How Agentic AI will Transform Financial Services with Autonomy, Efficiency and Inclusion?

Table of Contents

Subscribe To Our Newsletter

The financial sector is at a crossroads. While digital innovation has made banking more convenient, it still struggles with core issues—manual-heavy processes, underserved markets, and rigid systems. Enter agentic AI—a revolutionary concept that goes beyond automation. It’s not just about doing things faster; it’s about doing them smarter and with minimal human oversight.

What Is Agentic AI? Why It Matters for Finance?

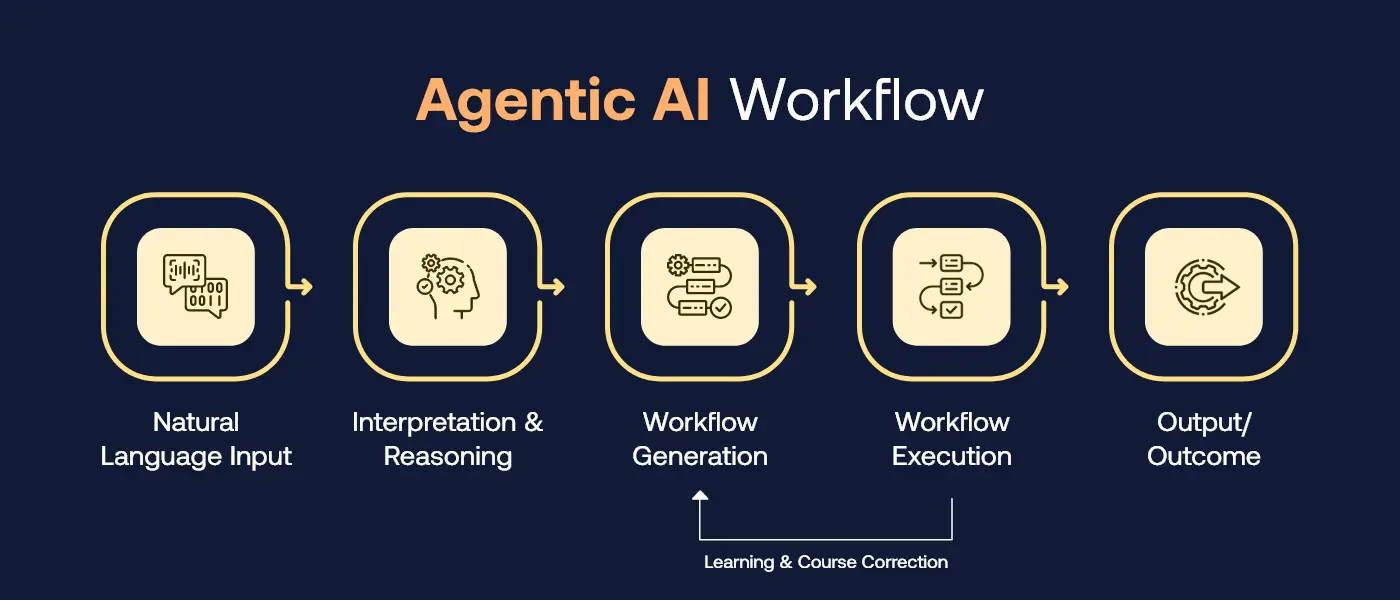

Agentic AI refers to intelligent systems that operate as goal-driven agents. Unlike passive tools, they take initiative, optimize for outcomes, and adjust behavior based on feedback. In a fast-moving domain like finance, this type of adaptive intelligence is a game-changer.

It’s a class of AI that sets its own goals, learns continuously, and adapts in real time. It doesn’t wait for instructions—it acts. In the context of AI in financial services, this means systems that detect fraud autonomously, create personalized investment strategies, and evolve compliance frameworks on their own.

Here are the core traits that define it:

Goal-Setting Capabilities: These agents interpret business objectives and autonomously plan the best course of action.

Continuous Learning: They adapt in real time by using each interaction to refine their decision-making.

Minimal Human Intervention: Once activated, these systems operate independently with minimal oversight.

