About LMS Insurance Chatbot

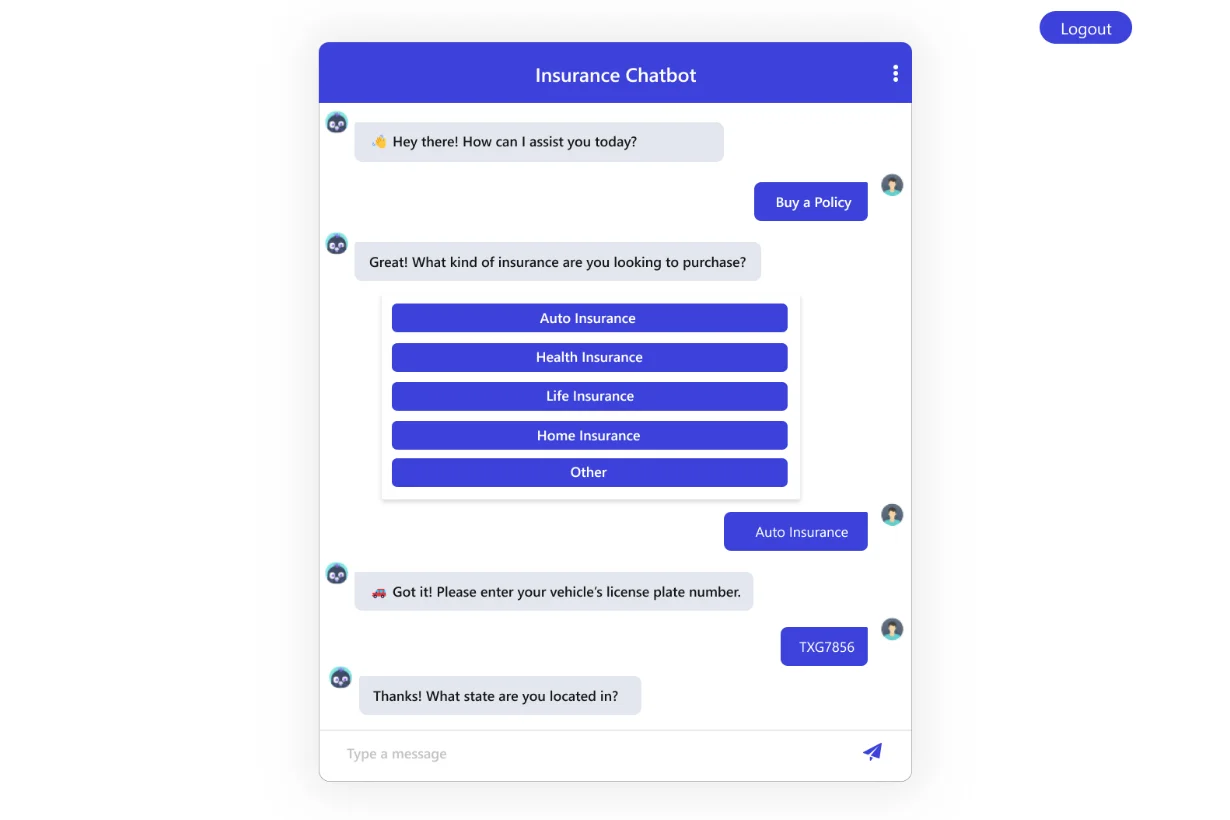

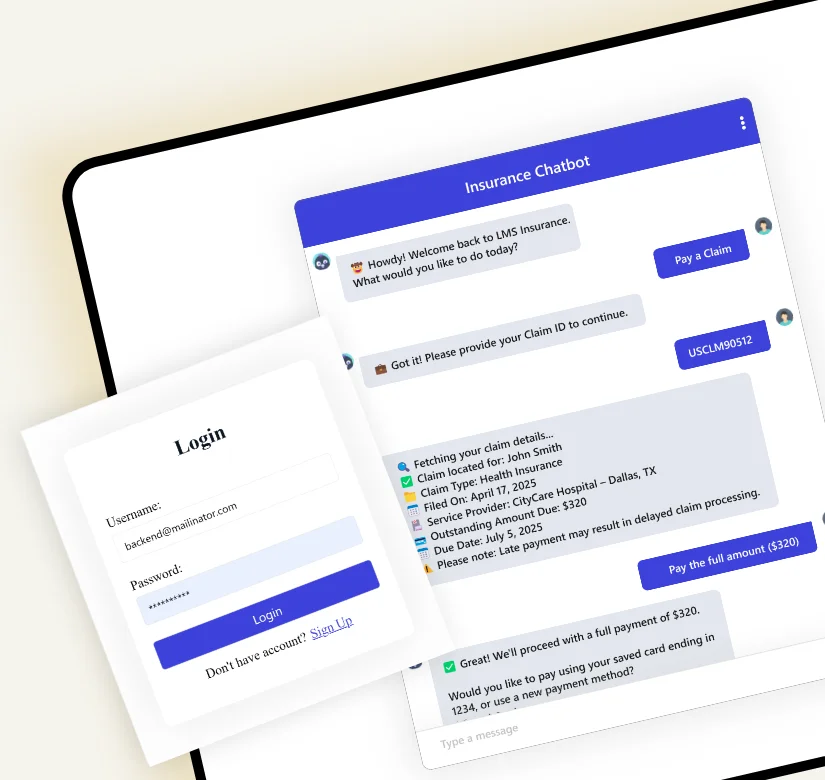

LMS Insurance Chatbot is an AI-powered tool that makes booking insurance policies easy with smooth, hassle-free interactions. Leveraging advanced NLP and ML algorithms, the chatbot assists users in selecting and purchasing the right insurance policies for health, life, auto, and home coverage. It guides users through the process and enables them to buy a policy directly. The system enhances accessibility to insurance services, minimizes manual intervention, and ensures a smooth, secure, and efficient policy acquisition experience.

-

Client’s Location

United States

-

Development Time

06 Weeks

-

Target Users

Insurance Policy Seekers, Agents, Insurance Companies

Technologies Leveraged

We utilized the power of robust and secure technologies, tools, and frameworks to enhance the development of new features and functionalities on this website.

Rasa

Fast API

Django

MySQL

HTML5

CSS

The Need

Traditional insurance policy booking often involves lengthy procedures, requiring extensive paperwork and manual processing. Users frequently struggle to navigate complex insurance options and understand policy terms, leading to confusion and delays. To overcome these challenges, the client aimed to develop an AI-powered chatbot capable of guiding users through the policy selection process, providing personalized recommendations, and enabling seamless insurance purchases. The solution needed to ensure security, accuracy, and efficiency while supporting scalability for a growing customer base.

Client Goals

The client partnered with Codiant to build an AI-powered chatbot that simplifies policy selection, boosts user engagement, and streamlines insurance booking with real-time support.

Key Objectives

- Develop an AI chatbot for seamless insurance policy recommendations.

- Enable direct policy booking with minimal manual intervention.

- Provide real-time insights on customer preferences and trends.

- Ensure security and compliance with industry regulations.

- Scale the system for a high volume of insurance transactions.

