AI Solutions in Insurance: – How Insurers Are Cutting Resolution Time by 50%

Table of Contents

Subscribe To Our Newsletter

When someone files an insurance claim, they expect help quickly. But what usually happens is very different. A person gets into an accident, sends the paperwork & then waits. Days pass. Sometimes weeks. The customer keeps calling to check the status & most of the time the answer is, “it’s still under review.” By the time the claim is paid, the customer is tired, upset & often feels the company does not care.

This slow system is also hard for insurers. Employees spend too much time on paperwork; mistakes keep piling up & costs go up each year. Nobody is happy, neither the customer nor the company.

AI is now changing this old picture. AI in insurance claims processing can scan forms, check photos of damage & even answer customer questions automatically. This means claims that used to take weeks can now be finished in days. Some simple cases are even done within hours. Insurers using AI development solutions are seeing resolution times drop by almost 50% & that’s a big change for both the business and the customer.

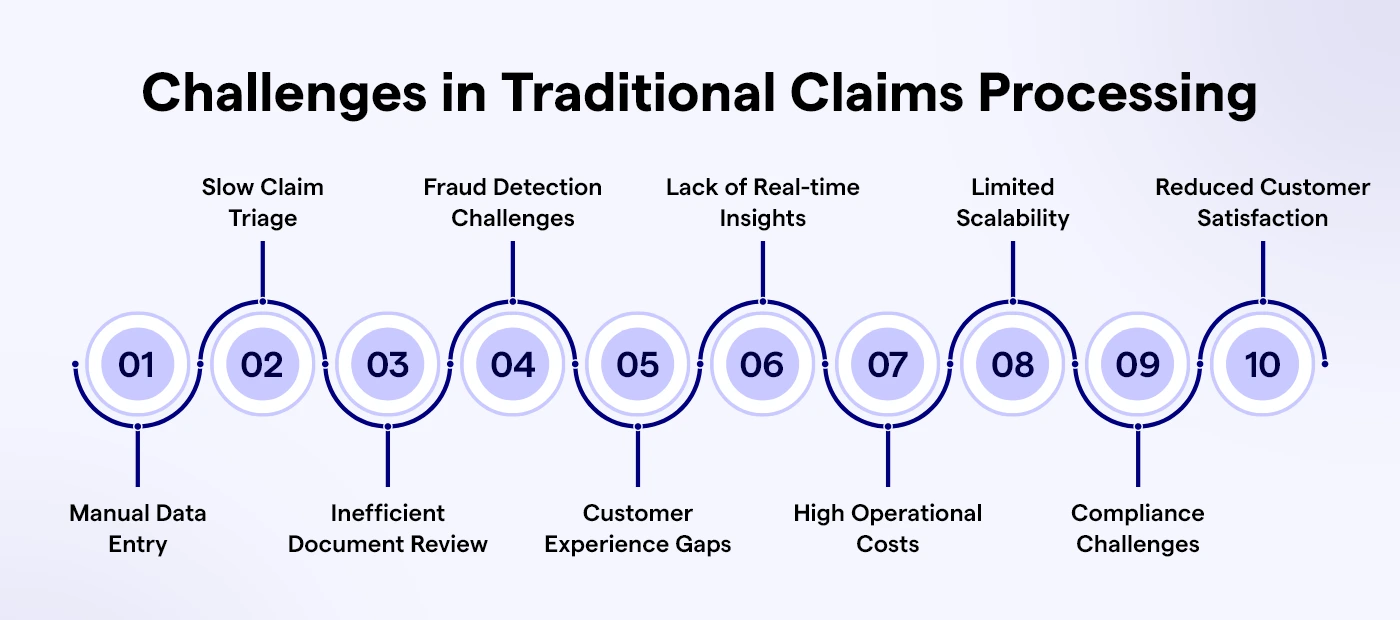

Why Traditional Claims Handling Is Broken

Traditional claims handling is slow, costly & frustrating. The problems come from heavy manual work & here’s how they show up-

- Manual reviews take too long. Each claim comes with documents like medical bills, police reports & repair invoices. Adjusters have to check them one by one. Even a simple case can take hours & when hundreds of claims arrive at once, the backlog quickly grows.

- Mistakes happen often. Human workers get tired. A small error-like typing in the wrong policy number or forgetting to attach a file, can delay the claim for days. Customers then have to resend documents, which only adds more waiting.

