About the project

Simple Expense is an AI-powered expense management platform built to simplify how individuals, teams, and organizations record, track, and approve daily spending. The system automates receipt capture, categorization, and reimbursement workflows, reducing manual effort and improving financial accuracy. Designed for fast-moving businesses, it delivers real-time visibility and a seamless, unified expense experience across mobile and web.

Challenge

Manual expense tracking remained fragmented across spreadsheets, chat threads, and outdated tools, creating delays, errors, and poor financial visibility for individuals and teams. Existing solutions lacked automation, real-time insights, and user-first design. Codiant identified a clear opportunity to build a streamlined, AI-driven system that eliminated inefficiencies at scale.

Approach

Codiant’s product, design, and engineering teams collaborated end-to-end to shape a broad concept into a focused, scalable solution. Through structured discovery, detailed user research, and sharp feature prioritization, we built a clear roadmap and used agile sprints to prototype, validate, and deliver a market-ready AI-powered expense management platform.

Discovery phase

The discovery phase focused on understanding how employees, managers, and finance teams currently handled expenses and where the biggest inefficiencies occurred. Through interviews, workflow mapping, and competitor analysis, we identified key gaps in speed, accuracy, and reporting structure. These insights shaped the product direction, prioritized AI-driven automation, and ensured the MVP solved the most critical user frustrations.

Market Research

The Gap

Most expense tools still function in fragments - separating receipt capture, trip reporting, approvals, and tracking across multiple steps. They lack AI-supported automation, fast mobile-first entry, and a unified experience for on-the-go teams. Simple Expense fills this gap with an integrated platform where scanning, logging, reporting, and approvals work together seamlessly for faster, more accurate expense management.

Audience Struggles

71% of finance leaders : said they struggle with expense compliance and fraud prevention due to manual tracking.

47% of employees : reported delays in reimbursements due to outdated approval processes.

Manual expense reports cost: small businesses on average US $35.02 to process each.

