How Industries Can Benefit From M-Wallet App Development

Table of Contents

Subscribe To Our Newsletter

M-wallet app development has been among the most searched keywords among investors and entrepreneurs globally. Driven by the massive surge in mobile commerce, mobile wallets are all set to become the most popular online payment method by 2024.

The surge is certain! Everyone has shifted to the e-wallet system to carry forward all types of transactions. From big market leaders to those roadside small hawkers, everyone prefers to use e-wallets because of the convenience, security, and transparency it offers. In fact, U.S alone is predicted to overtake physical cards by mobile wallet as it will become the most popular online payment method in the next three years, predicts a report by FisGlobal.

No sooner, the term ‘cashless world’ will prevail and normalize itself. The Statista reports 2021 shows that mobile wallet transactions will increase up to $9,419,619.76 million by 2025.

Considering its increasing usability and market demand, no true entrepreneur can escape the thought of investing in mobile wallet app development.

To keep you updated with this trend and the significant benefits it has to offer, here we have covered topics that shed light on different types of mobile wallets, top market leaders, key benefits, industries benefitted, and its significance in the e-commerce industry. Keep reading.

The Most Popular Wallet Apps

The popularity of mobile wallet apps is rising exponentially due to numerous reasons but COVID outspread is one of the major ones. The need of the hour and ease of usage has accelerated online transactions and now these mobile wallet apps have become a part of our daily lives. Before we dig deep into the term, let’s underpin the topmost popular mobile wallet apps.

Google Pay

Google Pay is currently the topmost application under this category and is effectively helping the common public to enjoy an effortless payment stack with a secure and simple procedure. Individuals can make payments online using this Google wallet by just adding existing bank account or debit/credit card details.

It is widely used to send money to acquaintances, make multiple purchases, pay bills, recharge phones, order food online, etc. The app also surprises its users with a variety of rewards and scratch cards occasionally after making the transaction which obviously introduces additional value. The best part is that you don’t need to refill your wallets rather the amount is directly deducted from your personal bank account.

PhonePe

It is the second most used mobile wallet app which was introduced in the market in 2015. The excellent user interface of PhonePe became the major reason for its success and gaining so much popularity. The users can easily perform transactions such as sending money to friends and family, paying bills, buying products and services, booking tickets, ordering online food, etc..

Individuals can also reap other benefits like it is fast, convenient, secure, and a 24/7 available payment platform. To showcase the vast reach of the app, it is important to note that more than 100 million customers are demanding the same services and are already using them.

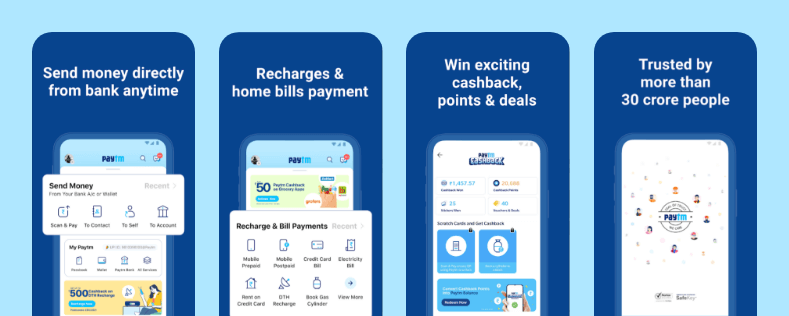

Paytm

Paytm is not just used as a payment wallet but it is also known as one of the largest e-commerce platforms where people can buy a range of items for their daily needs. The app was launched in 2010 and was the only secure and biggest mobile wallet platform before UPI was introduced in the market.

The payments like entertainment, bills, money transfer, phone recharge, etc. can be carried out seamlessly. Paytm works on the semi-closed model therefore, it can easily take the advantage of mobile and other smartphone models. To use the app and enjoy its multiple benefits Paytm must have tie-ups with companies you are dealing with.

Related Reading: How Much Does It Cost To Develop A Mobile Wallet App Like Paytm?

Amazon Pay

Amazon Pay has also attained success in adding its name among the top payment processing platforms. It was launched in 2007 and is owned by the eCommerce giant- Amazon. This platform allows users to pay for multiple platforms like BigBazaar, Flipkart, etc. and users can also shop on Amazon.

To use this application, you just need to connect your bank source with an Amazon Pay account, and then it becomes seamless to operate. Also, every piece of your information is secure and safe as it is already stored in Amazon Pay. To continue your transactions with Amazon Pay, you need to directly access the Amazon Pay account because there is no such app that can support Amazon Pay to carry out transactions.