- Fraud is hard to catch. Fraudsters know how to take advantage of the system. They file repeated claims, inflate repair costs or use fake documents. With so many cases to check, it’s nearly impossible for humans to see these patterns across thousands of files.

- Costs keep rising. Companies hire more staff to deal with the growing volume of claims. But most of that time is spent on repetitive tasks like data entry or document checking. These costs add up without actually improving the customer experience.

- Customers lose trust. People are used to fast services in every other part of life-whether it’s food delivery, online shopping or banking. When their insurance claim takes weeks with little communication, they feel ignored. That disappointment damages loyalty and makes them think twice about staying with the company.

The result is a system that works, but barely. It’s too slow, too expensive & too outdated for the world we live in today.

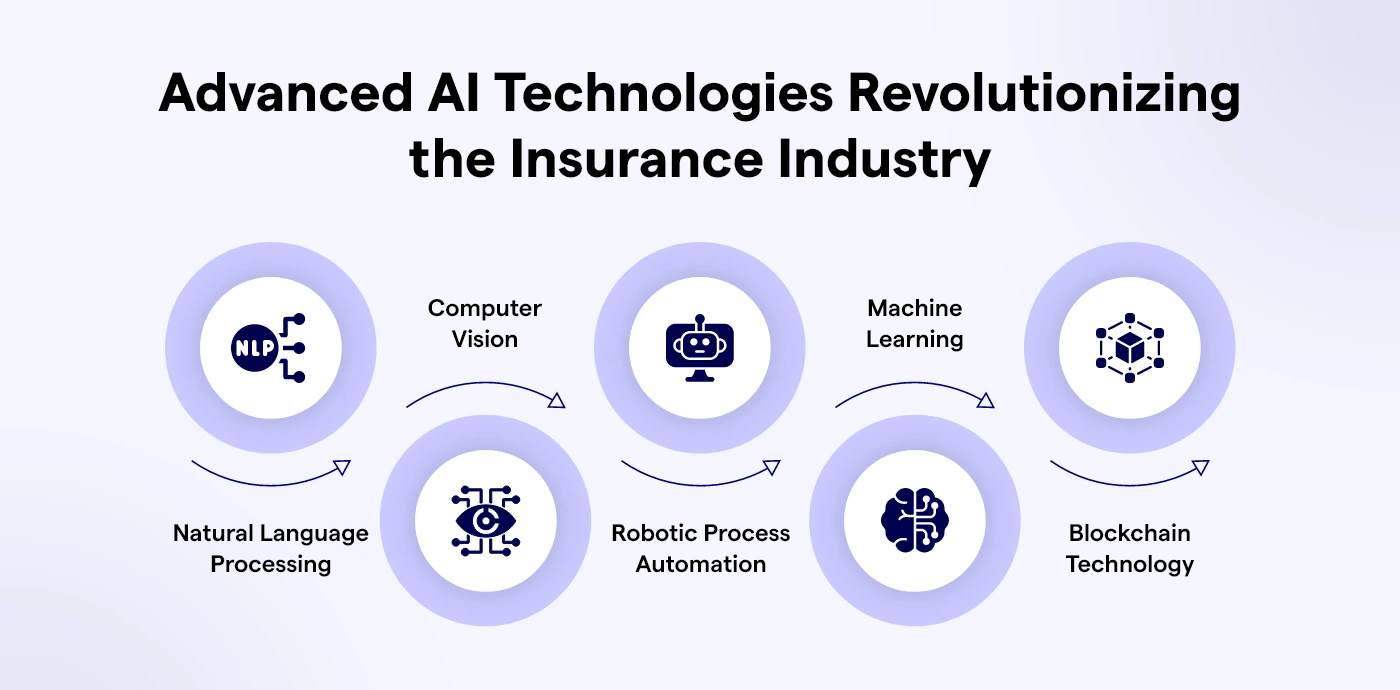

How AI Changes the Way Claims Are Handled

Insurance companies don’t need to keep using slow and old methods. That’s where AI comes in. Think of AI like a helper that works super-fast, never gets tired & doesn’t make silly mistakes. It doesn’t replace people, but it does the heavy work so humans can make the big decisions.