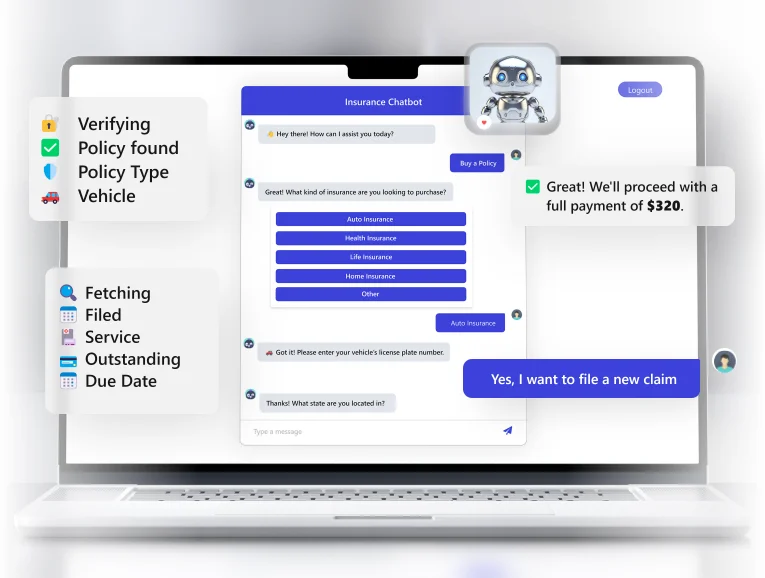

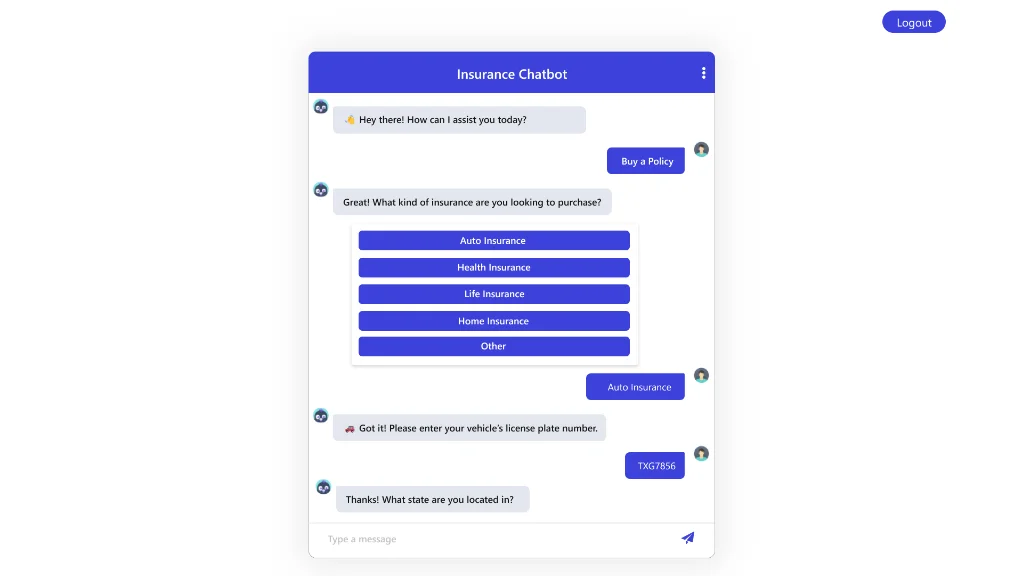

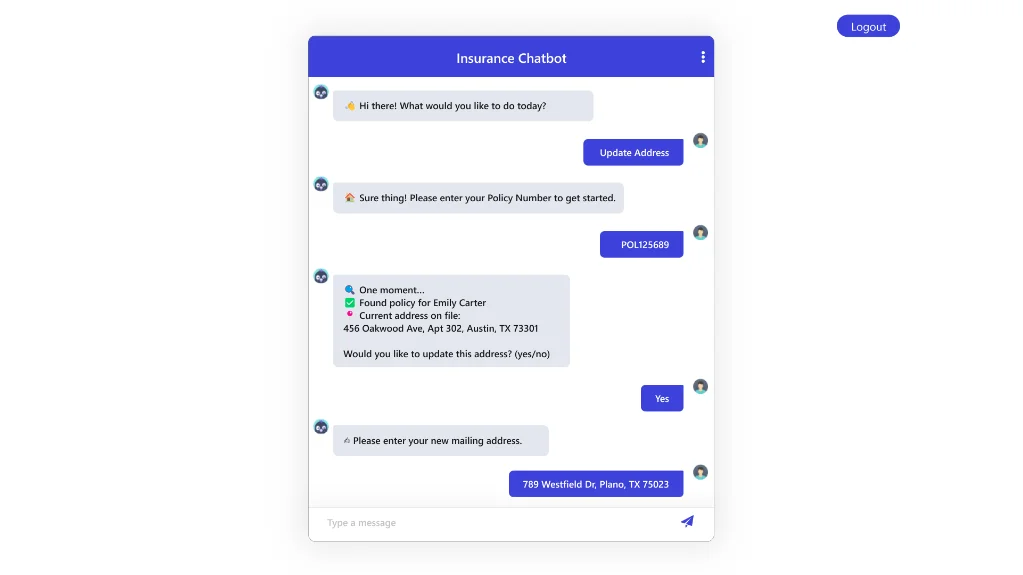

Digitally Appealing Designs

Our UI/UX team developed hi-fi prototype after low-fi approval, through intuitive interfaces and aesthetically appealing layouts.

Web Visual Designs

To design visually captivating websites, our UX experts combined creativity and functionality to create a simple yet impactful interface that delivers the brand's message.

Development

The project followed a structured AI-driven development approach, integrating key features to optimize the insurance policy booking experience.

AI-Powered Policy Recommendations

Analyzes user preferences and requirements to suggest the most suitable insurance policies.