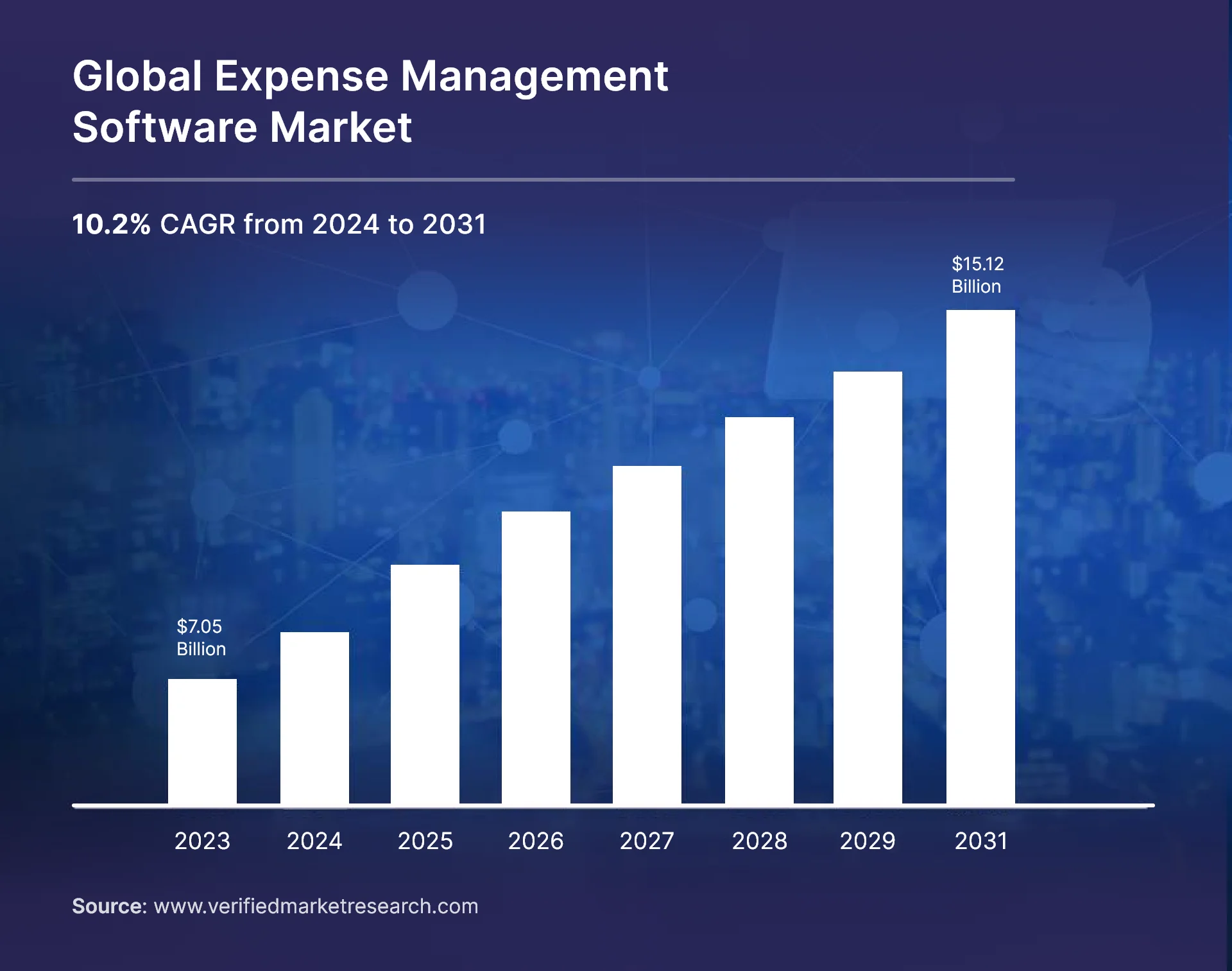

Opportunity

The market had no unified solution that could streamline daily expense tracking without forcing users into spreadsheets or scattered apps. Many existing tools were either overly complicated or lacked the depth needed for growing teams. Simple Expense addressed this gap with an AI-enabled, end-to-end platform that minimized manual work, improved data accuracy, and provided instant spend visibility.

Execution Timeline

1. Research & Discovery

2. Structure & Concept

1 Weeks3. Design & Prototyping

3 Weeks4. Development & Testing

6 WeeksResearch Phase

Our research combined market analysis, stakeholder interviews, and workflow studies to validate the strongest pain points users faced. Teams struggled with missing receipts, slow approvals, and rising compliance risks due to inconsistent processes. Cost barriers and low adoption rates in existing tools highlighted the need for a lightweight platform with faster onboarding, guided flows, and minimal learning curves. These findings shaped the product scope, feature prioritization, and operational logic.

User Insights

| Tasks | Emotions | Challenges | Opportunities |

|---|---|---|---|

| Receipt Capture | 😩 Overwhelmed | Losing paper receipts or capturing unclear images leads to missing proofs. | AI receipt scanning auto-extracts details, ensuring clean, complete records every time. |

| Expense Entry | 😓 Fatigue | Typing merchant names, dates, and amounts repeatedly slows daily logging. | Auto-filled entries reduce manual input and make logging instant. |

| Trip Reporting | 😫 Stress | Gathering expenses across multiple days and cities becomes unorganized and error-prone. | Trip-based reports group all expenses automatically for easy submissions. |

| Category Selection | 😕 Uncertainty | Incorrect or inconsistent categories cause rejections and compliance issues. | AI-driven categorization ensures accurate, policy-aligned assignments. |

| Approval Review | 😣 Pressure | Managers spend too long validating proofs, totals, and policy compliance. | Multi-level approvals streamline checks with clear status and automated validations. |

| Budget Tracking | 😟 Concern | Limited visibility into spending leads to overruns and inaccurate forecasts. | Budget guardrails show real-time usage and help teams stay within limits. |

| Team Submissions | 😖 Coordination Stress | Multiple team reports create fragmentation and delay month-end closing. | Unified dashboard centralizes reports, statuses, and pending actions for clarity. |

| Reimbursement Follow-Up | 😵 Exhaustion | Delayed updates and missing receipts slow reimbursement cycles for employees. | Real-time notifications ensure timely submissions, approvals, and payouts. |

User Persona Development

Sarah Mitchell

32

Business Travel Executive

Seattle, Washington, USA

Persona Snapshot:

A frequent corporate traveler who needs a fast, hassle-free way to record travel expenses and submit trip reports on the go.

Goals:

Log travel expenses instantly without typing long details.

Submit trip-based reports quickly for timely reimbursements.

Keep all receipts and spending organized during multi-city travel.

Challenges:

Loses paper receipts during flights, hotels, and transit.

Manual entry takes too long while traveling between meetings.

Delayed claims due to missing documents or unorganized expenses.

