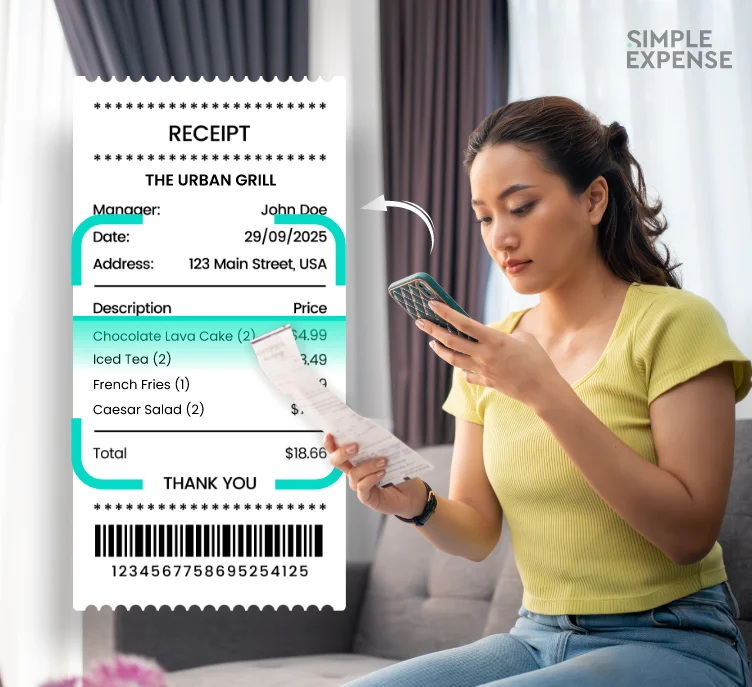

Smarter Tracking, Less Effort

Money management is no longer about typing every detail. With Simple Expense, receipts, bills or even quick notes get transformed into clear expense logs. The AI organizes everything-so you know exactly where your money goes without extra effort.

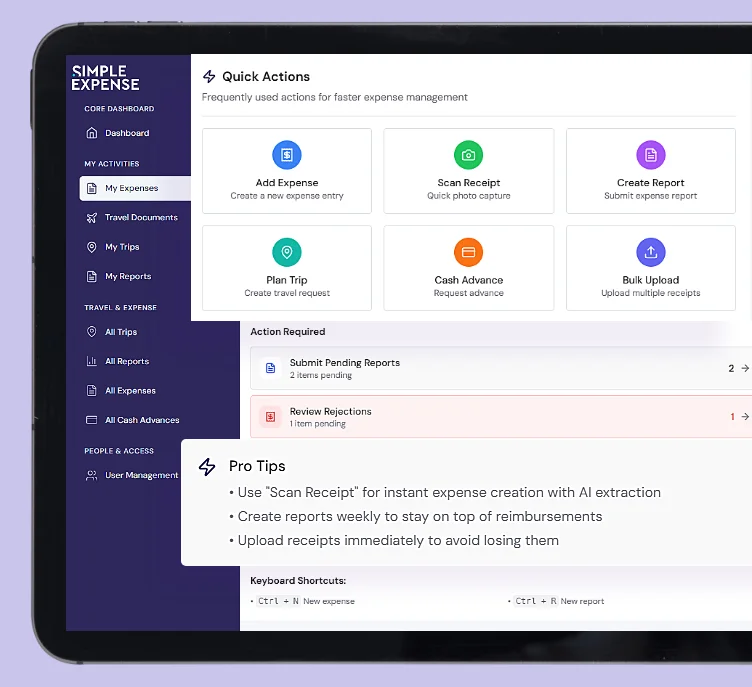

What You Can Do with Simple Expense

Smart features of Simple Expense designed to simplify your financial life.

Designed for Every Business Workflow

Built to support employees, managers, and finance teams across all kinds of work environments.