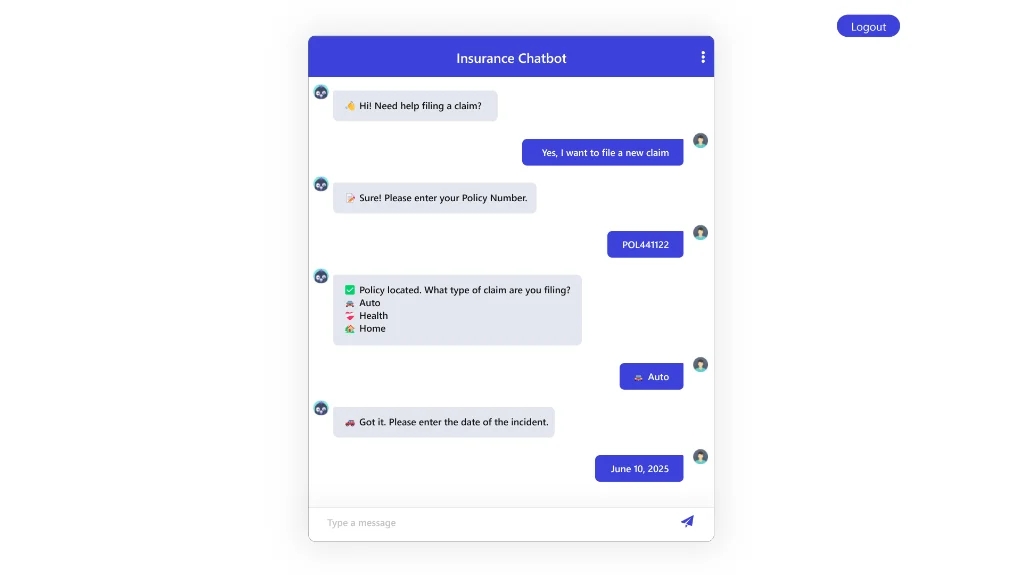

Seamless Policy Booking

Enables direct purchasing of health, life, auto, and home insurance policies within the chatbot interface.

Real-Time Assistance

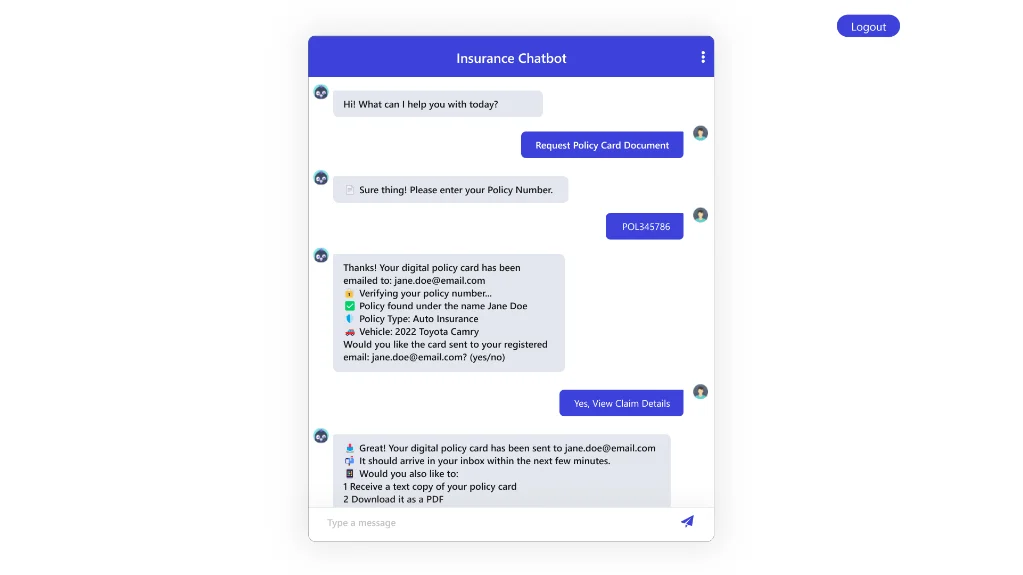

Provides 24/7 support for user inquiries, claim guidance, and policy-related queries.

Instant Premium Calculations

Uses AI-driven algorithms to calculate insurance premiums based on user inputs.