How Simple Expense Helps:

- AI receipt scan captures expenses instantly without manual typing.

- Trip-based reports keeps all travel logs structured and submission-ready.

- Real-time updates ensures every expense sync across devices without loss.

Jason Reed

41

Finance & Accounts Supervisor

Chicago, Illinois, USA

Persona Snapshot:

A finance professional responsible for validating expenses, ensuring policy compliance, and closing reports accurately across multiple teams.

Goals:

Streamline review and approval cycles across departments.

Maintain accurate, audit-ready expense records with minimal manual checks.

Track spending patterns to control budget usage for travel and operations.

Challenges:

High volume of unstructured receipts slows verification and audits.

Frequent policy violations due to unclear categories and missing proofs.

Limited visibility into trip budgets causes overspending and delays.

How Simple Expense Helps:

- AI auto-extraction reduces manual verification and improves review accuracy.

- Multi-level approvals enforces policies and accelerates compliance checks.

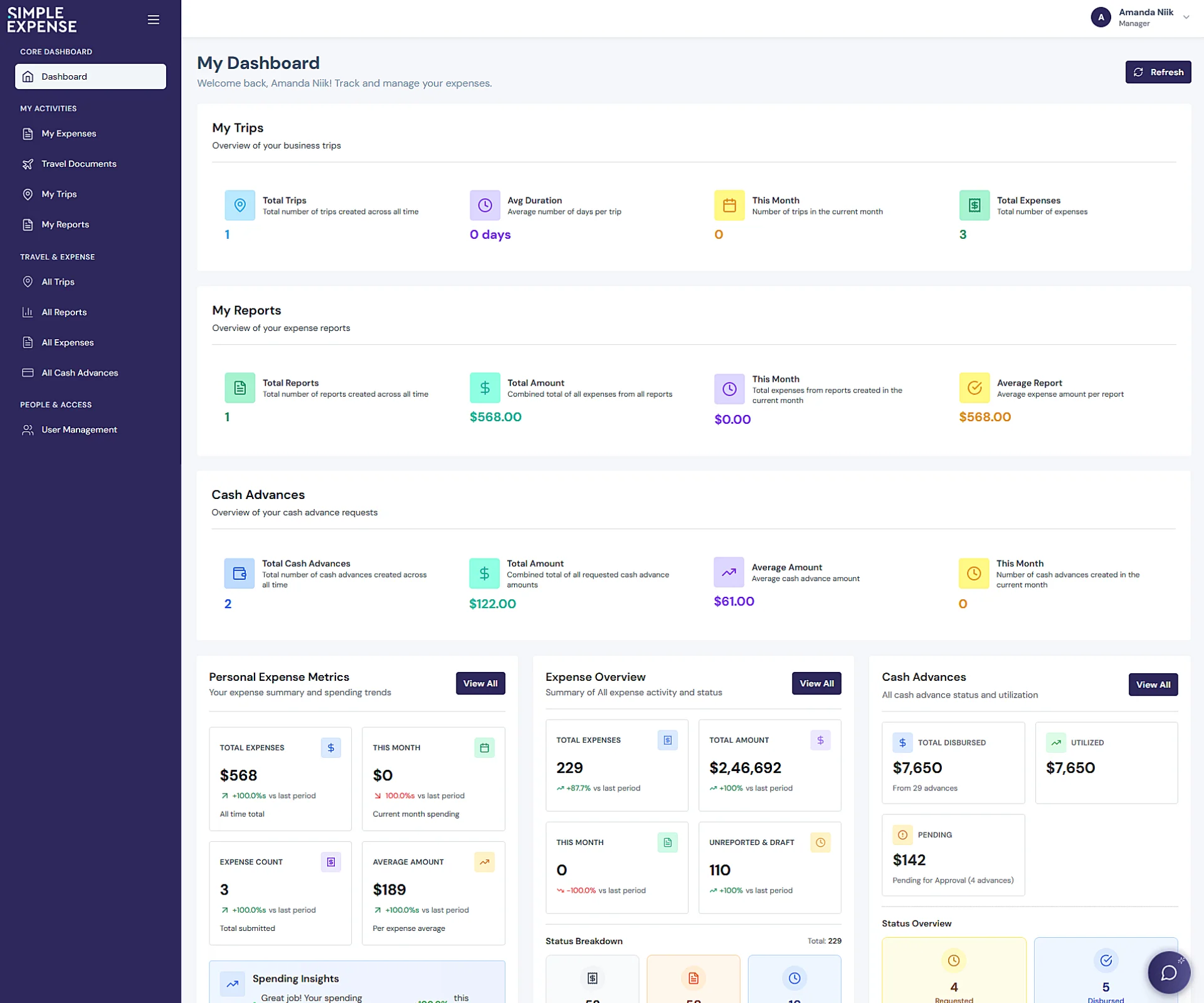

- Unified dashboard provides clear visibility into reports, budgets, and trends.