Apple Wallets

To compete with the outside marketing world, Apple has introduced its wallet called Apple Wallet where users can add multiple cards like credit, debit cards, etc. This platform supports only Apple devices such as iOS, watchOS, macOS, and cannot be accessed with Android devices.

Related Reading: Key Strategies Adopted by Mobile Wallet App Companies for Driving Consumers

How is mobile wallet app development impacting the business landscape?

With features like rapid payments, easy accessibility, and safe transactions, mobile wallet app development is changing the face of business. Prominent applications such as Google Pay, PhonePe, Paytm, and Amazon Pay provide customers with rewards, security, and ease. These apps are changing the face of online payments with advantages like lower transaction costs, more security, and a decrease in cart abandonment.

Key Benefits of Mobile Wallet Applications

1. Easy Accessibility & Convenience

It becomes easy for the user to perform day-to-day tasks as they don’t need to carry wallets or cards with them, rather every single piece of information is readily synced with mobile wallet apps. The user just needs to download the app and create an account with bank account details. Hence, it becomes as simple as operating like any other app on your mobile device.

2. High Security

E-wallets are highly secured as users need to unlock the phone using fingerprint, passcode, or face recognition. Other new techniques are ensuring high security of your data and money through technologies like blockchain, tokenization, etc. These methods makes the online payment process safer and secure. The online transactions are more secure than the money a user keeps in a locker because the key to unlock user’s online transactions can only be accessed by the user himself.

3. Multiple Usages

No matter whether you are looking to buy groceries from a local Kirana shop or visiting a reputed departmental store, the usability of the mobile wallet apps is rising with each passing day. That being said, people can perform any payment-related activity such as online bill payment, shopping, buying groceries, booking tickets, ordering food, etc through m-wallet app solution. They do not have to wait for any kind of assistance or physical payment assets as everything can be done with a few taps on your smartphone wallet app. Users also have the option of buying or gifting movie or travel tickets to your friends and family to surprise them with the best.

4. Instant Payment/Transfer

When we talk about instant payment, the transfer of the money can be done within a few seconds, earlier which was no less than a dream. Using e-wallets, many personal and professional challenges get minimized like, refilling the bank accounts, sending money to another person, sharing funds for business activities, and allowing payment 24/7. It also helps in matching the latest trends of the society i.e., being part of a cashless society.

5. Incentives/Discounts/Promotions

Don’t worry about the special discounts, offers, and promotions because every e-wallet that you use comes with some discounts and promotional strategies. You will get different money-saving opportunities, cash-backs, discounts, free gifts, and offers. In case, you feel like you are missing out on something then you can choose to visit and see the discounts and wall section of that brand store. Also, you need not worry about any discount/promotional part because it will be transferred to your online business account automatically.

Types of Mobile Wallets Apps

Here is the list of most-widely used mobile wallet apps with quick pointers. By following their business case successfully you can unlock new mobile wallet engagement opportunities.

i. Open Wallet

- These services are associated with banks.

- All types of transactions can be done using open wallets.

- It offers higher flexibility i.e., easy transfer of funds.

- Users can make both online and in-store payments effortlessly.

- To use open wallet accounts the sender and receiver must have accounts in the same app.

- An example of an open wallet app is PayPal.

ii. Semi-Open Wallet

- Users can also send money to any mobile number along with the usual merchant payment.

- An example of a semi-open wallet is Airtel Money.

iii. Closed Wallet

- These services are associated with specific merchants.

- Users can only pay for the transaction initiated by a specific merchant.

- Closed wallets are generated by the companies that are selling special products or services.

- If you cancel or reject the payment then the money gets stored in the wallet only.

- User is not allowed to pay outside the restricted walls.

iv. Semi-Closed Wallet

- Users can send transactions to several merchants only when they have any contractual relationship between them.

- Funds can be withdrawn into bank accounts.

- Users cannot withdraw funds in cash.

v. Crypto Wallet

- Users can send or receive, and spend all types of cryptocurrencies like Bitcoin and Ethereum.

- Users can store public and private keys in crypto wallets.

- In case users want to operate these offline, they can use a USB stick to operate them.

- To ensure the highest security level, it offers hardware wallets or cold wallets.

Industries Benefited From Mobile Wallet Development

Healthcare Industry

The healthcare industry is experiencing greater relief and witnessing better outcomes after the introduction of mobile wallets. It helps in streamlining the overall process and provides a convenient ending including all the medical slips and bills. A decrease in manual labor has facilitated the healthcare industry to provide excellent service to their patients.

