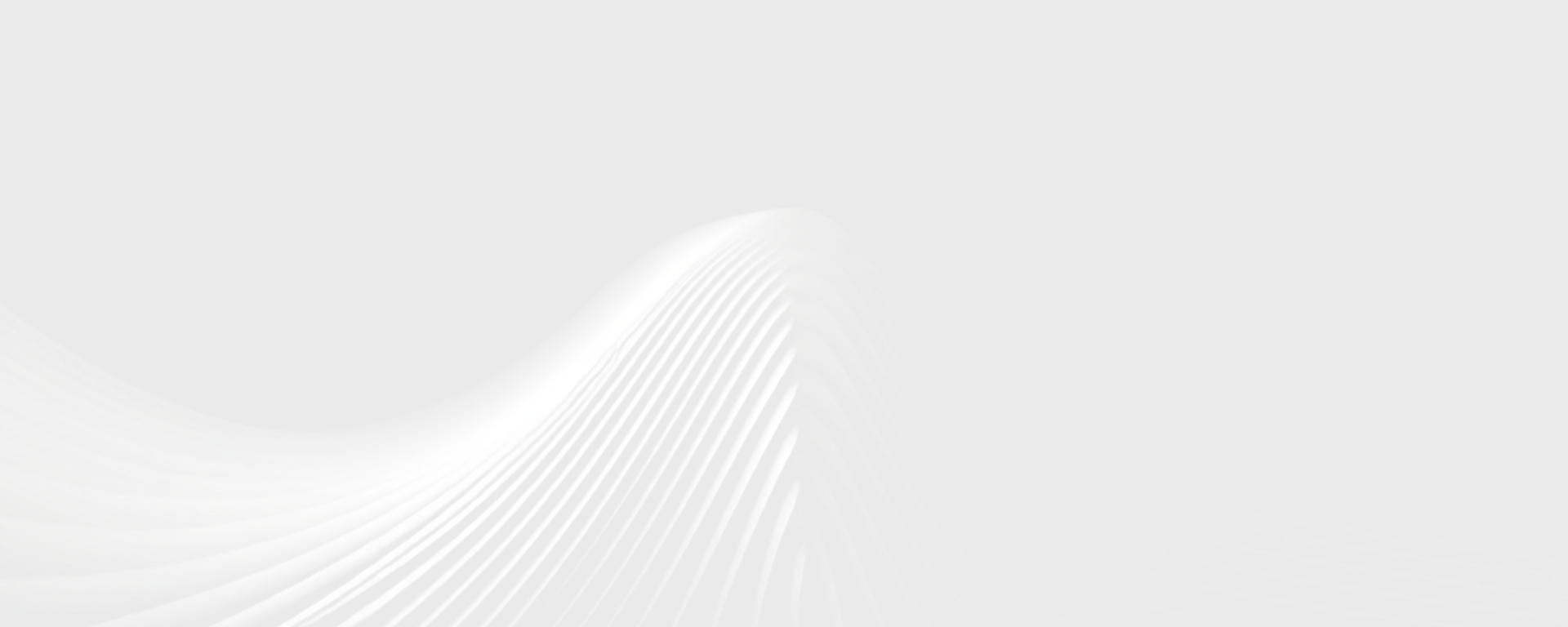

Streamlined Policy Selection Through Intelligent Conversation

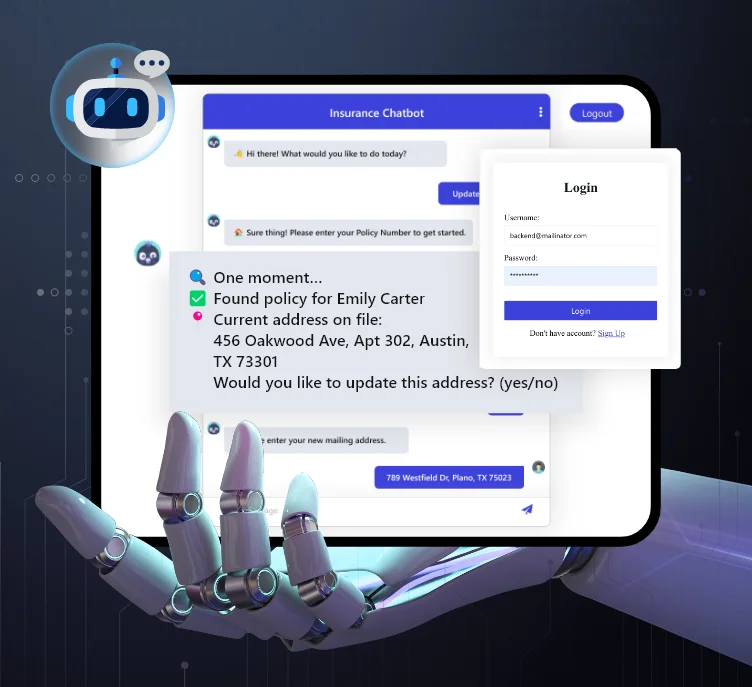

LMS Insurance Chatbot makes insurance feel simple. With AI at its core, it guides users through choosing the right health, life, auto or home policy - step by step. From personalized recommendations to instant premium quotes and secure checkout everything happens in one smooth, easy-to-follow chat. It’s fast, multilingual and built for scale - making it a perfect fit for both individuals and large insurance providers looking to modernize the way they connect with customers.