Ideation

Persona insights highlighted the need for a workflow that minimized effort, reduced dependency on manual entry, and supported fast decisions. Our ideation sessions centered on simplifying expense actions into a few predictable steps, grounded in real travel and daily-spend scenarios. Early sketches explored how AI-powered scanning, trip grouping, and structured approvals could remove friction across users. Each concept evolved with a clear focus on clarity, speed, and reducing cognitive load for employees, managers, and finance teams.

Feature Concepts

For Employees:

1. Smart Trip Creation

Organizes business travel by letting users create trips, set dates, and manage related expense reports seamlessly.

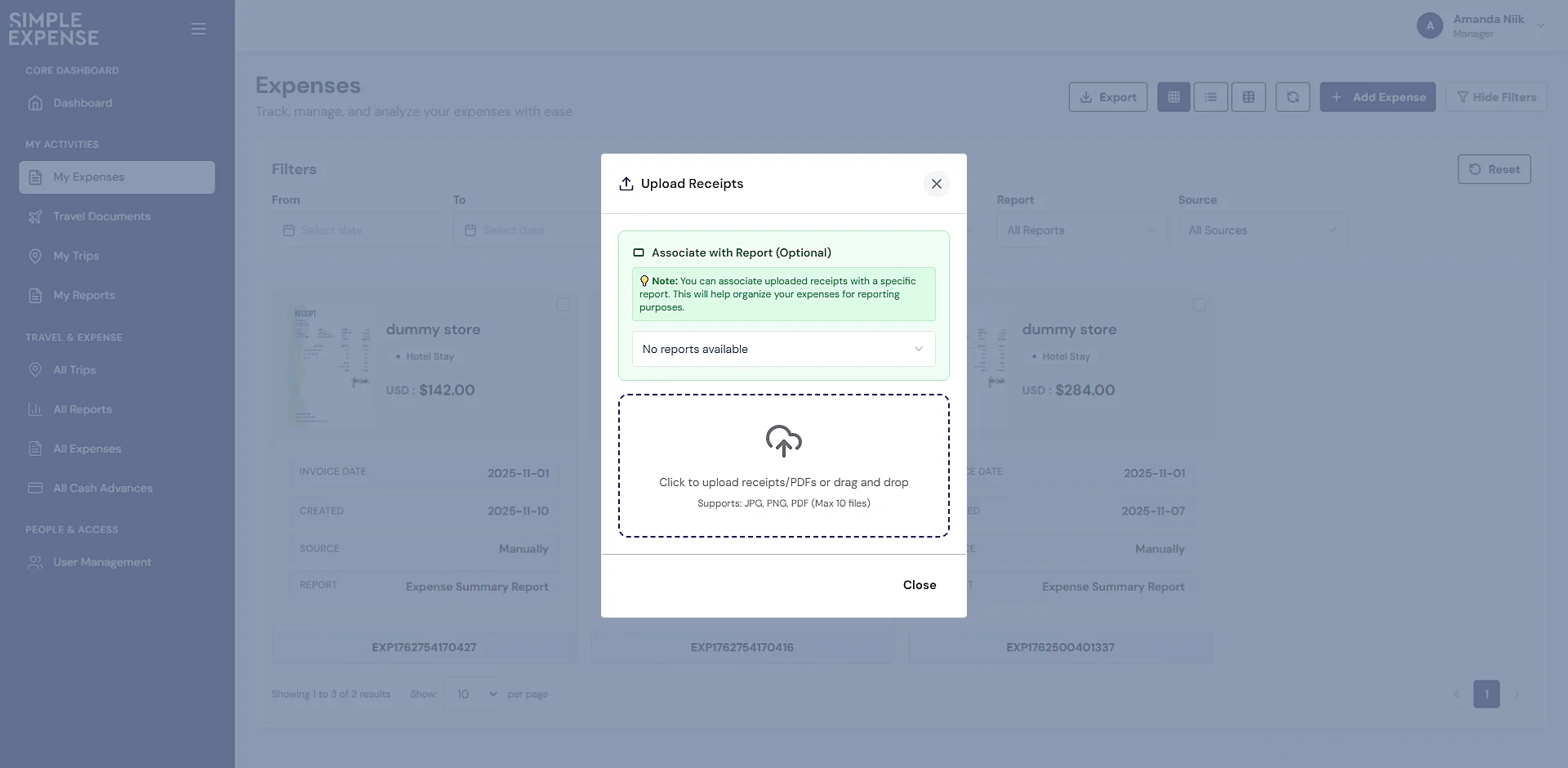

2. AI-Powered Bill Scanning

Scans bills instantly and auto-extracts date, amount, and vendor details with high accuracy.

3. Real-Time Expense Categorization

Classifies expenses automatically into correct categories for consistent and error-free reporting.