Telecommunication Industry

The telecommunication sector can experience tremendous growth opportunities after encountering mobile wallets. According to Juniper’s research study, the number of people using mobile wallets will rise from 2.3 billion to 4 billion by 2024. Apart from this, the telecom sector will benefit in these areas:

- Loan Origination

- Currency Exchange

- Integrate Wallet with Messaging Platforms

- Support In Creating A Closed-Loop

Agriculture Industry

With the integration of mobile wallets in the agriculture industry, farmers can experience a powerful force to bring the performance of this industry to the next level. Narrowing down the list of benefits for farmers with the use of mobile wallets:

- Farmers will be able to reap the quality line of credit.

- Sufficient opportunities will be open to farmers for crop insurance.

- Farmers will shift from financial off-grid to financial on-grid.

Construction Industry

One simple advantage of using mobile wallets in construction is that it will allow contractors to use everything in one go. From data basics to paying bills, using e-credit/debit cards can simplify the overall authorization process and can also help in reducing the processing fees.

Hospitality Industry

We are aware of the amazing response of mobile wallets in the hospitality industry. It has the power to complete transactions within a matter of seconds, but there is a lot more to encounter. Have a look at these silver bullets:

- Experience a high level of customer satisfaction.

- Allow quick and secure payment actions.

- Assist in maintaining hygiene especially during COVID times and simplify the check-in and check-out process.

How Ecommerce Industry Benefits From Mobile Wallet App?

The eCommerce industry is prospering to offer fabulous services to customers. A few remarkable changes that support the industry are its decrease in friction during the checkout process and also helps in increasing the conversion rates. Underpinning the few major takeaways for the eCommerce industry using mobile wallets:

Reduction In Transaction Fees

The role of the bank as a middle man gets eliminated i.e. the merchants provide their own payment option to use and eliminate the need for any digital card. So, once the bank is out of the picture to make any transaction, then the total transaction fees automatically get reduced or will be null.

Offering Increased Level Of Security

Mobile wallets provide the highest security level. Especially in current times when everyone is experiencing the threat of credit card fraud. The e-wallet successfully protects your amount and data because it is based on tokenization. It means, on every transaction a “Token” is given which is the replacement of credit card numbers and no one can use it any further.

A Chance To Increase The Overall Sales

To increase the overall sales, it is required that merchants must share personalized coupons that attract more people to buy. But recent data shows that almost 85% of the people do not even open such coupons and therefore they miss the chance of enjoying discounts. Increasing the sales ratio is easy, but merchants must focus on updating coupons regularly and try to remain in contact with the customers which leads to an increase in overall sales.

Decline In Cart Abandonment

The major benefit provided to retailers through m-wallet is cart abandonment reduction. It is being observed that when people find it difficult to complete the initial process, they do not look for other better options. Contrarily, people tend to buy more when the purchase processing system is simplified and fast. Here are a few ways that show how you can minimize Cart Abandonment:

- Reminding customers occasionally about the items left in the cart.

- Use good reminder subject lines with some emoticons.

- Go for segmentation and personalization as it boosts conversions.

Must-Have Features of A M-Wallet App

To build a standout m-wallet app, the app should be equipped with unique and latest features. So, let’s check out the most common and widely customer-accepted features of the digital wallet.

- Log In/User Profile- Whenever the user downloads the m-wallet app, then the user have to register themselves by entering basic details. Additionally, the user can login through their social log in credentials.

- Sync More Than One Bank Account- The user can link more than one bank account and can operate multiple accounts at a time with ease from a single device and location.

- No Minimum Transaction Limit- Setting the transaction limit bounds the user to spend their own money, but providing an app with no minimum transaction limit will give a free hand to the user to make digital payments for any small to heavy products and purchase it instantly.

- Split Bills- Allowing the user to split the bills among people, such as friends or relatives to make every individual pay their part, rather than a single person paying and then collecting cash from others.

- E-Receipts- The user receives each transaction details and the receiver details along with other details in the form of e-receipts from the bank and the app as well. This promotes transparency and makes the digital payment method more secure, safe, and easy.

- GPS Tracking- The user can track the location and check payment history that where they made the payment, to whom, and at what time along with other details. In case of any confusion, the user can refer to all the details instantly from the app.

- Reward Points- Giving users some cashback, offers, or coupons on random transactions can attract more users to the app.

- Privacy and Security- Data privacy and security is the major concern when monetary transactions are concerned. In e-wallet apps, the money is directly involved, and the users share their bank account details on the app. Therefore, the user can instantly make the payment by authorizing biometric access and entering OTP or password to enable the transaction.

- QR Code Scanner- The user can scan the QR code from their camera and can directly initiate the money transfer request to the payee account without any hassle. It is a very easy, quick, and reliable mode of payment and is the latest introduction in the m-wallet apps.