Here’s how AI is already helping with claims:

- Reading papers fast: With special tech called Natural Language Processing (NLP), AI can read accident reports, repair bills, or hospital bills in seconds. It picks out the key things like policy numbers or claim amounts without messing up. Work that took hours now happens almost instantly.

- Checking photos of damage: AI can look at pictures of a broken car or a damaged house and guess how much the repair will cost. This means not every case needs a human to go and check. Simple claims can be done super quickly.

- Finding fraud early: AI doesn’t just look at one claim. It compares new claims with thousands of older ones. If it notices something odd, like the same car showing up in many claims, it raises a red flag before money is paid.

- Helping human workers: AI can suggest what the next step should be or what result is most likely. This makes the work easier and less stressful for staff.

The big change? Claims don’t get stuck moving from one desk to another. AI moves the info around, checks it & gives fast answers. Humans are still important, but now they have tools that keep everything moving much faster. These benefits are possible only when AI is embedded into modern platforms through custom insurance software development, ensuring insurers have the right tech foundation to scale.

Did you know 72% of insurers using AI report faster claim resolutions?

AI is no longer optional. It’s the key to cutting delays, lowering costs, and delivering fair, hassle-free claims experiences.

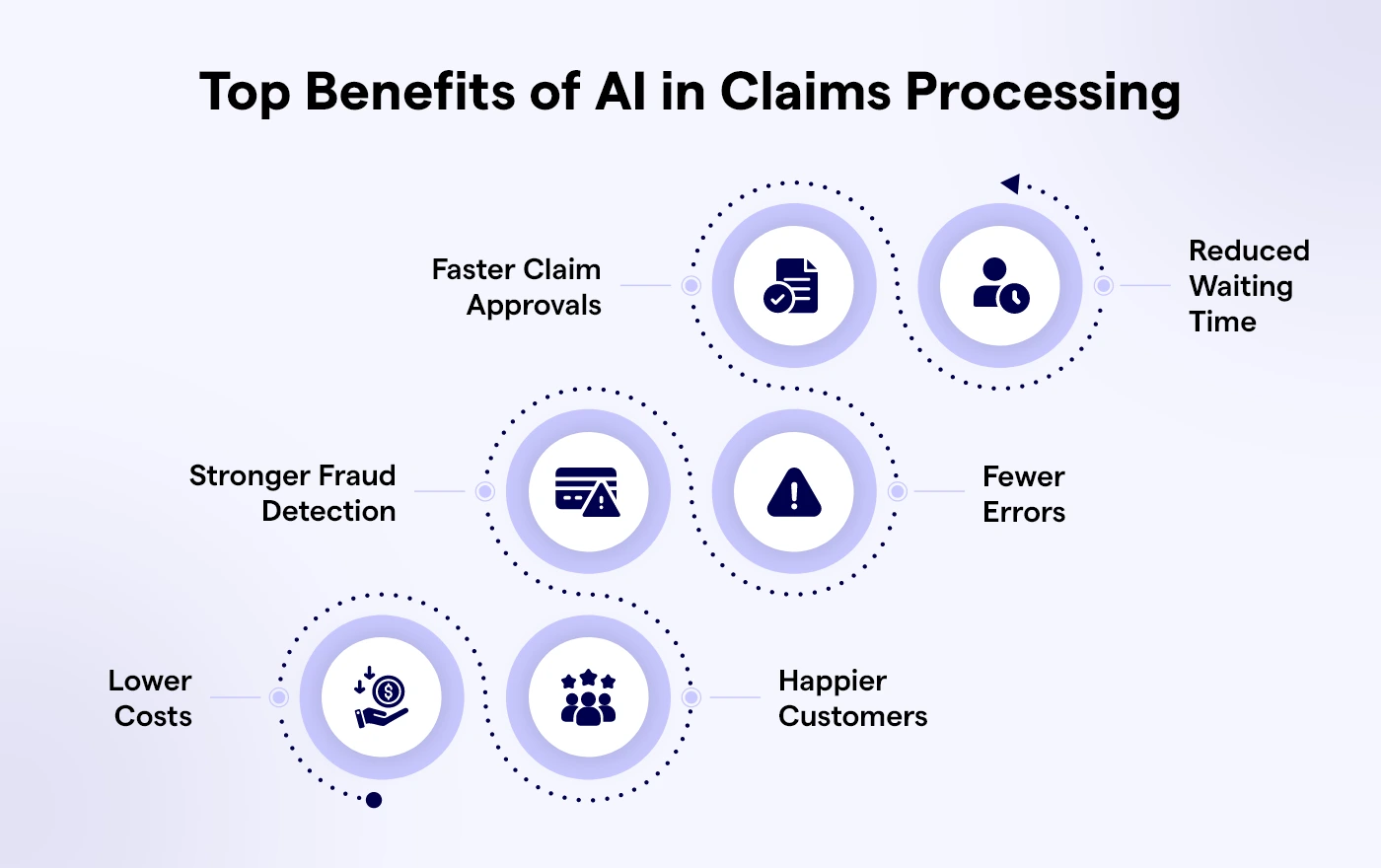

Core Benefits of Automating Claims Processing with AI

When insurance companies use AI instead of doing everything by hand, things get faster and easier. The changes show up quickly and help both the company and the customers.

Faster claim approvals

Claims that once took weeks can now be done in just a few days, or even hours if they are simple. This is a big help for people who need money right away for car repairs, hospital bills, or home damage.

Less waiting time

AI cuts out slow paperwork and repeated checks. This means more claims can be handled in less time. Customers notice the speed and start trusting the company more.

Stops more fraud

Fake claims cost insurance companies a lot of money. AI can look at thousands of claims and find strange patterns, like the same repair shop making many claims. This helps keep things fair for honest people.

Fewer mistakes

People can get tired and make errors when checking many claims. AI doesn’t get tired, so there are fewer errors, fewer arguments & less delay for customers.

Saves money

With less manual work, companies spend less on staff and paperwork. The savings can be used to improve services or lower the cost of insurance.

Happier customers

People want their claims solved quickly and fairly. When AI makes the process smooth, customers feel cared for and stay loyal to the company.