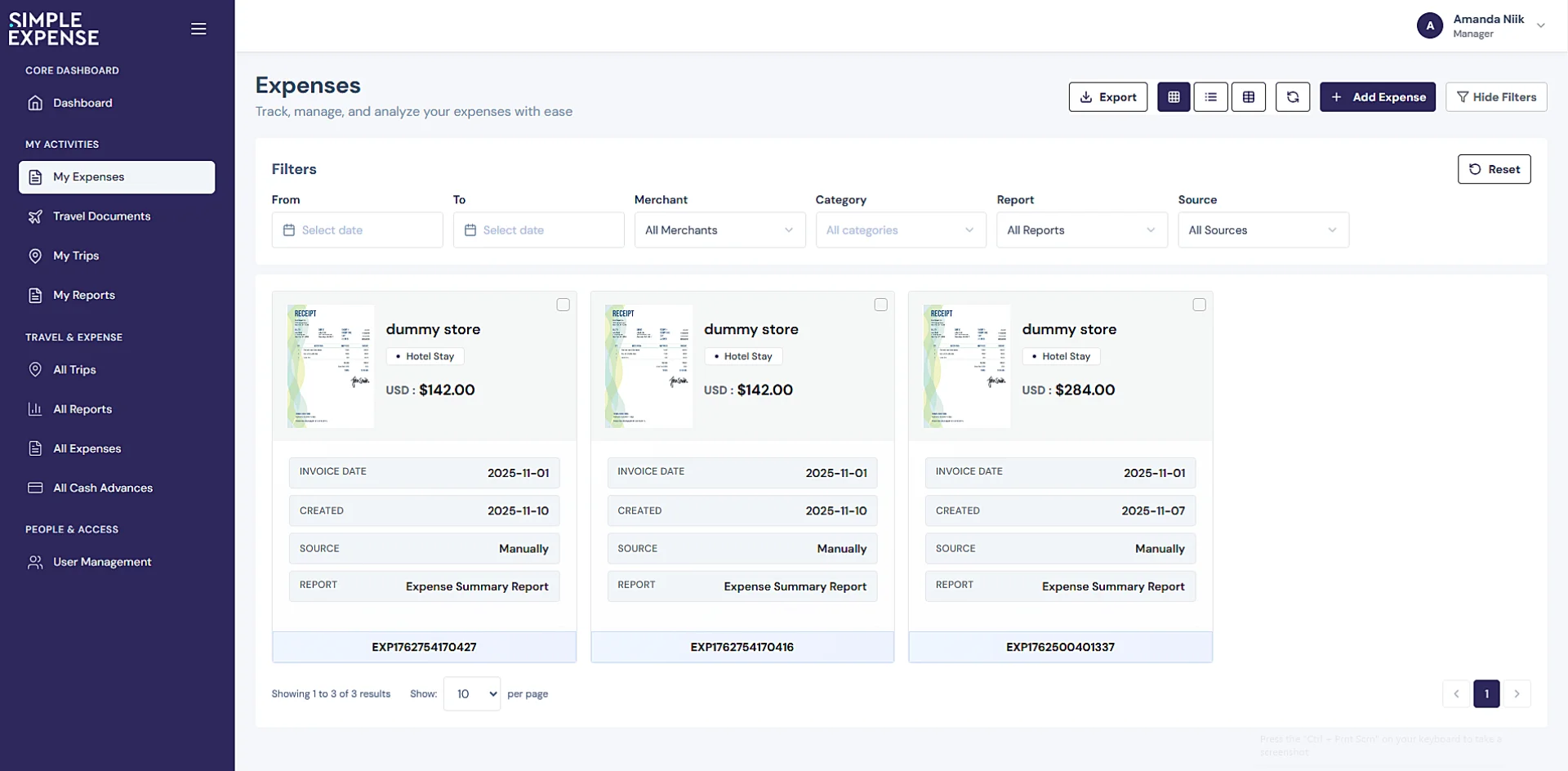

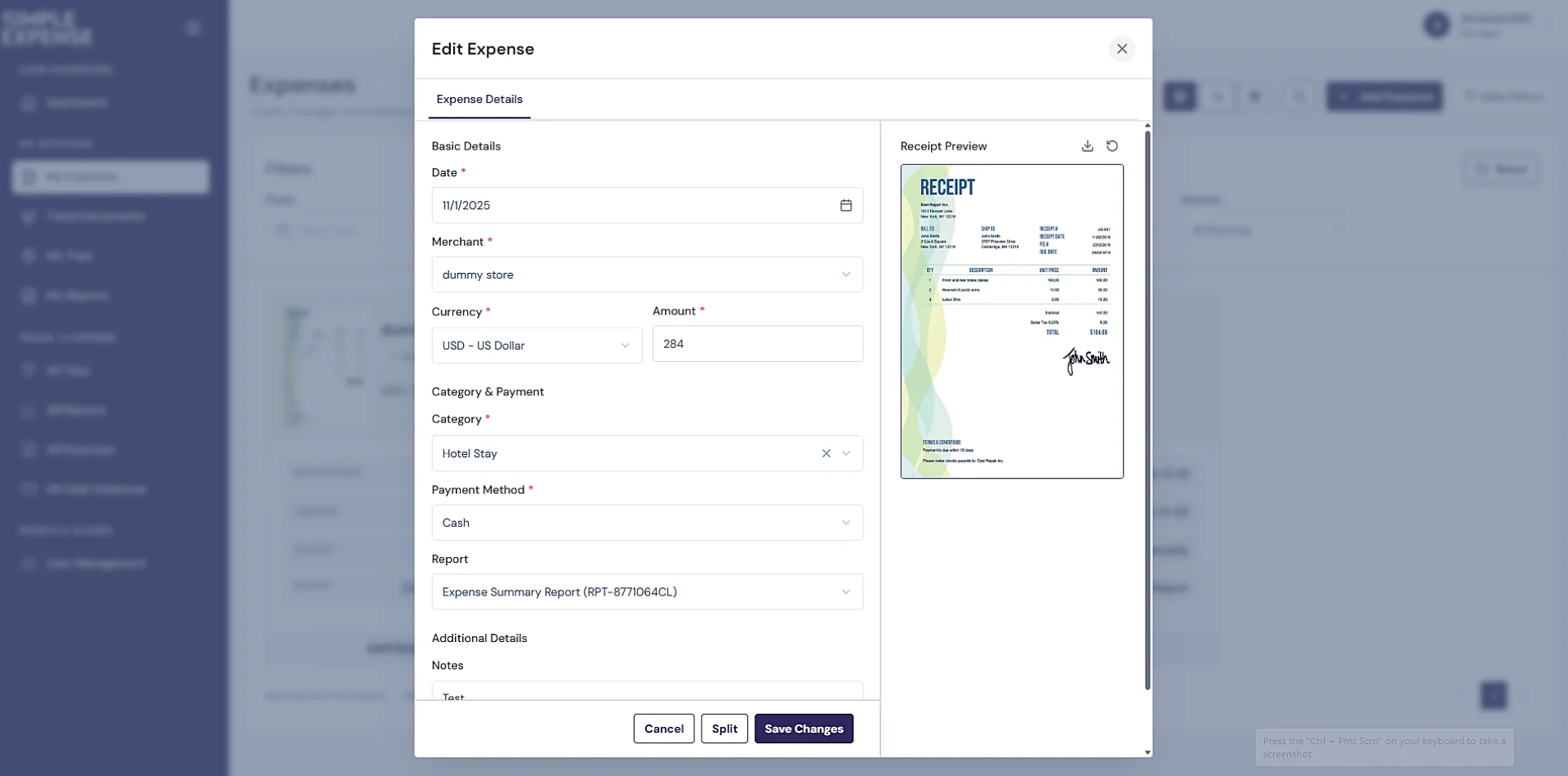

4. My Expenses

Displays all recorded expenses in one place with clear categorization and status tracking.