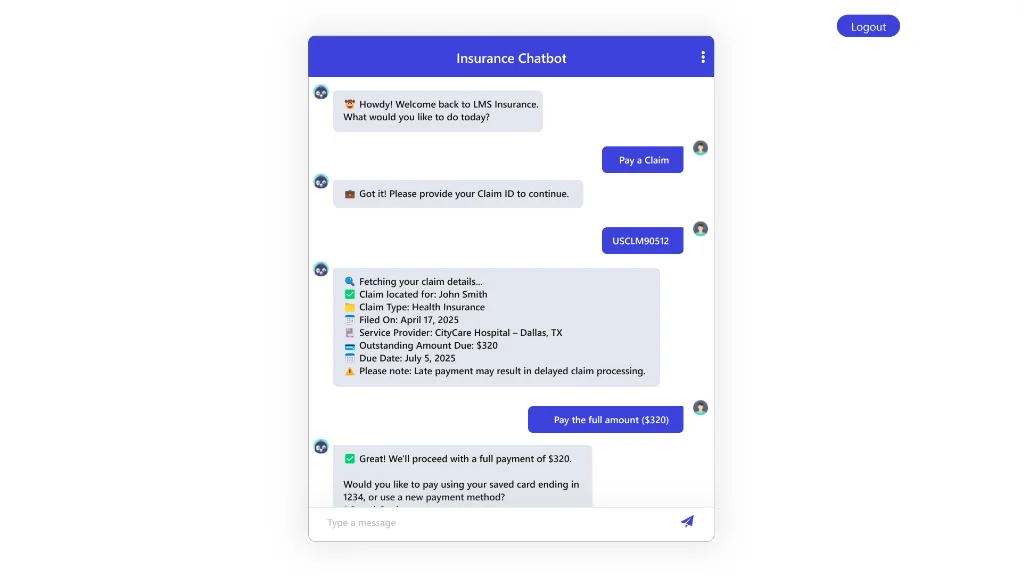

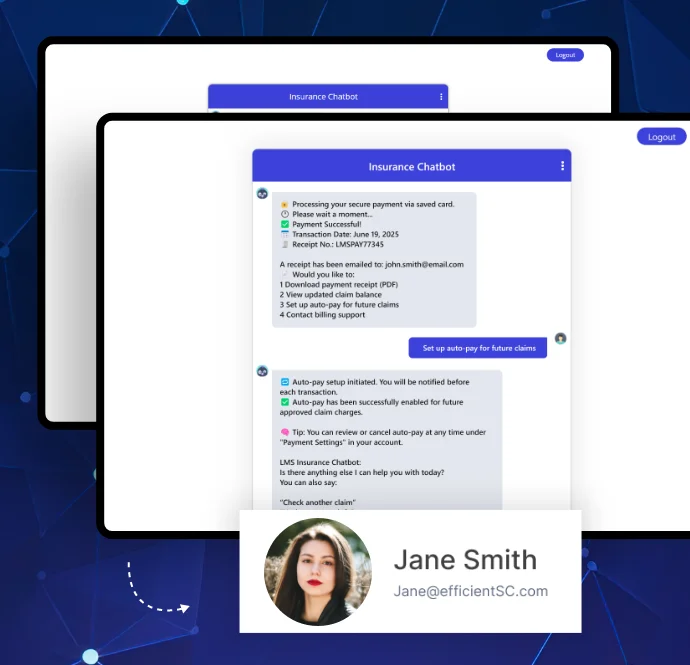

Secure Transactions

Ensures encrypted, safe, and compliant payment processing for policy purchases.

Policy Comparison Tool

Allows users to compare different policies and coverage options before making a decision.

Renewal & Claim Support

Notifies users about policy renewals and assists in claim filing processes.