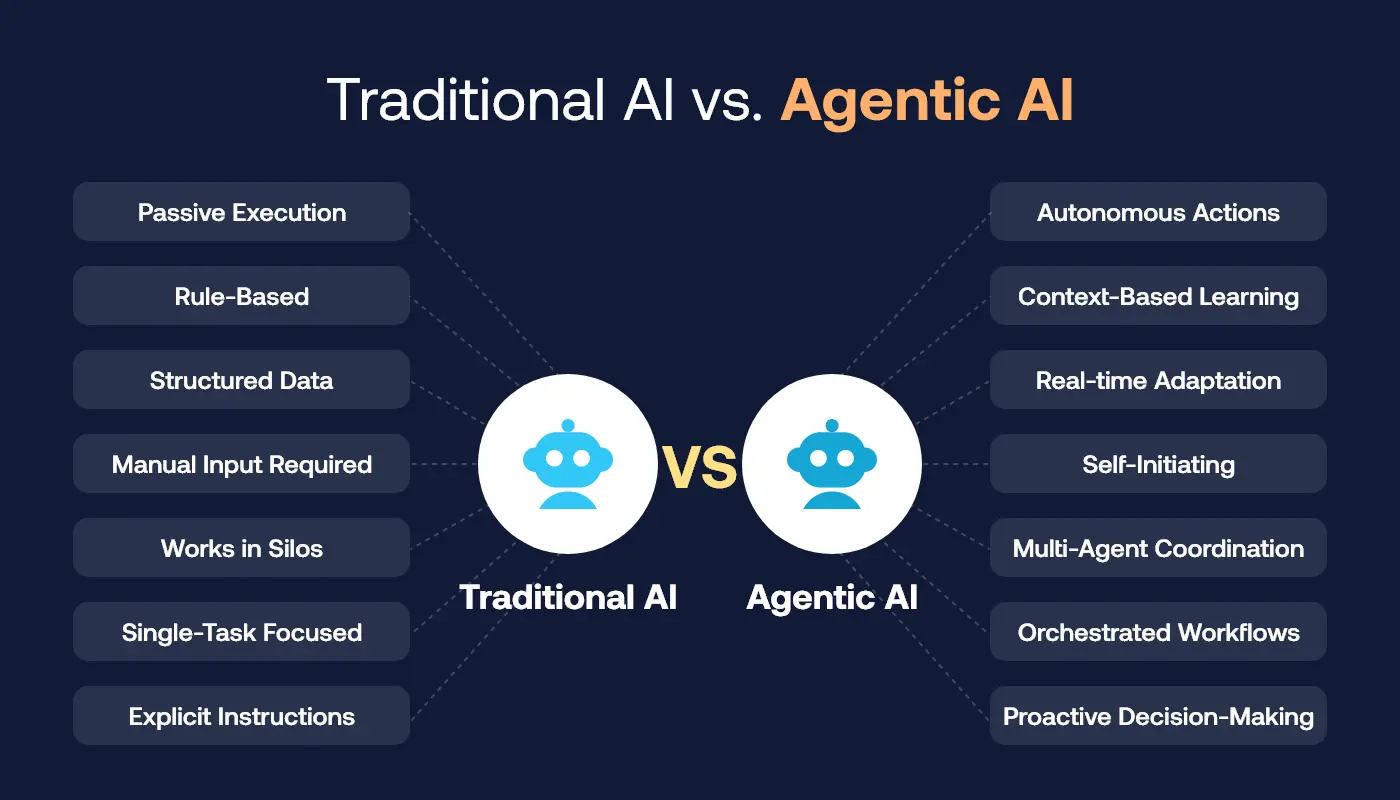

Difference Between Agentic AI and Traditional AI Models

Traditional finance has relied heavily on human-in-the-loop systems or predefined rules. These are static, error-prone, and incapable of scaling rapidly. Think of traditional AI like a helpful assistant that waits for instructions and follows fixed rules. You ask it to do something, and it does exactly that. It’s great for tasks like sorting data or answering basic questions, but it can’t think ahead or change based on new situations.