5. Travel Documents

Stores trip-related invoices, tickets, and approvals securely for quick access and organized reporting.

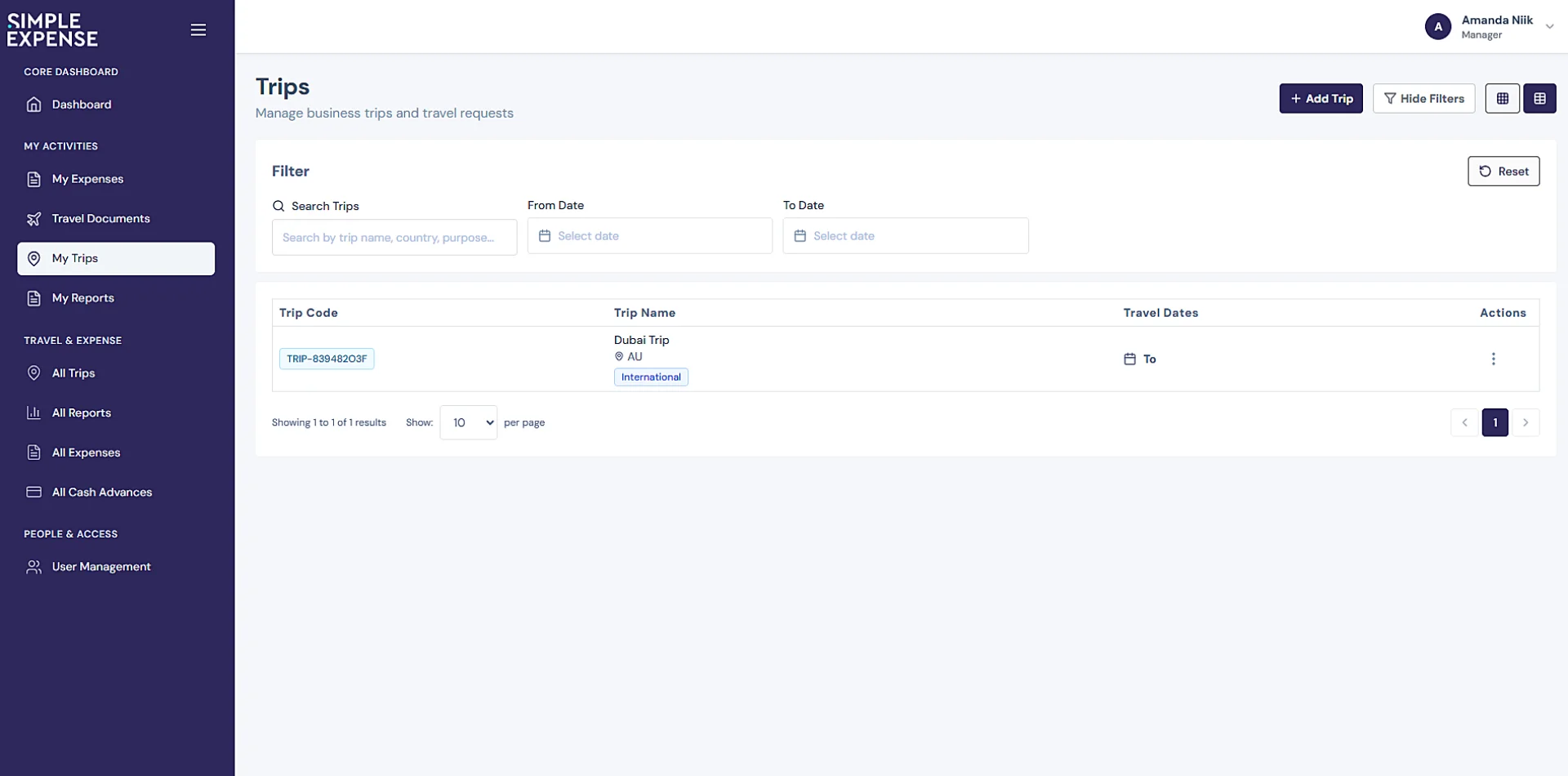

6. My Trips

Shows all active and past business trips with sortable filters and detailed itinerary views.

