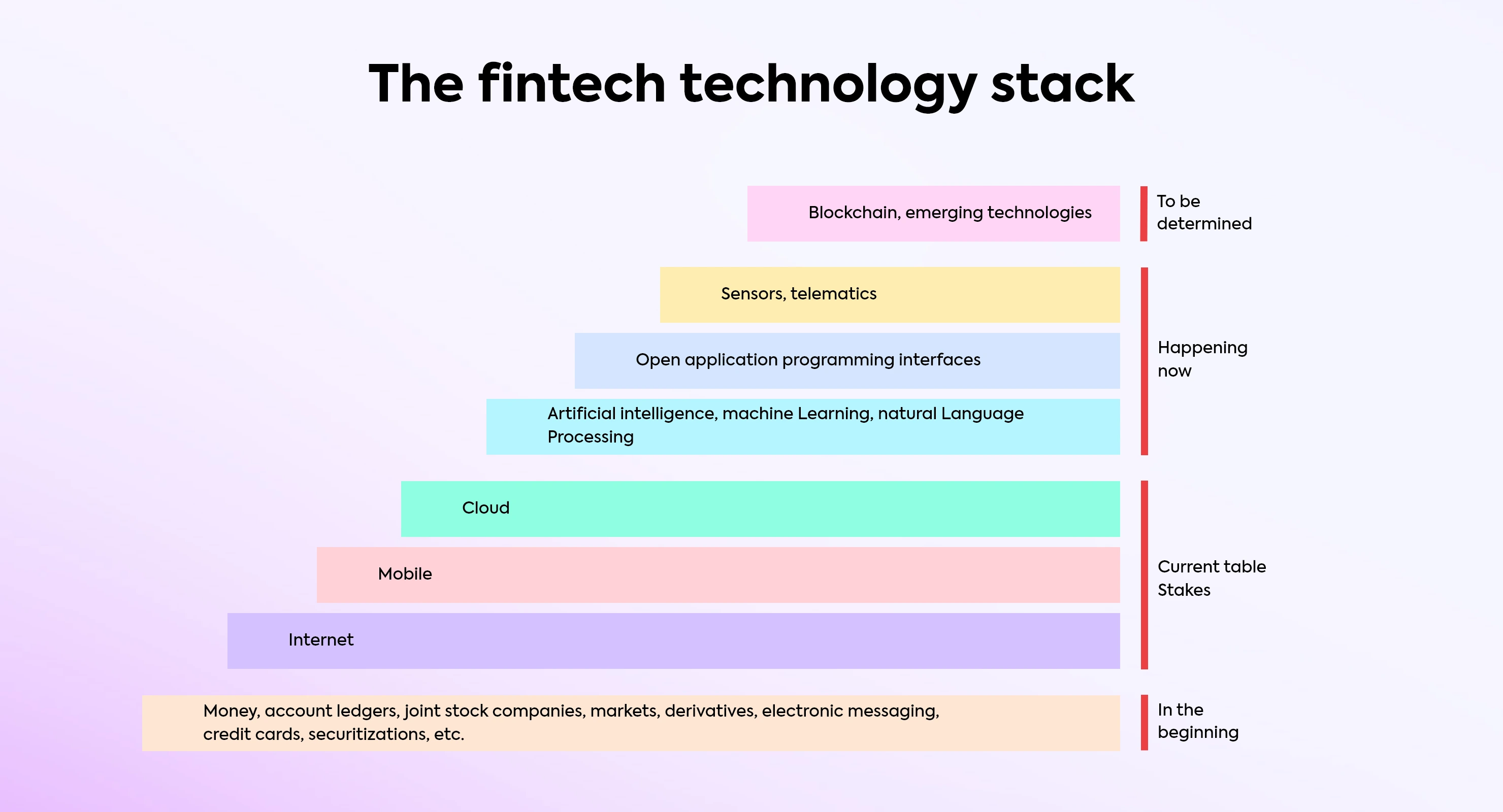

4. Technology Infrastructure & Scalability

Choosing the wrong tech stack can also set you back months — especially when scalability, performance, or integration issues pop up mid-way. Modern stacks often come with faster development cycles and robust community support, while outdated tech can slow you down or introduce future scalability issues.