But agentic AI ushers in a new era of decision making in finance, blending intelligence with autonomy to create systems that think, act, and improve—without waiting for us to catch up. It acts as a smart teammate. It doesn’t just wait around—it sees what needs to be done, sets its own goals, learns from experience, and adjusts its actions on the fly. It’s proactive, not reactive. That’s a big deal in finance, where things change fast.

| Feature | Traditional AI | Agentic AI |

| Nature | Reactive | Proactive |

| Learning | Fixed models | Self-learning |

| Oversight | High | Minimal |

| Examples | Chatbots | Self-optimizing robo-advisors |

While traditional AI needs a lot of human supervision, Agentic AI works more independently. It’s always improving, making smarter decisions over time. This shift from rule-following to self-guided intelligence is what makes Agentic AI a game-changer, especially for banks, insurers, and investment platforms that want to stay ahead.

Still Relying on Basic Automation? It’s Time for an Upgrade.

Step into the future of finance with Agentic AI.

📊 Experience up to 30% lower operational costs

📈 40%+ boost in customer engagement

Codiant empowers leading fintech brands to build autonomous, adaptive, and cost-efficient financial products. Let’s build your Agentic future—today.

Autonomous Decision-Making: How Agentic AI Is Transforming Financial Services

Financial institutions are entering a new era of autonomy—driven by agentic AI. No longer limited to task-based automation, AI agents can now learn, adapt, and act independently. From trading and lending to fraud prevention and advisory services, this evolution is unlocking faster, smarter, and more inclusive financial operations.

Autonomous AI in Trading, Lending, and Risk Management

Agentic AI is redefining financial decision-making by moving beyond static, rule-based automation. These intelligent agents operate with real-time awareness, enabling self-directed portfolio management that adjusts to market trends and client goals without manual oversight. In lending, AI credit rates dynamic using alternative data such as mobile payment history and behavioral signals – and helps financial institutions expand services to underrated populations. In addition, AI-driven scam detection systems continuously develop their models to identify new fraud patterns, reduce false positives and improve the response rate. This level of autonomy results in more responsive, inclusive and effective economic ecosystems.

AI-Powered Financial Advisors for Scalable, Personalized Guidance

Agentic AI development enables banks and fintech companies to provide hyperpersonalized economic advisory services in the scale-once reserved only for customers. Virtual advisors powered by AI provide real -time, 24/7 financial guidance based on the user’s goals and behavior. These smart systems not only respond – they train proactive users with tailor -made nudes, reminders and strategic suggestions that develop alongside their financial journey. The result? Smarter financial decisions, greater accessibility and a more authority customer base.

Read More: How to Build AI Agents That Can Speed Up Your Work and Reduce Other Expenses

How Agentic AI Enhances Efficiency in Financial Operations?

In a sector where every second counts, and compliance is critical, financial institutions can no longer rely on outdated and manual processes. By integrating agentic AI, businesses can drastically enhance operational speed, accuracy, and cost-efficiency—redefining how tasks are handled across claims, compliance, and transaction monitoring. Here is how-