Key Capabilities Designed for Policy Buyers

Every feature is designed to streamline decisions and drive down friction in policy selection.

Built for Today’s Insurance Ecosystem

Whether you're a customer, agent, or enterprise, LMS fits into your existing workflow.

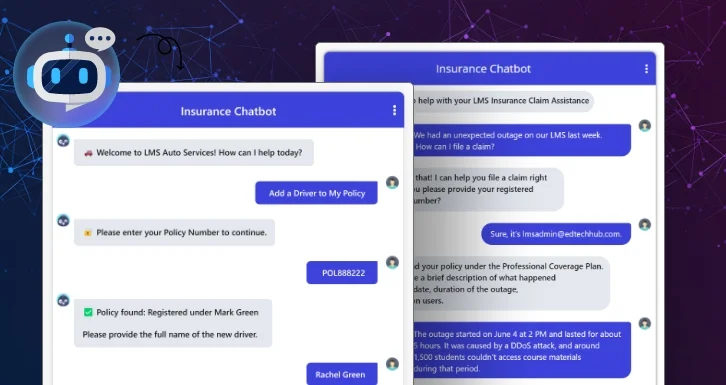

Individual Buyers

Navigate policy selection with ease, supported by AI-driven suggestions.

Insurance Providers

Automate the entire front-end booking process and reduce manual support.

Agents and Brokers

Handle more inquiries with less overhead through intelligent chat handling.

Digital Aggregators

Embed the chatbot to offer real-time quotes and secure booking across platforms.

Customer Support Teams

Deflect repetitive queries and focus on complex issues with AI-assisted triage.

IT and Compliance Teams

Maintain regulatory compliance with robust logging and secure data practices.

Why Organizations Choose LMS Insurance Chatbot

A secure, intelligent and scalable solution for modern insurance operations.

Efficient Policy Recommendations

- AI suggests policies by risk, budget and eligibility.

- Adjusts results instantly based on real-time user input.

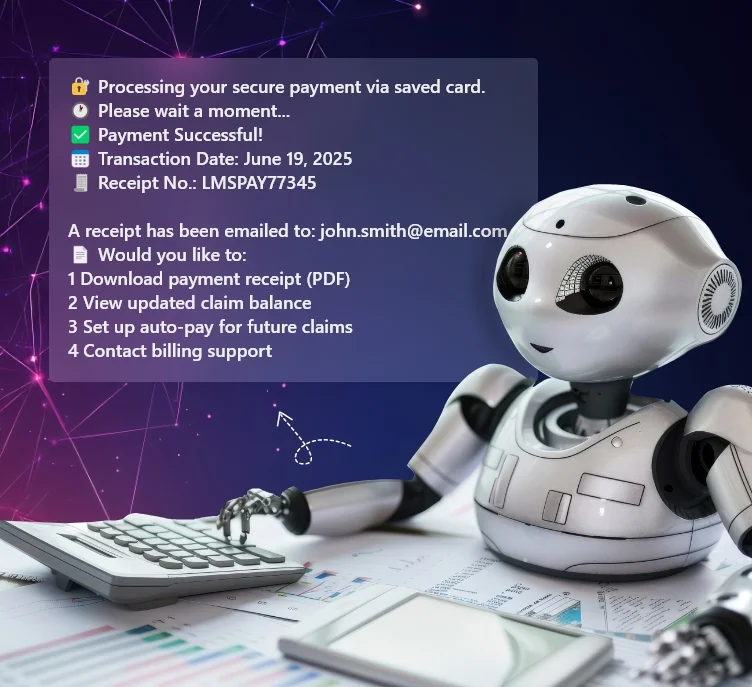

Seamless User Experience

- Quotes, comparisons, and purchases happen inside the chatbot.

- No redirection, extra forms or waiting queues required.

Scalable Architecture

- Handles large user loads without slowing system performance.

- Suitable for nationwide deployment and enterprise-level usage.

Secure Data Handling

- Encryption and access controls ensure user data protection.

- Complies with insurance-specific security and privacy regulations.

Operational Cost Reduction

- Reduces workload by automating common customer service tasks.

- Boosts conversions using personalized alerts and follow-ups.

Continuous AI Learning

- Adapts to user behavior and improves over time.

- Refines responses to enhance relevance and user satisfaction.

Core Features for Providers, Users, and Admins

Key functions designed to enhance efficiency, accuracy and user satisfaction.

Adapts to Real-World Insurance Workflows

Designed to serve every role across digital insurance operations.

Powering Conversations

Across Every Industry

Every industry operates differently, but all benefit from faster answers, better engagement, and intelligent interactions—powered by conversational intelligence.

What’s New in AI?

Stay updated with the latest breakthroughs, innovations, and real-world AI applications transforming industries worldwide.