5. Third-Party Service Integration & Dependency

FinTech apps often rely on third-party services like payment gateways (Stripe, PayPal), KYC/AML services, credit score APIs, or trading platforms. Each integration brings its own timeline and risk—especially when documentation is poor or changes are frequent.

6. Regulatory Adherence & Compliance Requirements

From AML and KYC to GDPR, every regulation needs custom workflows and secure data handling, even, non-compliance isn’t an option.

7. Thorough Testing and QA

You can’t afford bugs when money is involved. Each release must be rigorously tested for performance, functionality, and security. Skimping on QA might get you to market faster, but it’s a guaranteed way to crash post-launch.

8. Effective Project Management & Execution

Without agile frameworks and milestone tracking, even the best teams can lose momentum. Bottlenecks, communication gaps, or scope creep can drag your timeline endlessly.

Do You Know? 75% of FinTech founders say development delays cost them early traction and investor confidence.

At Codiant, we help you speed up development without compromising security, compliance, or scalability. With pre-built modules for payment, KYC, and user analytics, we cut your launch time by up to 35%.

At Let’s explore how we can get your FinTech app to market 2x faster.

Proven Strategies to Reduce Development Time of a FinTech App

If time-to-market is a priority — and it should be — here are tested methods to compress timelines and still deliver quality.