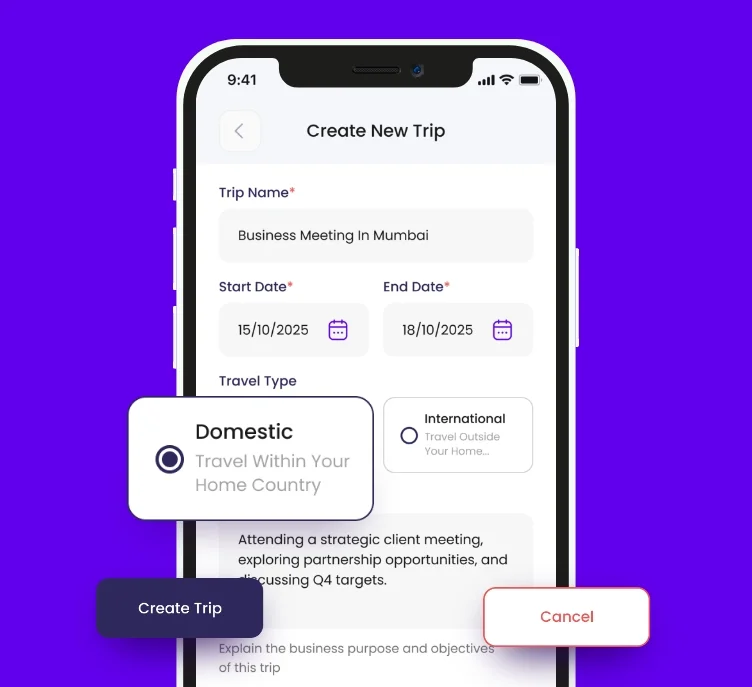

Business Travelers

Employees who frequently travel for work and need a fast way to record and claim expenses.

Remote & Hybrid Teams

Staff working from home or on the go who must track daily work-related spending easily.

Finance & Accounts Teams

Teams responsible for auditing, approving, and managing organization-wide expenses and reimbursements.

HR & Admin Departments

Stakeholders who oversee travel policies, cash advances, and employee reimbursements.

Team Leads & Managers

Supervisors who review, validate, and approve expense reports across their teams.

Small & Mid-Size Enterprises

Growing companies needing a structured, compliant, and scalable expense management system.

Why Smart Users Trust Simple Expense

Because business travel and reimbursement tools should feel effortless, not exhausting.

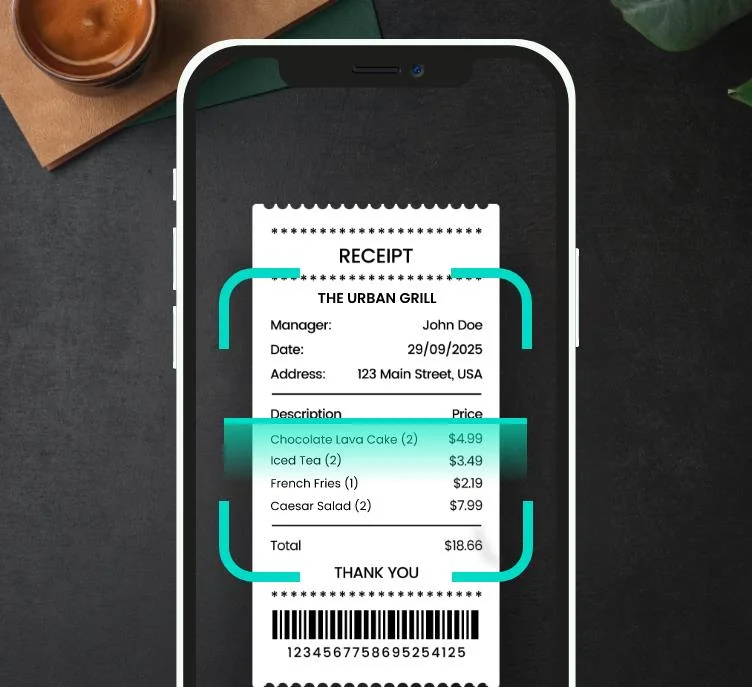

Effortless Expense Capture

- Scan receipts instantly with AI—no manual typing or spreadsheets.

- Auto-fill date, vendor, and amount for quick and accurate logging.