Read More: How Agentic AI will Transform Financial Services

Key AI Use Cases in Claims Management

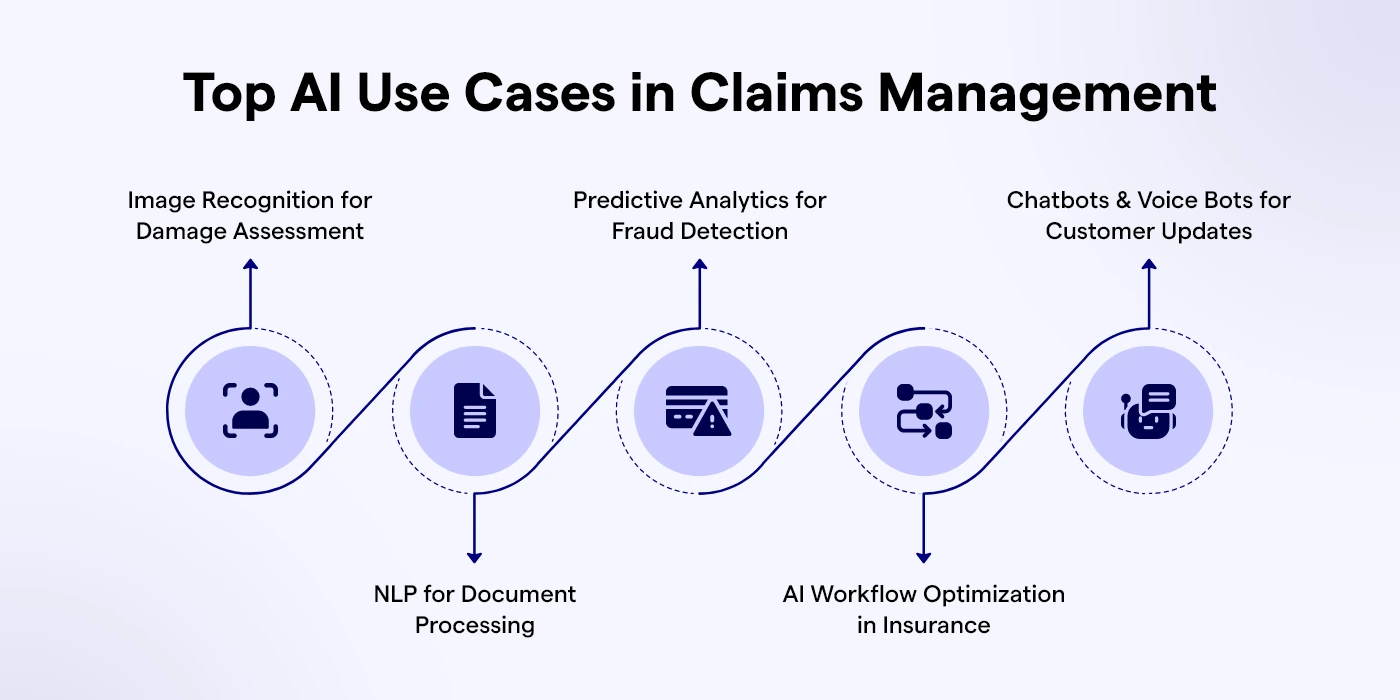

AI is not just a theory. It is already being used in very specific parts of the claims process. These use cases show where the biggest improvements are happening.

- Image recognition for damage assessment. After a car accident, customers often take photos of the damage. Instead of waiting for an adjuster to visit, AI can look at the images, compare them to thousands of past claims & suggest repair costs. This makes the process much faster and removes delays in simple cases.

- Natural Language Processing (NLP) for documents. Claims usually come with long forms, medical reports & invoices. AI can scan these documents and pick out important information like policy IDs, accident dates & billing codes. This reduces errors and frees workers from hours of repetitive data entry.

- Predictive analytics for fraud detection. Fraud is one of the biggest problems in insurance. AI can look at patterns in claims data and flag cases that look unusual. For example, if the same customer has made three similar claims in a short period, AI will highlight it for review.

- AI workflow optimization in insurance. Claims often get delayed because they move slowly from one desk to another. AI can manage the entire flow, sending the right information to the right team at the right time. This reduces bottlenecks and makes the process more organized.

- Chatbots and voice bots for customer updates. Customers hate waiting on hold to ask about claim status. With AI chatbot development services, they can get answers instantly through an app or website. Voice bots can also provide updates over the phone. This keeps customers informed without using up staff time.

These use cases show that AI doesn’t just improve one part of the process-it helps across the entire claims journey, from the first report to the final settlement.

Real-World Results- Cutting Resolution Time by 50%

Talking about AI in theory is one thing. But the real test is what happens when insurers actually use it. The results so far have been very clear- AI cuts claim resolution time in half.

Take the case of a mid-sized auto insurance company. Before AI, the average claim took about two weeks to close. Customers often had to call multiple times for updates & simple cases still dragged on.

After the company introduced an AI-powered claims management system, the average time dropped to just seven days. For minor accidents where damage photos could be scanned and verified, claims were settled in under 48 hours.

Health insurers have seen similar improvements. One company used AI to review medical records and check billing codes automatically.

This reduced claim errors by almost 30% and shortened settlement time by nearly half. Patients got their reimbursements faster & disputes between hospitals, patients & the insurer decreased.

The real value of these results goes beyond improved metrics or faster turnaround times. When claims are resolved quickly, customers feel genuinely supported during stressful moments. That reassurance fosters a lasting sense of trust—an essential ingredient for loyalty. By integrating an AI chatbot for insurance, companies can deliver instant assistance, streamline claims, and provide that human touch at scale, turning efficiency into empathy that customers remember.

AI doesn’t solve every problem overnight, but it removes the biggest delays that used to frustrate both companies and their customers. And the proof is already visible- resolution times cut by 50% or more.