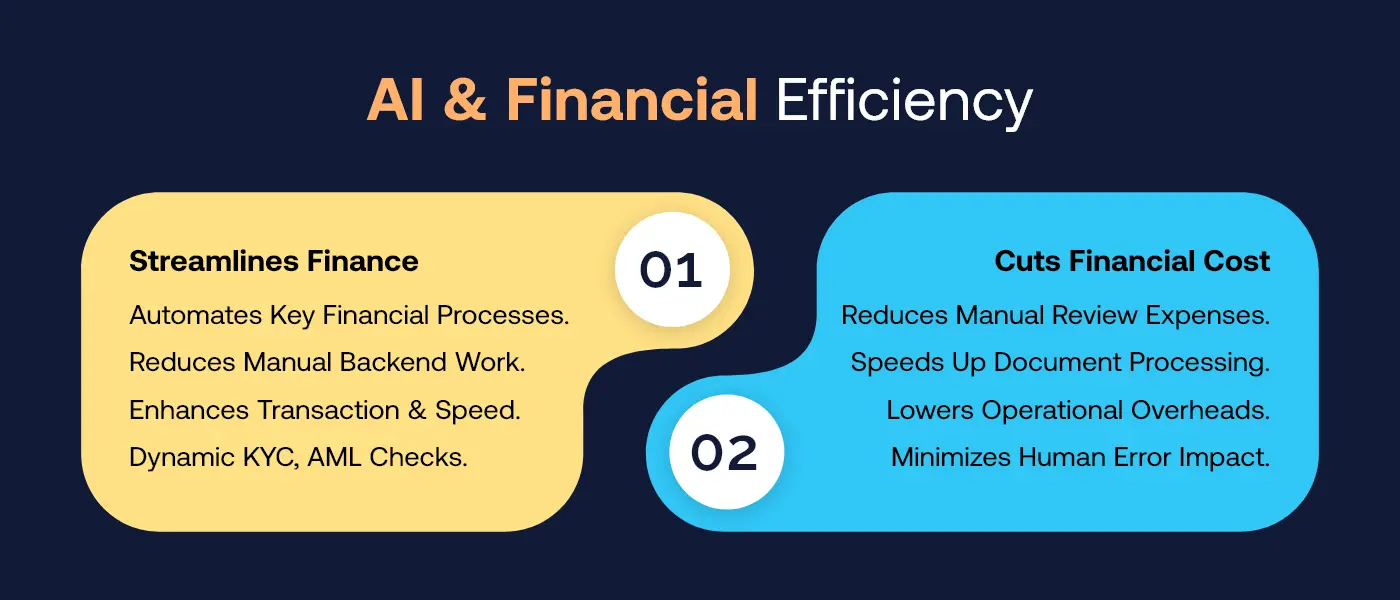

Streamlining Financial Workflows

Manual backend processes continue to drain valuable time and resources from financial institutions. With automation in financial services, Agentic AI introduces a smarter way to manage operations and automate key functions. From real-time insurance claims evaluation to dynamic KYC and AML checks that rely on behavioral patterns instead of static rules, AI is transforming how financial tasks are executed. It also enhances transaction monitoring by continuously adapting to new data, making anomaly detection faster and more accurate.

Driving Down Operational Costs and Delays

By implementing intelligent document processing and end-to-end workflow automation, financial firms can significantly reduce overheads. In fact, companies are seeing up to 70% savings on manual review costs alone. What once took hours can now be completed in minutes—entirely hands-free. This not only accelerates internal processes but also improves accuracy and scalability, allowing teams to focus on high-impact decision-making.

Read more: How AI is Transforming the Insurance Industry – A Complete 2025 Guide

Use Case: Agentic AI in Finance

AI in financial services work in pace with dynamically changing industry regulations. Agentic AI ensures compliance adapts just as quickly.

- Monitors for new rules in real-time.

- Pushes autonomous policy updates across systems.

- Generates instant alerts for regulatory breaches.

How Agentic AI Uses Adaptive Financial Services for Inclusion?

The future of finance must be inclusive—and agentic AI is making that possible. By enabling adaptive, intelligent systems that respond to individual needs and cultural contexts, financial institutions can now extend services to previously underserved populations, bridging gaps in access, understanding, and trust.

Expanding Financial Access for the Unbanked and Underserved

Today, more than 1.7 billion people remain globally unbanked, mainly due to lack of formal documentation, financial literacy or digital access. Agentic AI converts this narrative by operating micro-loan platforms with real-time, risk-based models-like strengths informal sector workers to access credit without relying on traditional bank measurements.

These AI-driven platforms also support culturally adaptive user interfaces, and offer multilingual support and personalized financial experiences that assess local customs and behavior patterns. The digital transformation of banking results in a more inclusive economic ecosystem that respects diversity and promotes the opportunity.

Delivering Personalized Financial Engagement at Scale

From rural farmers to urban gig workers, agentic AI enables hyper-personalized, real-time engagement for every type of user. By analyzing tone, context and user history, the AI systems adjust the communication style to match the individual’s comfort level and knowledge of financial concepts. They also provide tailor-made content of financial literature that meet users where they are.

All these things help to reconcile complex topics and offer actionable insights based on each user’s unique financial journey. This level of personalization not only increases the commitment, but also promotes long -term trust and authority in local communities that are traditionally abandoned from the economic system.

Ready to Serve the Next Billion Users with Adaptive AI-Powered Financial Solutions?

Codiant can help you build inclusive, autonomous platforms.

Real-World Examples of Agentic AI in Finance

Agentic AI is no longer a concept of the future—it’s actively reshaping financial operations today. From automating compliance to delivering hyper-personalized investment strategies, AI agents are proving their value across real-world platforms. Here are standout examples demonstrating how autonomous AI is driving results in the financial sector.

