Generative AI in Insurance: Benefits, Risks & Use Cases

Table of Contents

Subscribe To Our Newsletter

In a Nutshell:

- Generative AI is giving insurance a major upgrade – turning hours of paperwork into minutes of smart automation.

- It helps insurers read claims, write summaries, and understand risks faster than ever before.

- Customers feel the change too – getting quicker claim approvals, fairer prices, and policies written in plain, simple language.

- Big names like Lemonade, Allianz, AXA, and Zurich are already using AI to save time and cut manual work by nearly 40%.

- The market is growing fast – from $761 million in 2022 to a projected $14.4 billion by 2032, showing how fast insurers are adopting it.

- Still, AI isn’t perfect. It can make mistakes or show bias if not guided carefully – that’s why human oversight is key.

- By 2030, Generative AI will be at the heart of every major insurance company, helping people get faster, fairer, and more transparent coverage.

Insurance has always been a numbers game wrapped in paperwork and policy fine print. For decades, it’s relied on human judgment – cautious, rule-bound, and painfully slow at times. Then came Generative AI in insurance, and suddenly, the industry’s most traditional processes started moving at digital speed.

What used to take hours of manual review – risk summaries, claim descriptions, underwriting notes – can now be generated in minutes. Not copied, not templated, but freshly written from scratch by systems that understand language almost like we do. It’s not magic- it’s machine intelligence that’s learned to write, reason, and make sense of uncertainty.

Behind the scenes, insurers are quietly testing these models on real problems- handling claim inquiries, scanning fraud patterns, rewriting dense policy documents into plain English. The shift isn’t loud or headline-hungry – it’s pragmatic. Generative AI in insurance isn’t replacing people- it’s removing the paperwork that kept them from thinking.

This new chapter in insurance isn’t about automation for the sake of efficiency. It’s about giving back what the industry lost somewhere along the way – speed, clarity, and a bit of human sanity in a business built on trust.

What Is Generative AI in Insurance?

Simply put, Generative AI Solutions in insurance means using smart computer systems that can think, learn, and create new things on their own. These systems don’t just follow set rules – they understand patterns in data and can write, summarize, or make smart suggestions that sound almost human.

In the past, regular AI could only sort or predict information. But Generative AI can create. It can write policy documents, prepare claim summaries, or even build risk reports in seconds. This helps insurance teams save time, reduce errors, and focus on helping customers instead of doing endless paperwork.

The real change, though, is in the Generative AI for insurance customer experience. Imagine a virtual assistant that answers questions, explains confusing terms, and gives updates right away – without waiting on hold. Or a system that creates custom policy options based on each person’s needs. It’s not taking away the human touch – it’s making customer care faster and more personal.

Paperwork slows people down. Generative AI fixes that.

If your teams still spend hours on summaries and reports, it’s time to let AI do the typing.