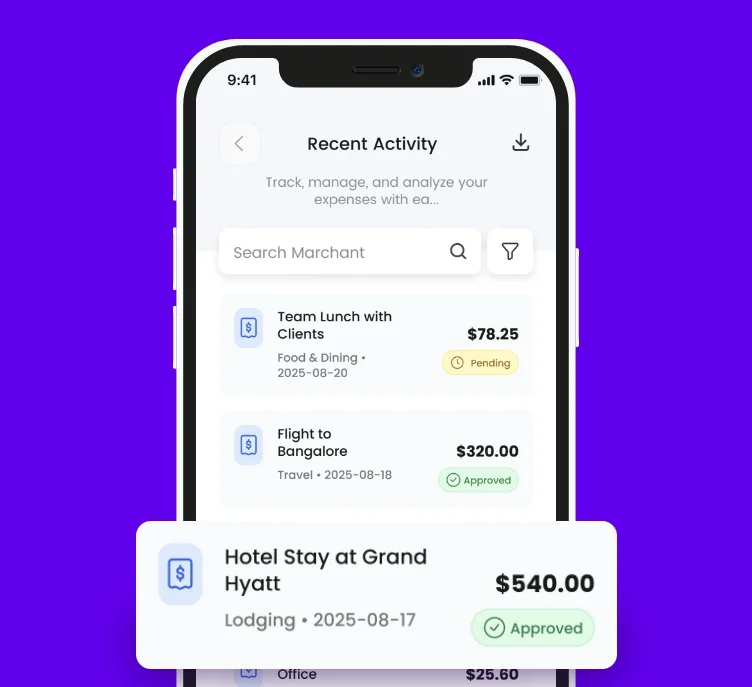

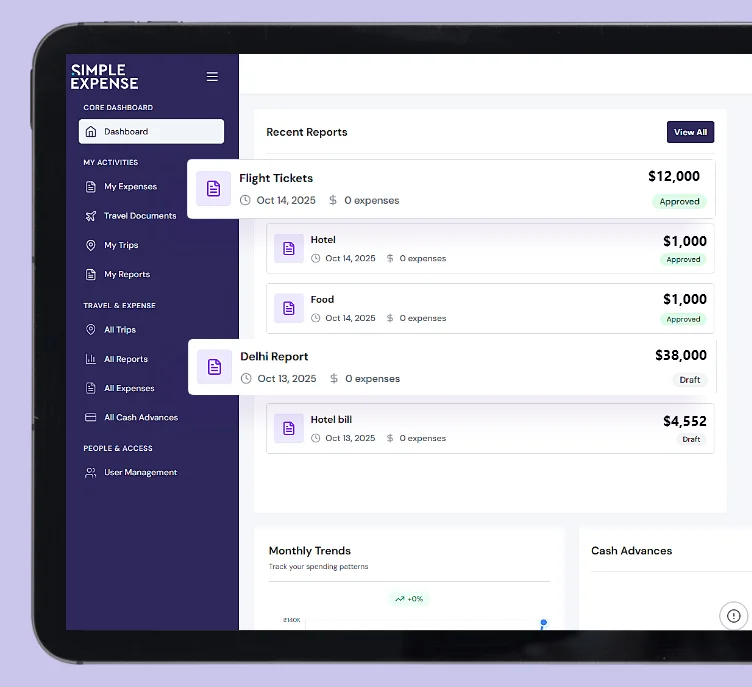

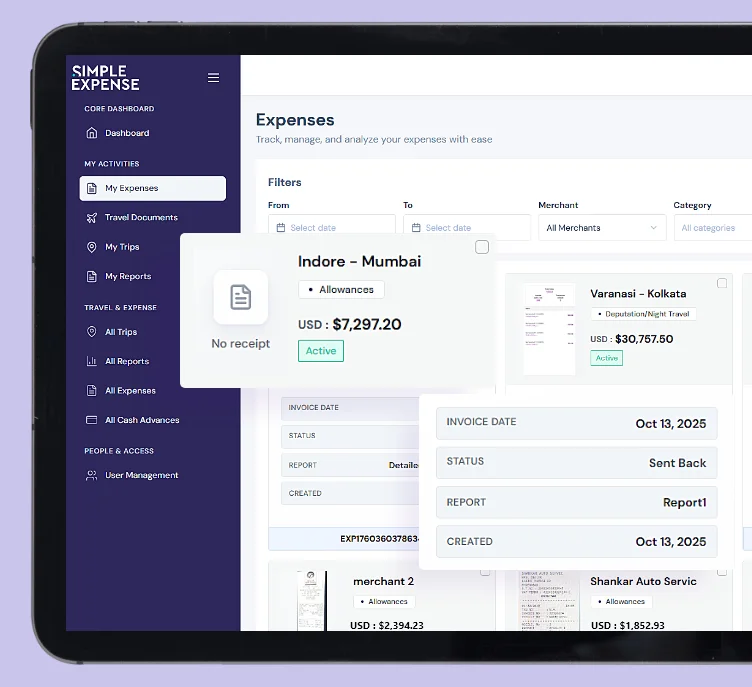

Real-Time Trip Management

- Track all trip details, documents, and submissions in one organized place.

- Get instant visibility into duration, total spend, and report status.