Silent Eight: Automating AML & Compliance with Self-Learning AI Agents

Silent Eight is a powerful example of how agentic AI is modernizing anti-money laundering (AML) and compliance operations. Its intelligent agents autonomously resolve nearly 80% of compliance alerts without human involvement, thanks to continuous learning and self-correction. By reducing false positives and improving decision accuracy over time, Silent Eight enhances both regulatory adherence and operational efficiency. This not only minimizes manual review overhead but also accelerates the resolution of high-risk cases—making compliance faster, smarter, and more scalable.

Read more: Generative AI Trends to Watch

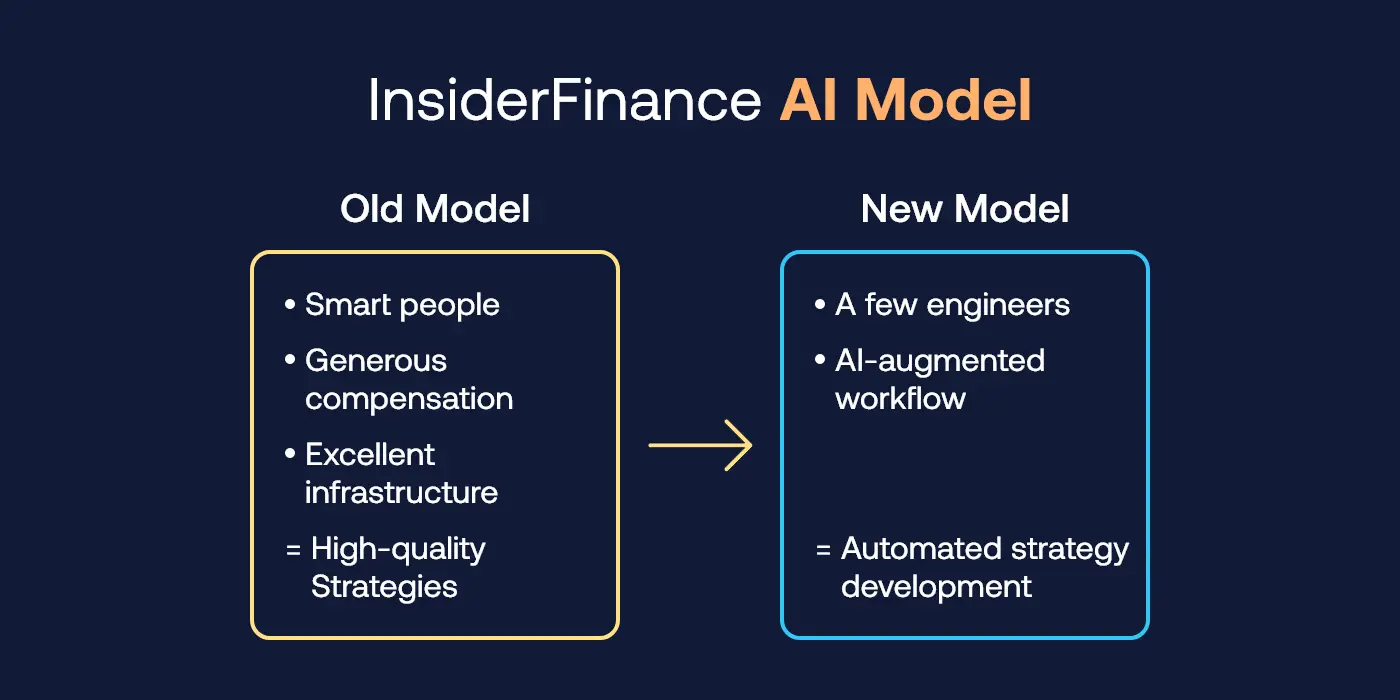

InsiderFinance: Real-Time, Adaptive Portfolio Management

InsiderFinance uses agentic AI to transform portfolio management into a dynamic, real-time experience. Instead of relying on static models, its AI agents assess user sentiment, market fluctuations, and global economic trends continuously. The platform delivers evolving strategy recommendations every hour, tailored to the investor’s risk profile and market conditions. This level of intelligent personalization empowers users with timely, data-driven insights—helping them make more informed investment decisions and adapt proactively to market volatility.