How Generative AI Is Changing the Future of Insurance

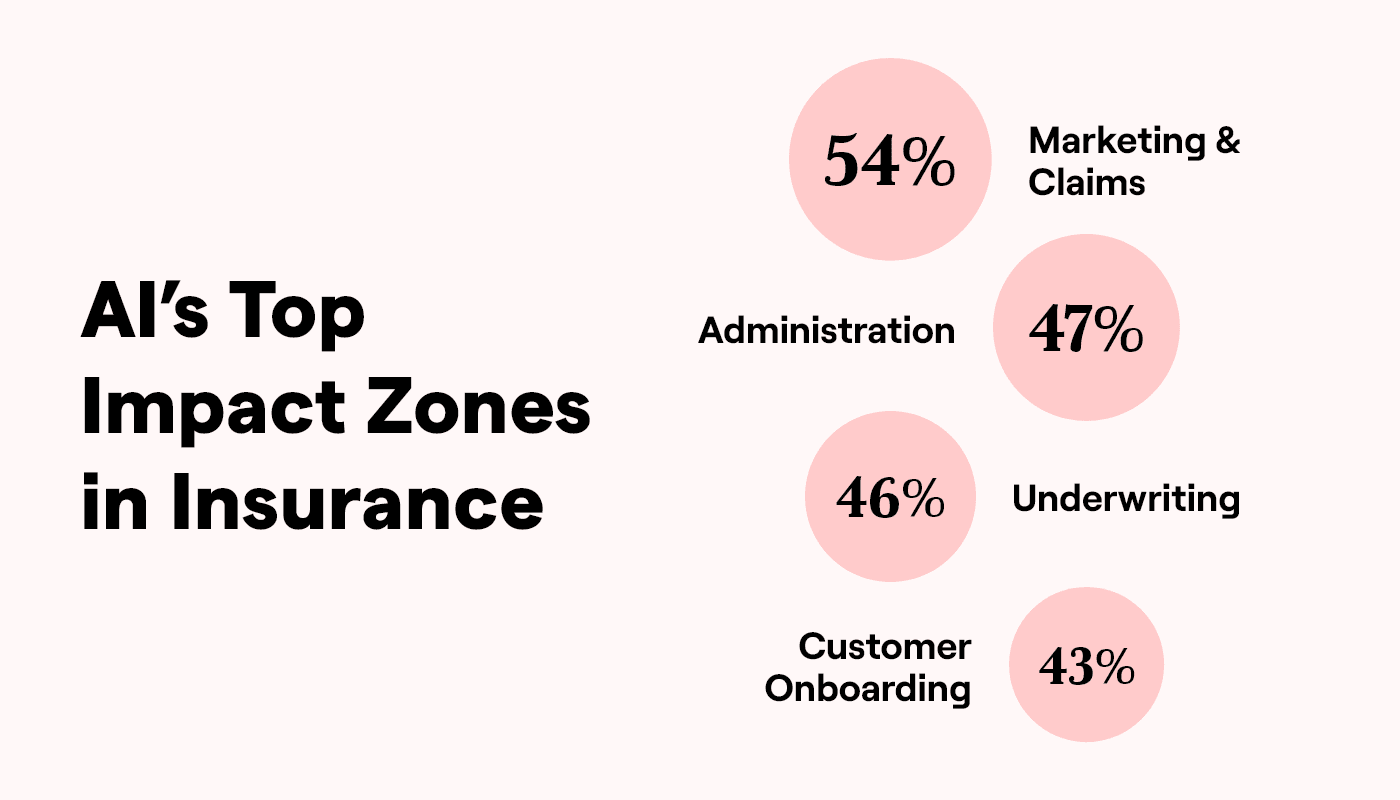

The impact of Generative AI in insurance goes far beyond chatbots and automation. It’s changing how insurers understand customers, assess risk, and handle every step of a policy’s journey – from onboarding to claims. Below are some of the most powerful ways it’s reshaping the industry.

- Smarter Underwriting and Risk Assessment

Underwriting used to rely heavily on manual data checks, long forms, and cautious assumptions. Now, Generative AI can analyse years of historical data, market trends, and even satellite or IoT inputs to create precise risk profiles in minutes. It can generate draft policies, summarize risk patterns, and flag unusual cases before a human ever steps in. The result? Faster decisions and far fewer blind spots.

- Faster, Fairer Claims Processing

One of the biggest breakthroughs is Generative AI in insurance claims processing. Instead of sifting through endless reports and forms, AI can instantly read, summarize & categorize claim details. It drafts settlement summaries, detects possible fraud & even predicts claim outcomes based on previous patterns. Customers get quicker resolutions & insurers save valuable hours of manual review – a win for both sides.

- Personalized Customer Experience

Generative AI for insurance customer experience is transforming how policyholders interact with insurers. AI-driven assistants can explain coverage in plain language, generate personalized policy recommendations & provide real-time updates – all without human delay. Every interaction becomes faster, clearer & more personal, creating trust where it used to take time and repetition.

- Regulatory and Compliance Automation

Compliance has always been a time sink in insurance. Generative AI helps draft policy documents, generate audit summaries & translate complex legal texts into simple terms. It ensures regulatory requirements are met – while freeing human teams to focus on strategy, not paperwork.

- Product Innovation and Simulation

Before launching a new insurance product, companies can use Generative AI to simulate market responses or test policy language for clarity and fairness. It can even generate marketing content tailored to each customer segment. This blend of data and creativity lets insurers innovate confidently – and move faster than competitors tied to old workflows.

Benefits of Generative AI in the Insurance Industry

Generative AI is transforming the way insurance companies operate. It isn’t just duplicating what it finds – it learns from, understands and generates new content that can help with the accelerating of this process and makes things clearer. Here’s how it’s making insurance smarter and quicker.

- Faster Claim Handling

It used to take a while to file an insurance claim. Now AI can read accident reports, extract data from forms and even draft the first few versions of claim summaries. This enables companies to resolve cases more quickly and provide customers with faster answers when they truly need them.