Points to Consider While Developing A M-Wallet App

1. User Data Security

The online transactions are the major concern for any individual to take care of their personal data. Such data security maintenance builds trust among customers with the application. As the users are storing their credit and debit card details along with the password and for that data security becomes the mandatory factor. Therefore, to ensure user data security the mobile app development companies should follow and prefer the implementation of the latest technological advancements.

2. Fraud Risk

The platform should be secure and eliminate the risk of fraud when monetary transactions are in process. The money laundering or illegal transactions from anonymous accounts taking place are quite difficult to track, and for that the app owner is accountable. Therefore, to forbid all such risks and illegal activities the developers should make sure to design a risk-free platform.

3. Regulatory Compliance

The m-wallet app should abide by the rules and regulations proposed by the government and any other authorized regulatory body. The development of an app that follows all the rules and works under legalities can eliminate any fraud or data security risk. The app will only support fair and transparent transactions to generate trust and transparency between the user and the platform.

4. Digital Receipt Functionality

The m-wallet apps are equipped with a variety of functionalities and these can’t be hopped. After the successful payment through digital mode, the user requires a confirmation and intimation from the platform for the same. The app should follow the same process, in case of a failed transaction as well. Apart from that, the m-wallets should be integrated with emails and these payment receipts should be sent through emails too.

5. Integration of Features

In the competitive market, the quality of the app enables it to sustain the market and all this happens only by intelligently selecting the features and functionalities that can be infused into the app; same with the m-wallet app development. The selection and integration of features and functionalities can be carried out after a careful and detailed market study, latest trends, and customer expectations. The study will help to carve a roadmap for an m-wallet application.

6. Select The Right App Development Partner

While planning for m-wallet app development, having the right partner is the major criterion for developing a seamless and feature-rich mobile wallet app. Therefore, it becomes a very tedious process to find an expert development company from the pool of options. For that, you require to follow a proper detailed interview process to analyze the developer’s learnings and skills, then go for the suitable one.

Data Transfer Technologies Used In M-Wallet Apps Development

To build an application first and foremost is to understand the technologies and their applications that can be used in the app. Usually, the m-wallet apps use one or a combination of technologies to present data transfer, and are as follows;

1. Bluetooth and iBeacon

iBeacon technology facilitates the transfer of data by eliminating the necessity of having an internet connection. Evidently, almost each smartphone device is equipped with Bluetooth technology and is compatible with Beacon technology. The technology initiates the contactless transfer of data in a seamless environment. The Bluetooth device establishes a connection with the payment device and enables to receiving of all the required data stored in the mobile wallet to POS, which allows the transfer of money.

2. QR Codes

QR Codes are very much in fashion after the wide acceptance of digital modes of payment. The QR codes are unique that can encrypt vital details, codes, sensitive information, and even images/pictures. To avail of the services, the user needs to scan the QR code image from their smartphone app to make the payment. The scanned QR code enables to fetch the data and make payment by entering a secret code/password. After that payment, the sender and receiver both get the payment receipt, which makes the mobile wallet a secure platform.

3. NFC

NFC stands for Near Field Communication Protocol- the technology facilitates contactless money transfer services. The transfer can be made between only the specific types of devices, where the smartphone is the sender device that is equipped with an NFC chip and a transmitter in a POS device. The transmitter connects instantly with the NFC device, which is less than one-tenth of a second. NFC can store card details in the digital form within the mobile wallet app, the process is termed a card emulation technique. To facilitate the payment, the NFC protocol transfers the data instantly to the POS terminal.

Summing Up!

There is enough information, facts, and figures available in the market to justify the rapid growth in the mobile wallet app industry and this trend is strengthening with time. But to beat the competitors and take hold of greater market share, you need to plan robust strategies. Invest your research time into adding functionalities and exclusive features that serve the customer demands.

Featured Blogs

Read our thoughts and insights on the latest tech and business trends

Navigating Challenges and Seizing Opportunities in E-Wallet App Development

- October 21, 2024

- Wallet App

In the past 3-5 years, eWallet apps have reformed how people handle finances. The apps are handy tools that can be on smartphones to store and manage money. These apps allow people to make secure,... Read more

How Technology Enhances Courier Management Systems?

- October 16, 2024

- Courier Delivery

Courier management is the mainstay of the swiftly growing e-commerce sector. Customers love to select their favorite products online and want to get them delivered as early as possible. A few 5 years back, courier... Read more

Using Big Data for Digital Marketing Success

- October 14, 2024

- Marketing

Ever wondered how those online ads seem to know exactly what you're thinking? Or how your favourite e-commerce site always suggests products you might like? Well, that’s the power of big data. In digital age,... Read more