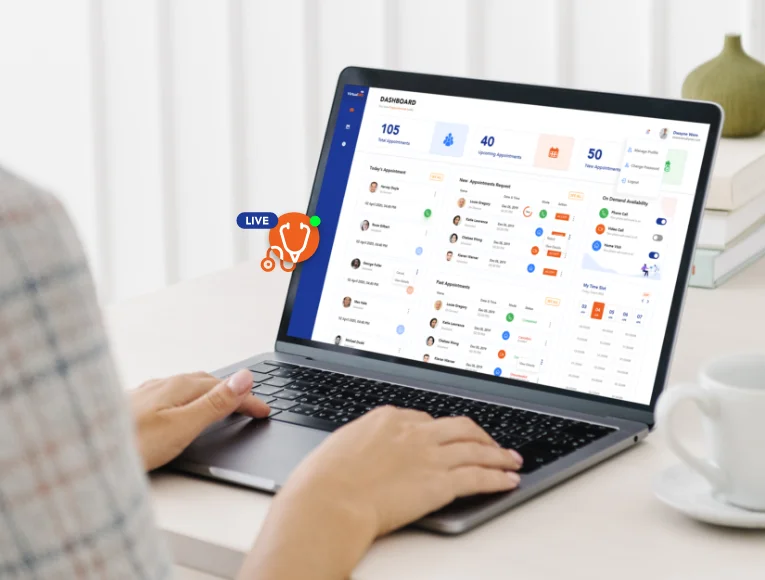

Personalized Insurance Dashboard

Provides a centralized view of policies, payments, claims, and renewal reminders

Multi-Language Support

Ensures accessibility for a diverse user base with multilingual chatbot capabilities.

Automated Lead Management

Captures and organizes potential customer inquiries for follow-ups.

Customer Query Analysis

AI-powered insights into user concerns, frequently asked questions, and preferences.

Policy Sales Tracking

Real-time data analytics on policy purchases and customer engagement.

Integration with CRM & Underwriting Systems

Ensures seamless connection with backend insurance systems for efficient processing.

Fraud Detection & Risk Assessment

Uses AI algorithms to identify potential fraud cases and assess risk factors.

Real-Time Alerts & Notifications

Notifies agents about new policy inquiries, renewals, and claim requests.

Automated Document Processing

Extracts, verifies, and processes user-submitted documents for faster approvals.

Customer Segmentation & Insights

Provides data-driven insights to customize marketing and customer engagement strategies.

Claims Status Monitoring

Offers real-time tracking of claim approvals, rejections, and settlements.

User & Policy Management

Centralized control over policy details, customer accounts, and transactions.

Advanced Analytics Dashboard

Comprehensive reports and real-time insights on chatbot interactions and policy bookings.

Regulatory Compliance Management

Ensures adherence to insurance industry standards and legal requirements.

AI Model Optimization

Continuous learning from user interactions to refine chatbot responses.

Role-Based Access Control

Secure authentication and authorization for different user roles within the system.

Customer Feedback & Support System

Collects feedback to improve chatbot efficiency and overall user experience.

Integration with Third-Party APIs

Seamless connectivity with external insurance data sources for real-time updates.

Performance Monitoring & Optimization

Tracks chatbot response times, issue resolution, and system uptime for optimal performance

Knowledge Base & Content Management

Maintains and updates chatbot responses with the latest insurance policies and FAQs.

Project Outcomes: Evaluating the Impact

By integrating AI and NLP capabilities, the LMS Insurance Chatbot has revolutionized the insurance policy booking process, offering a streamlined and user-friendly experience. Users can now explore and purchase insurance policies effortlessly, ensuring informed decision-making and faster transactions.

- AI-powered recommendations improved user satisfaction and policy selection accuracy.

- Automated booking minimized processing time, reducing manual intervention.

- Real-time insights enabled insurance providers to refine their customer engagement strategies.

- The system continuously learns from interactions, enhancing future policy recommendations

Read More Case Studies

See how we’ve helped businesses across industries solve complex challenges, unlock growth, and create lasting impact. Our case studies highlight the strategies, technologies, and teamwork behind every success story.

A Comprehensive Taxi App Solution with a Product Differentiation

Taxi App UK is one of the first taxi-hailing apps in the UK, and it stands out by being 100% funded and managed by the taxi drivers it serves. This is a first-of-its-kind non-profit platform, and it is managed exclusively by licensed London taxi drivers.

A Multi-Lingual Legal Consultation App

SHOR is a multilingual legal consultation service provider application that fulfills users’ legal consultation requirements with ease. Legal advisors get a number of clients through the consultant app. Users get multiple legal consultants without wasting much time finding a good legal advisor. Consultants receive notifications from users who are looking for consultation.

Virtual MD- A HIPAA Compliant Telemedicine App

A HIPAA compliant Telemedicine App for USA where patient and doctors can register to give and avail telemedicine services through the platform. It helps care providers, improve patient satisfaction, and increase practice revenue. Patients can book doctors on-demand, select mode of communication, and payment mode. Doctors can set their own on-demand availability on phone, video, […]