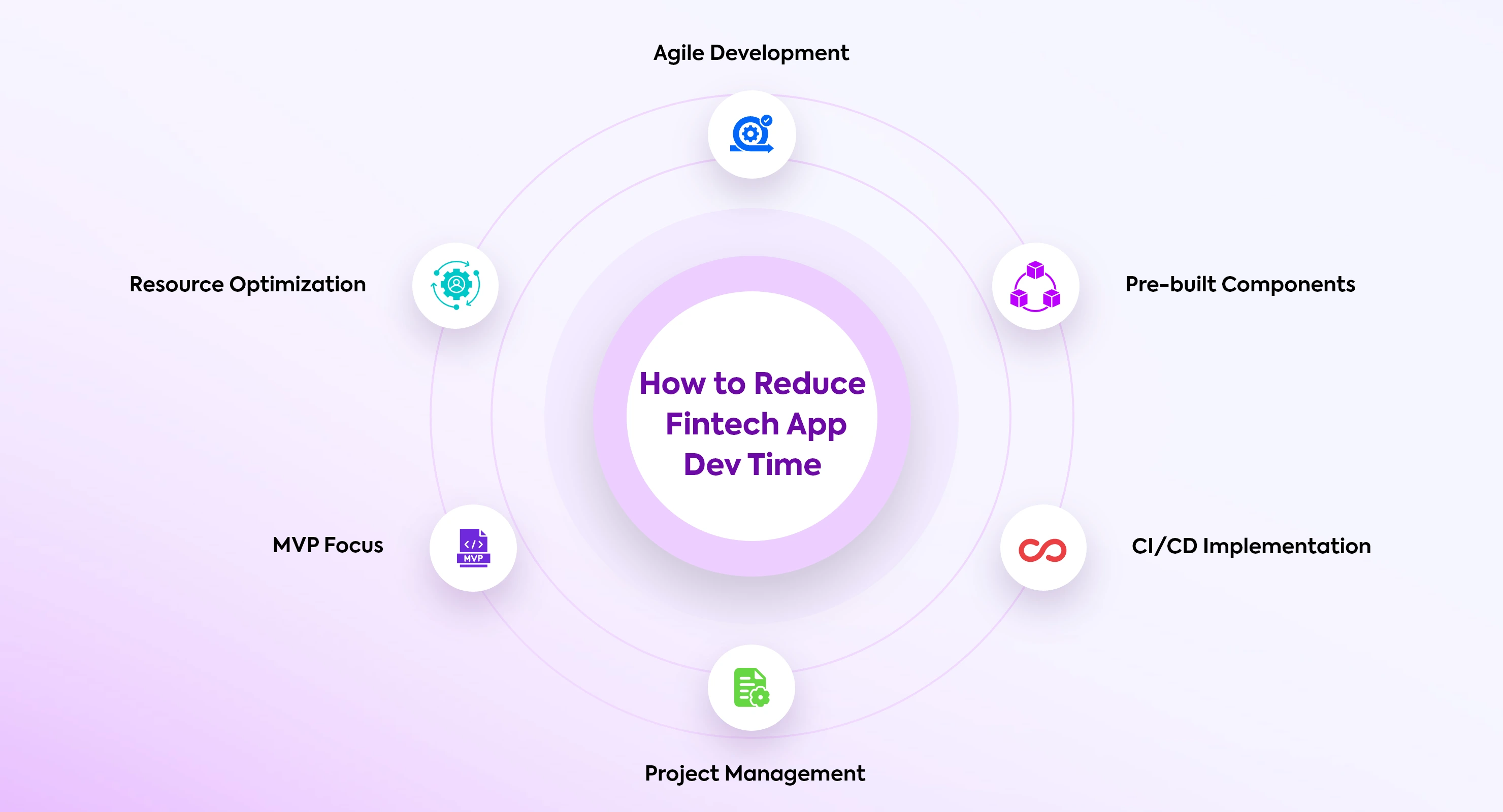

1. Agile Development Methodology

Agile methodology supports the iterative process of development, feedback, and pivoting. Unlike the waterfall process, it splits development into sprints — where you can test, learn, and launch faster.

Bonus Tip: Start with 2-week sprints and hold daily stand-ups to ensure alignment across teams.

2. Utilize Pre-Built Components and Frameworks

Why build a login system or payment processor from scratch when robust, secure versions already exist for mobile banking apps? Using SDKs, APIs, and white-labeled modules can shave off months from your timeline.

For example:

- Firebase for authentication

- Plaid for banking data aggregation

- Mambu or Finastra for core banking logic

These integrations allow you to focus on building your unique value proposition, not reinventing the wheel.