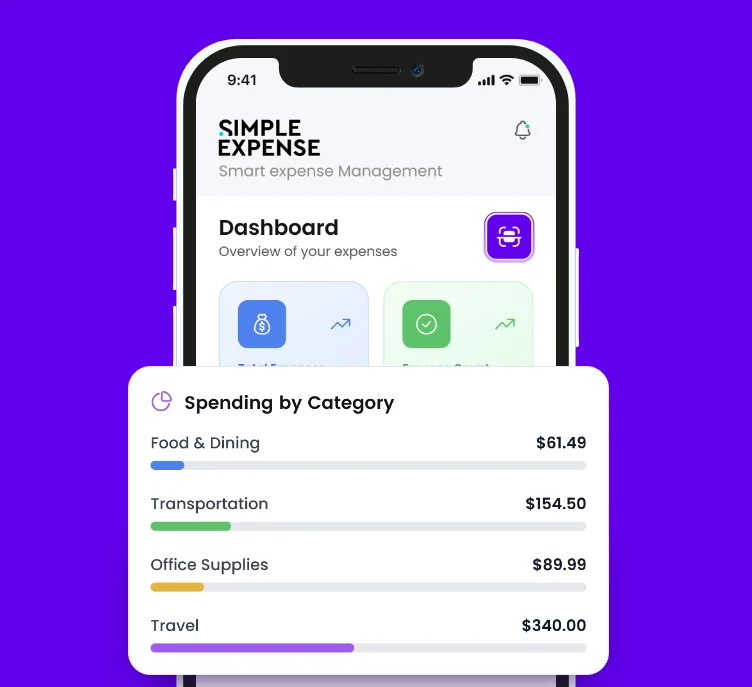

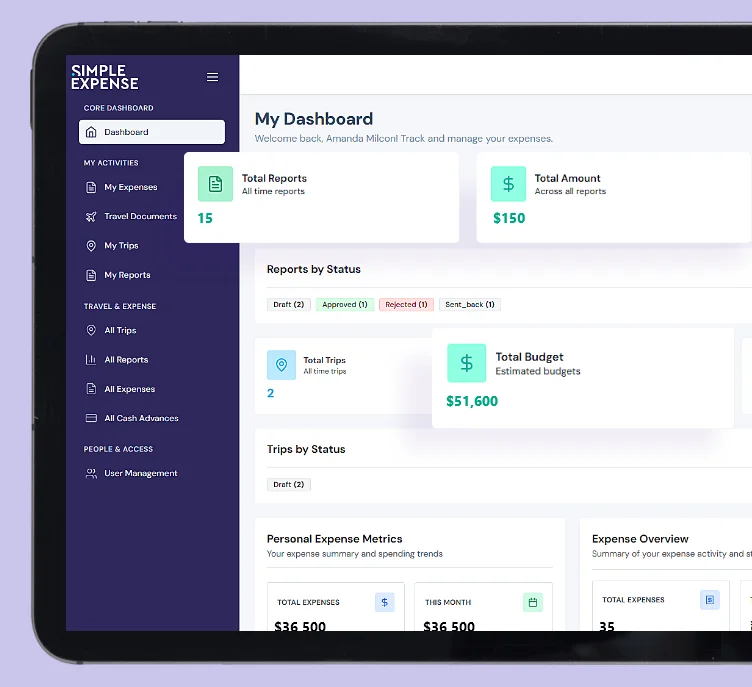

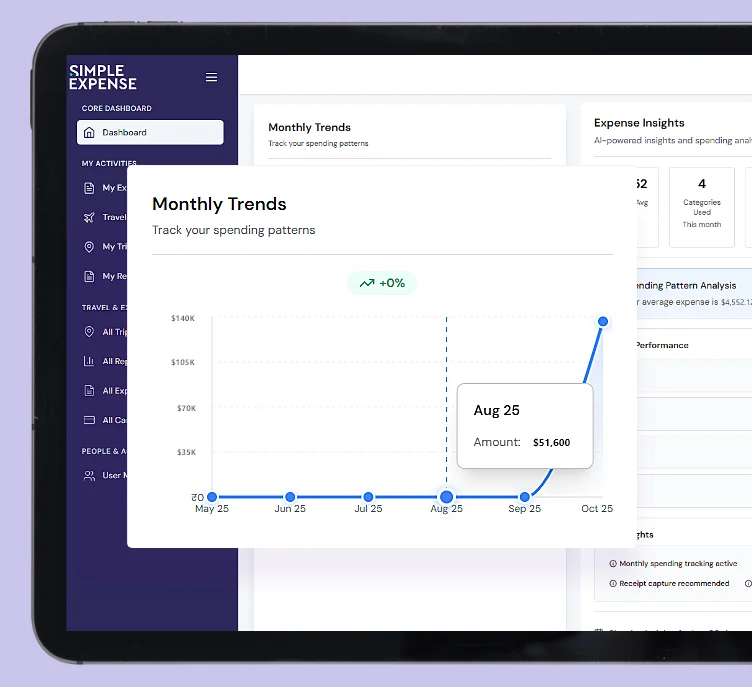

Actionable Spend Insights

- Visual dashboards highlight top categories, monthly trends, and spending spikes.