- Personalized Policy Creation

No more one-size-fits-all insurance plans. Generative AI assists companies in crafting policies that meet the needs of each individual. It can analyze driving patterns, health statistics or nearby weather hazards to offer individualized coverage and equitable pricing for all.

- Smarter Risk Checking

Instead of only using old charts or statistics, AI can look at more kinds of data – like satellite photos, sensor data, or past claims – to find possible risks. This helps insurance agents make better decisions and set prices more accurately.

- Clearer Customer Conversations

Insurance language can be confusing. Generative AI can explain tricky terms in plain English, answer questions instantly, and summarize policy details. This helps customers feel more confident and informed instead of lost in complex documents.

- Saving Time and Money

AI can write reports, fill out forms, and handle other repetitive office tasks automatically. This means employees can focus on solving real problems and helping customers. Many companies have already seen their efficiency improve by 30–40%.

Common Generative AI Use Cases in Insurance

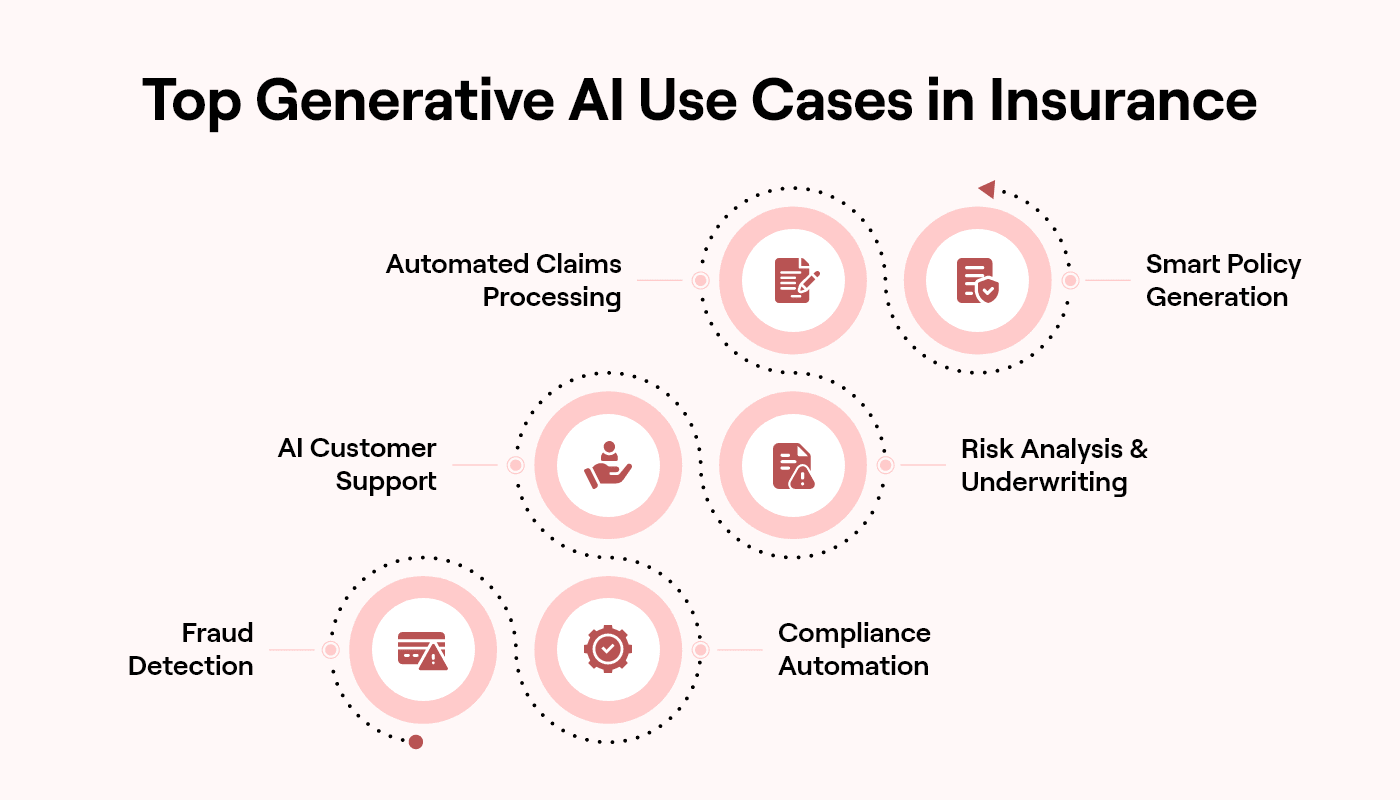

Generative AI isn’t just for tech experts anymore-it’s now helping real insurance companies do their daily work faster and smarter. From handling customer chats to checking claims, AI is making tough jobs easier. Here are some of the main way’s insurance companies use it today-