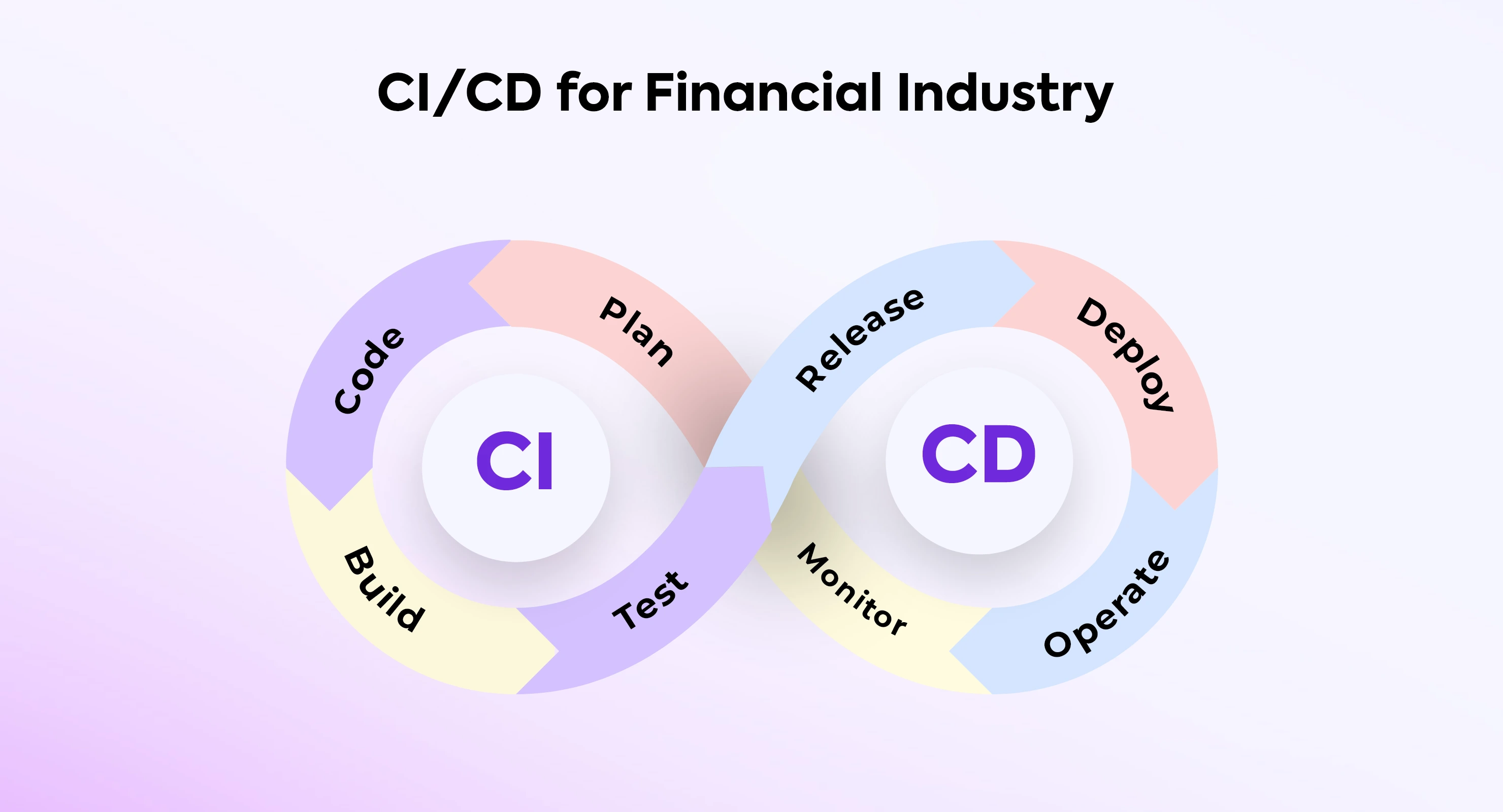

3. Implement Continuous Integration and Continuous Deployment (CI/CD)

CI/CD automates the process of testing, building, and deploying code. This means every time a developer commits code, it goes through an automated pipeline — reducing human errors and accelerating releases.

CI/CD is the backbone of agile FinTech development today.

Benefits include:

- Faster bug identification

- Reduced rollback risks

- More frequent releases

4. Effective Project Management

A well-organized development process is a hidden gem to save time. Using tools such as Jira, Trello, or ClickUp and writing down milestones, deadlines, and the name of task owner can promote transparency and discourage scope creeps.

At Codiant, our project managers have a FinTech domain background – so they know what questions to ask at every step.

5. Focus on Minimum Viable Product (MVP)

Don’t wait to build the full suite of features. Identify the core functionality — the one that solves your user’s biggest problem — and build that first. Launch with an MVP, gather feedback, and iterate.

MVPs allow you to:

- Validate your idea in the real market

- Start generating early revenue

- Attract investors with a live product

6. Optimize Resource Allocation

Avoid bottlenecks by distributing work smartly. Assign the most complex modules to your senior developers, while junior developers can take on frontend views or simpler backend logic.

You can also leverage staff augmentation model— temporarily onboard specialized resources like DevOps engineers or compliance consultants — for speed without long-term overhead.

60% of App Delays Are Due to Poor Team Structuring and Avoidable Reworks.