Read More: How to Modernize Legacy Systems with AI – A Step-by-Step Guide

What Agentic AI Means for Financial Software Development Companies?

To keep up with Agent AI, Fintech software developers must build systems that learn and adapt, replacing traditional rule-based frameworks.

From Rule-Based Systems to Agentic AI Architectures

Legacy economic platforms were not built for autonomy. In order to utilize Agentic AI, Fintech software development companies must fully transfer from rigid, rule-based systems to flexible, learning-based architectures. This means reengineering core elements such as data pipelines, integration of goal -oriented decision -making algorithms and create modular system components that can develop in response to inputs in the real world. Without this basic shift, integration of agent AI will be ineffective, limited or directly indescribable.

Key Considerations for Building Agentic Financial Platforms

Developing agent AI platforms is not just about adding intelligence – it’s all about building responsible and sustainable. Financial software development services must prioritize data integrity and ensure safe and accurate data flow throughout the system. Ethical AI development is also crucial; This includes setting clear behavioral boundaries and built -in railings to prevent bias or abuse. Finally, continuous feedback loops must be integrated so that AI agents can limit performance over time using outcomes in the real world to improve decision-making and reliability.

Challenges and Risks of Agentic AI in Finance

While promising, this shift isn’t without concerns:

- Transparency Issues: AI systems often lack clear explainability and accountability.

- Over-Reliance: AI may act without ethical awareness or human judgment.

- Regulatory Gaps: Policies still trail behind rapid tech innovation.

Read More:- How Much Does It Cost to Maintain an App in 2025?

What’s Next: The Future of Agentic AI in Financial Services

The future of AI in financial services is evolving beyond automation—it’s becoming truly intelligent and self-directed. With innovations like AI expense management software, the industry is moving toward smarter, data-driven decision-making that optimizes spending, improves compliance, and enhances transparency. The road ahead envisions agentic banking ecosystems, where AI-powered agents collaborate with humans to streamline financial operations, drive ESG investments, and transform interbank settlements with unmatched precision and efficiency.

At Codiant, we’re redefining this transformation through custom AI agent development, enabling financial institutions to create intelligent, adaptive systems that act autonomously while maintaining transparency and trust.

Agentic AI is more than an innovation—it’s a revolution. It offers autonomy, amplifies efficiency, and promotes financial digital solutions inclusion like never before. Financial firms that embrace this shift early will lead the charge; those that don’t risk falling behind.

Frequently Asked Questions

Agentic AI in finance refers to intelligent systems that act independently to achieve goals like risk assessment, trading, and compliance with minimal human input.

Regular AI follows rules. Agentic AI sets goals, adapts, and evolves in real time, offering proactive decision-making capabilities.

Yes, it constantly updates fraud detection models based on evolving patterns, offering better accuracy and faster response than static systems.

When designed with transparency, ethical oversight, and feedback loops, Agentic AI can meet or even exceed compliance benchmarks.

They’re integrating it into smart advisors, compliance tools, risk engines, and adaptive customer interfaces to drive autonomy and inclusion.

Featured Blogs

Read our thoughts and insights on the latest tech and business trends

Top iPhone App Development Companies in USA in 2026

- February 18, 2026

- Mobile App Development

In a Nutshell The USA remains one of the strongest hubs for premium iPhone app development in 2026, especially for fintech, healthcare, retail, and SaaS brands. Choosing the right iOS partner goes beyond portfolios; the... Read more

How to Choose the Right AI Development Partner in the USA (Enterprise Guide 2026)

- February 12, 2026

- Artificial Intelligence

In a Nutshell Enterprise AI success starts with clear business goals, not vague plans like “we need AI.” The best AI development partners deliver real production systems, not just impressive demos or prototypes. Industry alignment... Read more

How AI Is Transforming Transport & Logistics Operations in Real Time

- February 10, 2026

- Artificial Intelligence Logistics & Transportation

In a Nutshell: AI in transport & logistics is enabling faster, smarter decision-making across fleets, warehouses, and supply chains. Real-time logistics optimization improves route planning, dispatching, and delivery efficiency as conditions change. AI-driven forecasting and... Read more