- Clear patterns help employees and finance teams manage costs better.

Always in Sync

- Cloud-backed data ensures expenses, reports, and trips stay updated across all devices.

- Access everything on the go—at airports, hotels, or remote locations.

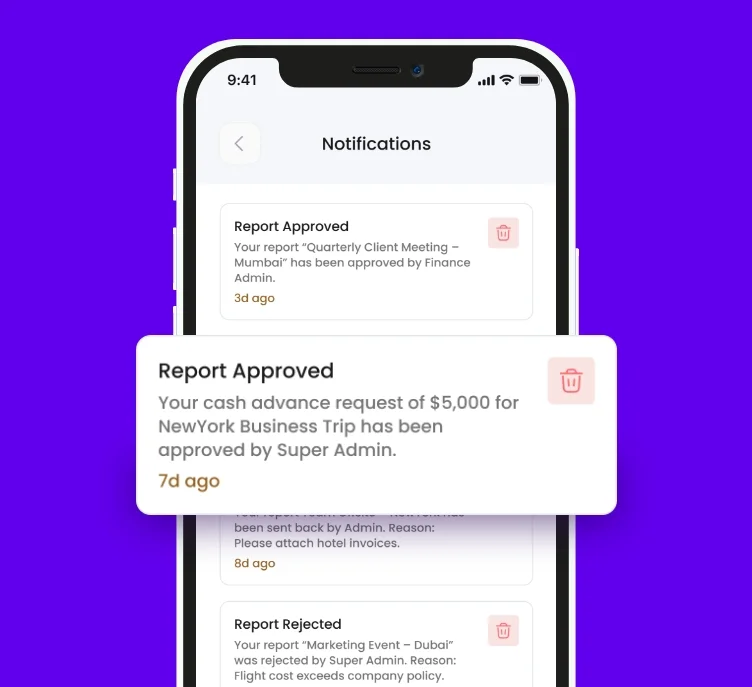

Smart Alerts

- Notifications for approvals, rejections, missing receipts, and pending submissions.

- Helps users stay compliant and avoid delays in reimbursements.

Enterprise-Grade Security

- End-to-end encryption protects every document, receipt, and financial record.

- Strict role-based access ensures only authorized users handle sensitive data.

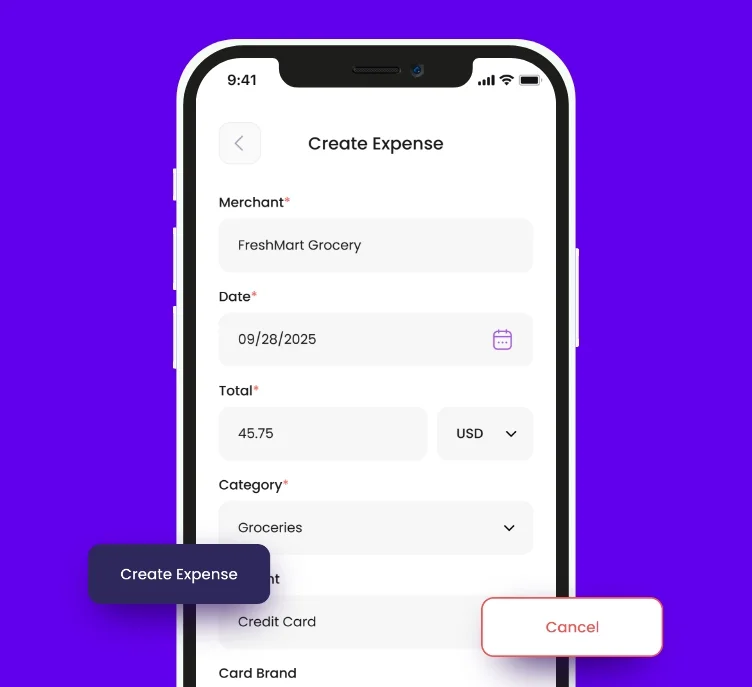

Powerful Features That Simplify Every Step

A curated set of tools designed to make business travel, expense tracking, and reimbursements effortless.

The Smarter Way to Manage Business Expenses

Simple Expense doesn’t just record claims. It helps teams stay organized, compliant, and financially confident across every trip and reimbursement cycle.

Powering Conversations

Across Every Industry

Every industry operates differently, but all benefit from faster answers, better engagement, and intelligent interactions—powered by conversational intelligence.

What’s New in AI?

Stay updated with the latest breakthroughs, innovations, and real-world AI applications transforming industries worldwide.