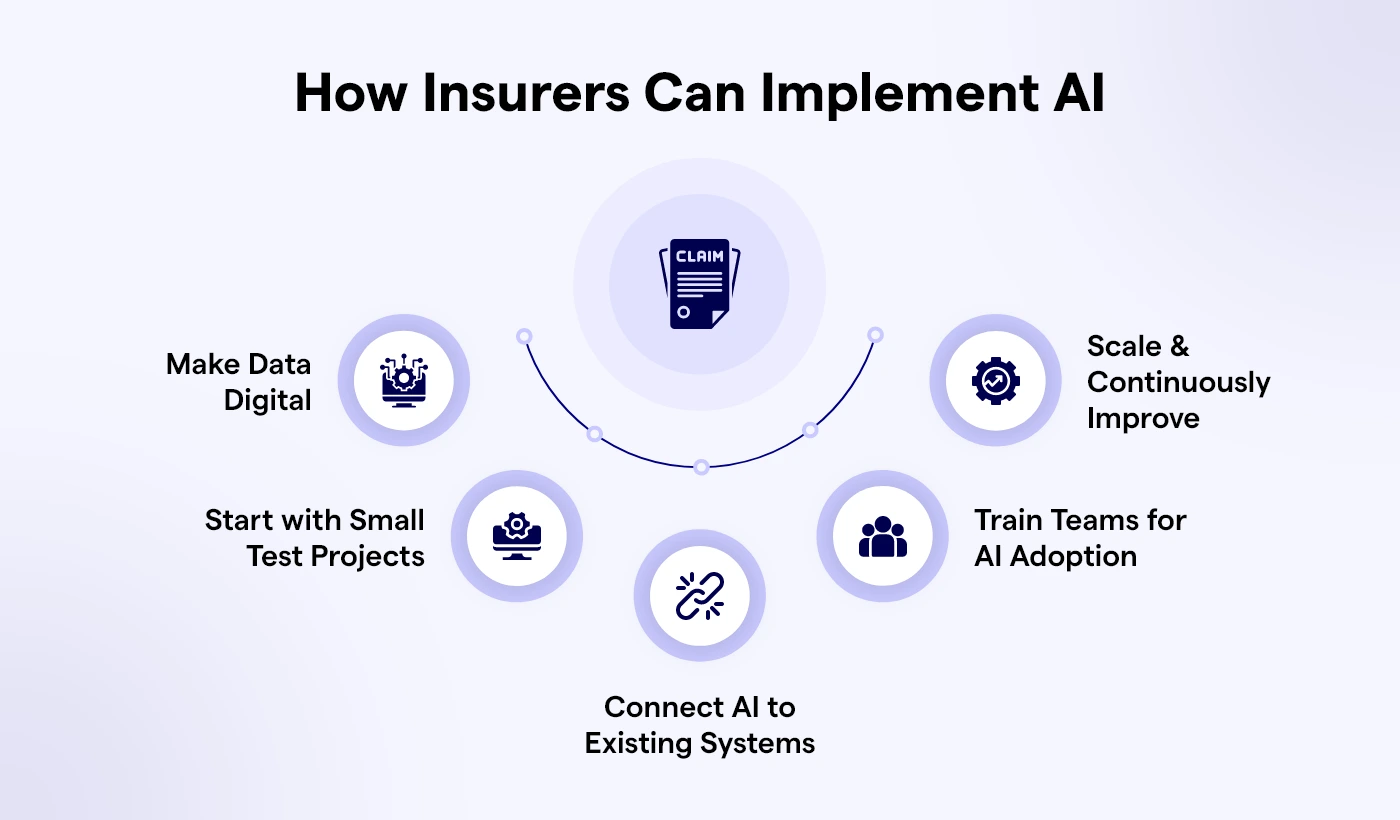

Roadmap for Insurers to Use AI

Switching to AI doesn’t have to happen in one big jump. Companies can start small, learn & then grow. Here’s an easy step-by-step plan:

Step 1 – Make data digital.

AI can’t read paper files. First, move all claims, invoices & forms into digital form. This means scanning old papers, cleaning up mistakes & putting everything into one clear system. Without this, AI has nothing to use.

Step 2 – Try small test projects.

Instead of changing everything, pick one claim type, like car accidents. Test how AI works there. Track results, see what goes right & fix what doesn’t. Tests lower the risk and build trust in AI.

Step 3 – Connect AI to old systems.

AI should work smoothly with current tools like policy databases, payment systems & customer apps. If not connected well, you end up with confusion. Good links make the whole system faster and stronger.

Step 4 – Train people.

Staff should know how AI works and when they need to step in. Training builds trust. It also shows AI is here to help, not to replace humans. This balance keeps teams happy and still in control.

Step 5 – Grow and improve.

Once the small test works, expand AI to other claims like health, property, or travel. Keep improving by listening to customers and changing workflows. Over time, AI learns and works even better.

Challenges in Using AI

Moving to AI is not always easy. Insurers face real problems, but each can be solved with the right plan.

- Protecting data.

Claims hold private info like health reports and bank details. AI systems must have strong security and follow rules like GDPR or HIPAA. Without this, trust is lost. - Old computer systems.