- Claims Documentation and Assessment

When people file claims, there’s usually a pile of papers-photos, notes, repair costs, and policy details. Generative AI helps sort and organize all this information. It can read documents, fill out forms, and even write short summaries. Some companies also use AI to look at photos of damage and guess repair costs, which helps speed up claim approvals.

- Policy Drafting and Summarization

Insurance policies are full of long and confusing words. Generative AI can write first drafts of these policies based on what kind of coverage someone needs. It can also make shorter, simpler versions that are easier to understand-so customers know exactly what’s covered and what’s not.

- Customer Support and Virtual Agents

AI chatbot Development and voice assistants can now answer customer questions anytime-like how to file a claim or renew a policy. They sound natural, not robotic, and they learn from every chat. The more they’re used, the better they get at helping people quickly and politely.

- Underwriting and Risk Insights

Before giving someone insurance, underwriters check all kinds of data-home details, location, past claims, and more. Generative AI can read through massive amounts of this data and point out what’s important. It helps spot possible risks, find missing details, and create clear reports that make decisions faster and more accurate.

- Fraud Detection and Investigation

Insurance fraud costs a lot of money each year. Generative AI can find strange patterns in claims-like fake photos or repeated information-that might mean someone is cheating. It also helps investigators by writing short, easy-to-read summaries about each suspicious case.

- Internal Reporting and Compliance Automation

Every insurance company must follow strict rules. Writing reports for this can take forever. AI makes it faster by automatically creating compliance checklists and summaries. This way, reports stay accurate and follow all the latest laws-without needing hours of manual work.

In short- Generative AI doesn’t just automate tasks-it understands information like a smart assistant. It helps insurers work faster, write clearer documents, and make better decisions. The result? Happier customers, smoother operations, and a more modern insurance experience.

The Risks and Ethical Concerns

Generative AI in insurance is helpful, but it also comes with it own set of risks. To use it safely, companies need strong rules and human oversight.

- Data Privacy & Compliance

Insurance companies handle a lot of personal and financial information. When they use AI tools they should make sure that this data must stay safe. If the system is not well-protected, private details can leak. This can break laws like GDPR or HIPAA and hurt the company’s reputation. You should first contact to HIPAA consulting company for that.

- Hallucination & Accuracy Issues

Sometimes AI makes things up or gives wrong answers – this is called “hallucination.” In insurance, a wrong claim report or policy detail could lead to confusion, legal trouble, or lost customer trust.

- Bias in Models

If an AI learns from unfair or unbalanced data, it might make biased decisions – like rejecting certain people’s claims or policies for no fair reason.

- Regulatory Gaps & Human Oversight

AI laws are still new and not always clear. That’s why humans should always double-check AI’s work. Using Explainable AI (XAI) helps everyone understand how the system makes decisions and keeps the process honest and fair.

Generative AI use cases in insurance

- Lemonade

Lemonade is one of the first insurance companies to use Generative AI for almost everything it does. Its smart AI helpers, “Maya” and “Jim,” can create new insurance policies, answer customer questions, and even approve small claims in minutes-no paperwork or long waiting times.

The AI understands what customers say, writes clear policy documents, and helps people get their money faster. This makes insurance simpler, quicker, and more transparent for everyone.

- Allianz

Allianz uses large AI models to make work easier across different countries and languages. The AI can quickly read long claim documents, summarize them, and translate messages for customers and teams.

This helps employees work faster, understand complex cases, and make better decisions. By saving time on paperwork and improving communication, Allianz delivers smoother and faster customer service everywhere.

- AXA

AXA uses Generative AI to create legal and compliance documents automatically. The system also writes drafts for new policies and sends personalized messages to customers.

This means less manual work for employees and fewer chances of mistakes. The AI helps AXA stay updated with new laws and respond faster to customer needs-all while staying safe and accurate.

- Zurich Insurance

Zurich Insurance uses AI tools like GPT to detect fraud & organize claim data. The system reads large amounts of information, creates short summaries & finds anything suspicious that might point to fake claims.