At Codiant, we help you speed up development without compromising security, compliance, or scalability. With pre-built modules for payment, KYC, and user analytics, we cut your launch time by up to 35%

• Cut down on resource scouting

• Avoid miscommunication

• Launch faster, safer, smarter

At Let’s explore how we can get your FinTech app to market 2x faster.

Bonus Tips: Post-Launch Optimization That Saves Time in Long Run

Fintech development doesn’t stop at launch — the smartest FinTech plan for speed even after go-live. Post-launch optimization isn’t just maintenance; it’s a strategy to save time (and money) on every future release. In short, post-launch optimization ensures your development velocity stays high well beyond day-one.

1. First, start with analytics from day one. Tools like Mixpanel or Firebase let you track user flows, identify friction points, and make data-backed product decisions. No more guessing what users want — just measure and respond.

2. Second, automate app performance monitoring. Platforms like New Relic or Sentry alert you to issues before users complain. Fixing problems early saves time and reputation.

3. Third, roll out new features gradually using feature toggles or A/B testing. You don’t need to drop everything at once. Controlled rollouts minimize risk, reduce hotfixes, and speed up development feedback loops.

4. Finally, maintain a continuous feedback loop between users, product teams, and developers. Feedback gathered via in-app surveys or support tickets can prioritize what to build (or fix) next — eliminating wasted effort on irrelevant features.

Codiant — Your FinTech Solution Partner

At Codiant, we’ve helped banks, insurance providers, neobanks, and startups build secure, scalable FinTech products that comply with regulations, impress users, and deliver ROI. Our agile development approach, coupled with deep domain knowledge, accelerates time-to-market.

Our USPs:

- 250+ FinTech apps delivered

- Domain experts in BFSI

- PCI-DSS compliant architecture

- Native and cross-platform builds

- 24×7 support and DevOps teams

Whether you’re building a P2P payment app, loan and credit scoring platform, investment dashboard, digital wallet app or BNPL solution, we have the pre-built modules, design thinking, security frameworks, and domain experts you need to accelerate development.

Frequently Asked Questions

On average, it takes 4–12 months depending on complexity. MVPs may launch in 3–4 months, while full enterprise-grade platforms take up to a year.

Agile enables iterative sprints, faster feedback cycles, and early testing — all of which prevent scope creep and reduce rework.

Codiant offers specialized fintech expertise, ensuring regulatory compliance and secure, scalable solutions. Their experienced team navigates complex integrations and delivers user-centric apps, minimizing risks and maximizing efficiency in the financial technology sector.

Clear timelines, structured tasks, and transparent communication channels eliminate confusion and delays — keeping the development on track.

Key factors include feature complexity, third-party integrations, regulatory compliance, team expertise, testing cycles, and clarity of project management.

Codiant employs agile methodologies, leveraging pre-built modules and efficient tech stacks. Their team’s domain knowledge streamlines development, while robust testing and clear project management prevent delays and scope creep, accelerating time-to-market.

Featured Blogs

Read our thoughts and insights on the latest tech and business trends

Which is Better for Your Business in 2025- Chatbots or Conversational AI?

- October 22, 2025

- Artificial Intelligence

In a Nutshell: Chatbots = Simple & Fast- Great for FAQs, appointment bookings & routine customer support. Conversational AI = Smart & Scalable- Uses NLP and machine learning to understand context, personalize replies & handle... Read more

Why Hiring Full-Stack Developers Makes More Sense for Complex Projects

- October 17, 2025

- Staff Augmentation

Let’s start with the obvious- software projects are messy. They never roll out like those neat diagrams in pitch decks where every arrow points forward and nothing breaks. Complex projects - think SaaS platforms, enterprise... Read more

Generative AI in Insurance: Benefits, Risks & Use Cases

- October 15, 2025

- Artificial Intelligence

In a Nutshell: Generative AI is giving insurance a major upgrade - turning hours of paperwork into minutes of smart automation. It helps insurers read claims, write summaries, and understand risks faster than ever before.... Read more