Many insurers still use very old software. Adding new AI tools to these can cause errors. The fix? Careful planning and slow upgrades. - Finding the right people.

AI projects need experts in data science, machine learning & cloud. Not all companies have them. This is why many work with tech partners who bring those skills. - Balance between AI and humans.

AI can process claims fast and catch fraud. But it cannot give comfort. For example, a person who lost their house in a fire needs a real human voice, not just a chatbot. Companies must decide when to use AI and when to keep people in charge.

These challenges are tough, but they’re not roadblocks. With training, partners & good planning, insurers can add AI step by step and avoid costly mistakes.

The Future of AI in Claims Management

AI in claims management is only at the starting line. The tools in use today-like document scanning, fraud detection & chatbots-are powerful, but the future goes even further.

Hyper-automation with IoT. Cars and homes are becoming smarter. A car involved in an accident could automatically send crash data, photos & repair estimates directly to the insurer. A smart home device detecting water leakage could trigger a claim before the damage gets worse. Claims may start and finish without customers even needing to call.

Predict-and-prevent models. Instead of just responding to claims, insurers can use AI to stop them from happening. For example, health insurers could analyze wearable fitness data to send early warnings about health risks. Auto insurers could use telematics to warn drivers about unsafe roads. Prevention means fewer claims and healthier, safer customers.

Personalized claim journeys. Every customer interacts differently. Some prefer getting updates on WhatsApp, others want a phone call & some check an app daily. AI will make these journeys personal, adjusting communication style, timing & channel for each customer automatically.

Read more: Health Insurance Software Development: Industry Guide for 2025

Conclusion

The way insurance claims are handled has always been a point of frustration. Customers wait too long. Companies spend too much. Mistakes happen. Fraud sneaks through. The old system is slow, costly & out of sync with how people live today.

AI isn’t a magic wand, but it’s transforming how industries solve complex challenges at scale. In insurance, AI streamlines claims processing—making it faster, more accurate, and cost-effective. By reducing review times by up to 50%, it empowers insurers to detect fraud earlier, minimize human errors, and deliver the quick, fair resolutions customers expect. With innovations like an AI survey form builder, insurers can also gather valuable customer insights effortlessly, enhancing every step of the claims journey and improving decision-making across the board.

The insurers that adopt AI now are not just catching up with expectations-they are building trust for the future. Faster settlements mean happier customers. Lower costs mean stronger businesses. And smarter systems mean fewer disputes and smoother operations. Codiant, a leading AI development company in USA, empowers insurers with tailored AI solutions that transform claims management and customer experience from end to end.

Ready to upgrade your claims process into something faster, smarter & more reliable?

Partner with Codiant to build AI-powered claims management systems that cut resolution times by 50%.

Frequently Asked Questions

AI scans documents, reviews photos & automates routine steps. This reduces manual work and shortens claim time.

Yes. AI systems don’t get tired or distracted. They read data accurately, which means fewer mistakes and disputes.

AI tools follow strict privacy rules and use strong security measures to keep customer information safe.

No. AI supports adjusters by handling repetitive tasks. Humans still make important decisions and provide empathy where needed.

The main benefit is faster resolution. Customers get their claims settled in days instead of weeks.

Featured Blogs

Read our thoughts and insights on the latest tech and business trends

Top iPhone App Development Companies in USA in 2026

- February 18, 2026

- Mobile App Development

In a Nutshell The USA remains one of the strongest hubs for premium iPhone app development in 2026, especially for fintech, healthcare, retail, and SaaS brands. Choosing the right iOS partner goes beyond portfolios; the... Read more

How to Choose the Right AI Development Partner in the USA (Enterprise Guide 2026)

- February 12, 2026

- Artificial Intelligence

In a Nutshell Enterprise AI success starts with clear business goals, not vague plans like “we need AI.” The best AI development partners deliver real production systems, not just impressive demos or prototypes. Industry alignment... Read more

How AI Is Transforming Transport & Logistics Operations in Real Time

- February 10, 2026

- Artificial Intelligence Logistics & Transportation

In a Nutshell: AI in transport & logistics is enabling faster, smarter decision-making across fleets, warehouses, and supply chains. Real-time logistics optimization improves route planning, dispatching, and delivery efficiency as conditions change. AI-driven forecasting and... Read more