It also helps employees make decisions more quickly and accurately. By using AI, Zurich saves time reduces manual work and protects customers from fraud more effectively.

How Insurers Can Adopt Generative AI Responsibly

Applying Generative AI in insurance requires careful planning and strict rules. Companies should begin by creating a comprehensive plan demonstrating how AI can be deployed safely & fairly. This plan should feature rules for dealing with data, for spotting bias & and making sure AI results are easy to understand.

Insurance Teams need to build secure systems to safeguard customer data and comply with privacy laws such as GDPR & HIPAA. All AI models and results should be tracked/ stored in a systematic manner.

To reduce risks, begin with simple and low-risk use cases – such as writing internal reports, summarizing claims or chatbots for customer help – before experimenting with AI in big areas like pricing or underwriting.

Just never forget the humans. That is, people should check and sign off on AI decisions to make sure they are accurate and fair.

Finally work with a trusted AI development company. The right partner helps you stay within the law, follow industry rules & use AI responsibly while keeping your customers’ trust.

The Future of Generative AI in Insurance: What to Expect by 2030

By 2030, Generative AI will be at the heart of how insurance companies work. AI helpers (called co-pilots) will support agents by writing quotes, understanding customer moods and even predicting which claims might happen next.

For customers, insurance will feel more personal. Prices and plans will adjust automatically based on data from smart devices that track things like health, driving, or home safety.

In the modern insurance landscape, automation and intelligence are transforming every step of the process. Advanced systems powered by RPA and AI can now manage everything—from policy creation to claim approvals—with unmatched accuracy and speed. By integrating an AI chatbot for insurance, companies can offer instant customer support, minimize delays, and resolve issues before clients even realize they exist. This seamless blend of technology not only saves time and reduces operational costs but also builds long-term trust through smarter, proactive service.

Conclusion

Generative AI will not replace underwriters, agents or adjusters-it will actually amplify their expertise. By transforming how insurers assess risk, process claims and engage with customers, GenAI solutions is reshaping the core of the insurance ecosystem into something faster smarter & more human-centric.

Yet, with innovation comes responsibility. The next era of insurance will belong to companies that embrace AI not just for efficiency, but with a commitment to ethical use, transparency and trust-ensuring technology serves people, not the other way around.

Reimagine Insurance. The AI Way.

Transform claims, risk, and customer journeys with Generative AI built for speed and trust.

Frequently Asked Questions

Many insurance companies already use AI for real work. For example, Lemonade uses AI chatbots to help customers file claims in minutes. Zurich Insurance uses it to write reports and study risk data. Some companies also use AI to help agents write emails, explain policy details & talk to customers in different languages.

No, not really. AI doesn’t replace people – it helps them. It takes care of boring tasks like writing reports or answering common questions. This gives agents more time to help customers, solve real problems & build better relationships.

The biggest issues are privacy, accuracy & bias. Sometimes AI can give wrong or unfair answers. It may also use old or sensitive data. That’s why humans still need to check what AI creates and make sure it follows the right rules.

Yes, they can. Many AI tools now come as affordable subscriptions or APIs. Small firms can start with simple things like chatbots or policy writers without spending a lot. They can use cloud platforms and grow as their needs increase.

Start small. Try AI for customer chats, email writing, or report summaries. Use only secure data, review results carefully & set clear limits on what AI can do. It’s smart to work with an AI expert who knows both technology and insurance rules.

Featured Blogs

Read our thoughts and insights on the latest tech and business trends

How to Hire AI Developers for Automation & Smart Applications- A Complete Guide for 2026

- January 29, 2026

- Staff Augmentation

In a Nutshell AI hiring in 2026 is a business decision, not just a technical one. Most AI failures happen due to wrong hiring models and unclear scope, not bad ideas. Successful automation starts by... Read more

How Much Does It Cost to Build an eCommerce Platform in Australia?

- January 27, 2026

- E-commerce

In a Nutshell eCommerce development costs in Australia typically start from AUD $10,000–$25,000 for basic stores, while advanced or enterprise platforms can range from AUD $80,000 to $250,000+ depending on complexity. Shopify offers a lower... Read more

How Long Does It Take to Develop an App in 2026?

- January 21, 2026

- Mobile App Development

In a Nutshell App development timelines depend more on scope clarity than technology speed. Simple apps take 2–4 months; complex platforms often require 9–12+ months. MVPs typically launch within 6–16 weeks when features remain tightly... Read more