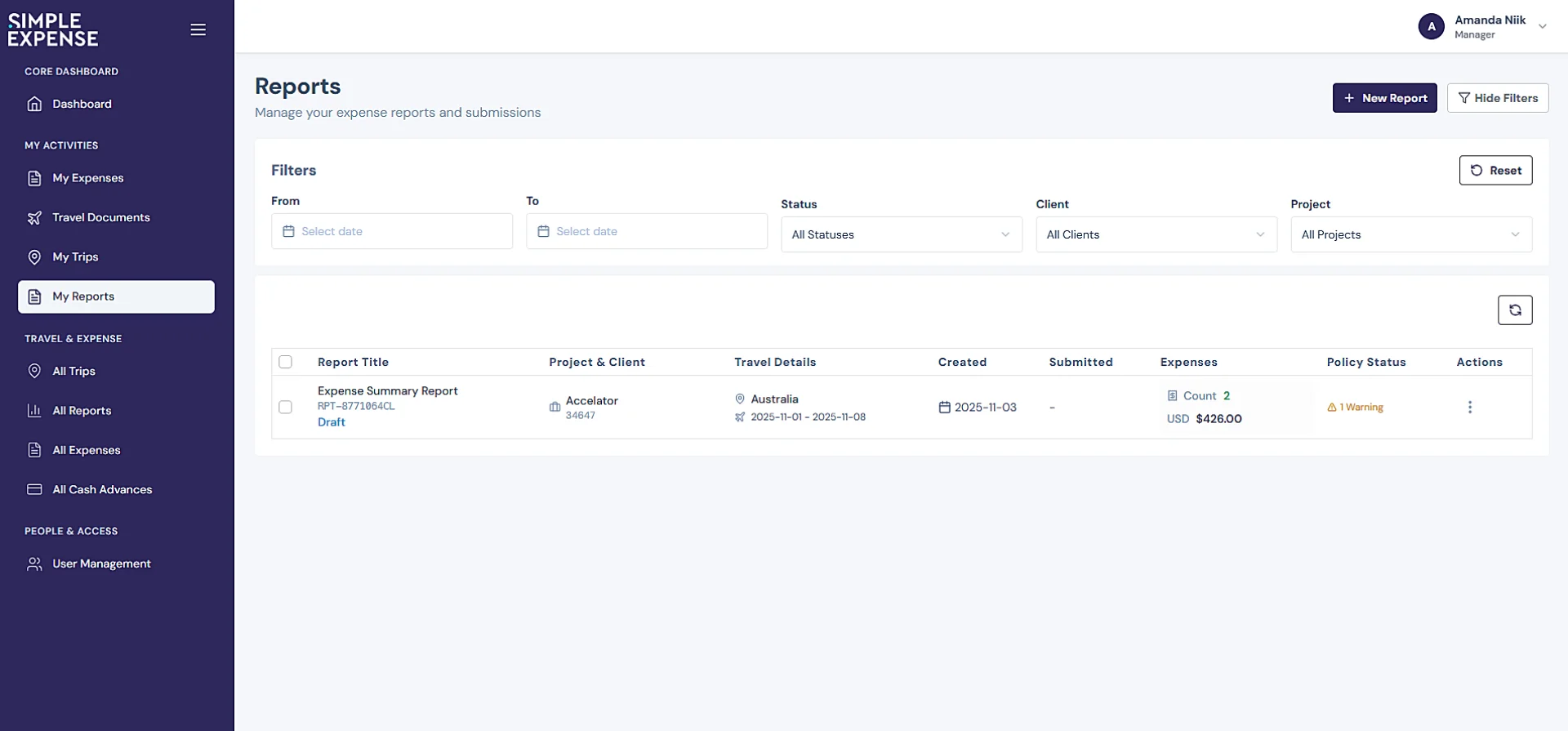

7. My Reports

Allows users to create, edit, and submit expense reports with transparent reimbursement tracking.

8. Trip-Based Reporting

Groups expenses by trip to provide clearer visibility into total spend and pending reimbursements.

9. Cloud-Synced Access

Keeps trips, reports, and expenses updated across devices through seamless cloud synchronization.

10. Secure Data Encryption

Protects every employee record and receipt with enterprise-grade encryption for secure data handling.

For Admin:

1. Multi-Level Approval Workflow

Enables role-based reviews where managers and admins can approve or reject reports efficiently.

2. Company Trips

Provides a unified view of all employee trips for complete organization-wide travel oversight.

3. Expense Reports

Offers access to every submitted report for verification, compliance checks, and structured approvals.

4. Expenses Log

Maintains a centralized ledger of all company expenses for auditing, budgeting, and financial analysis.

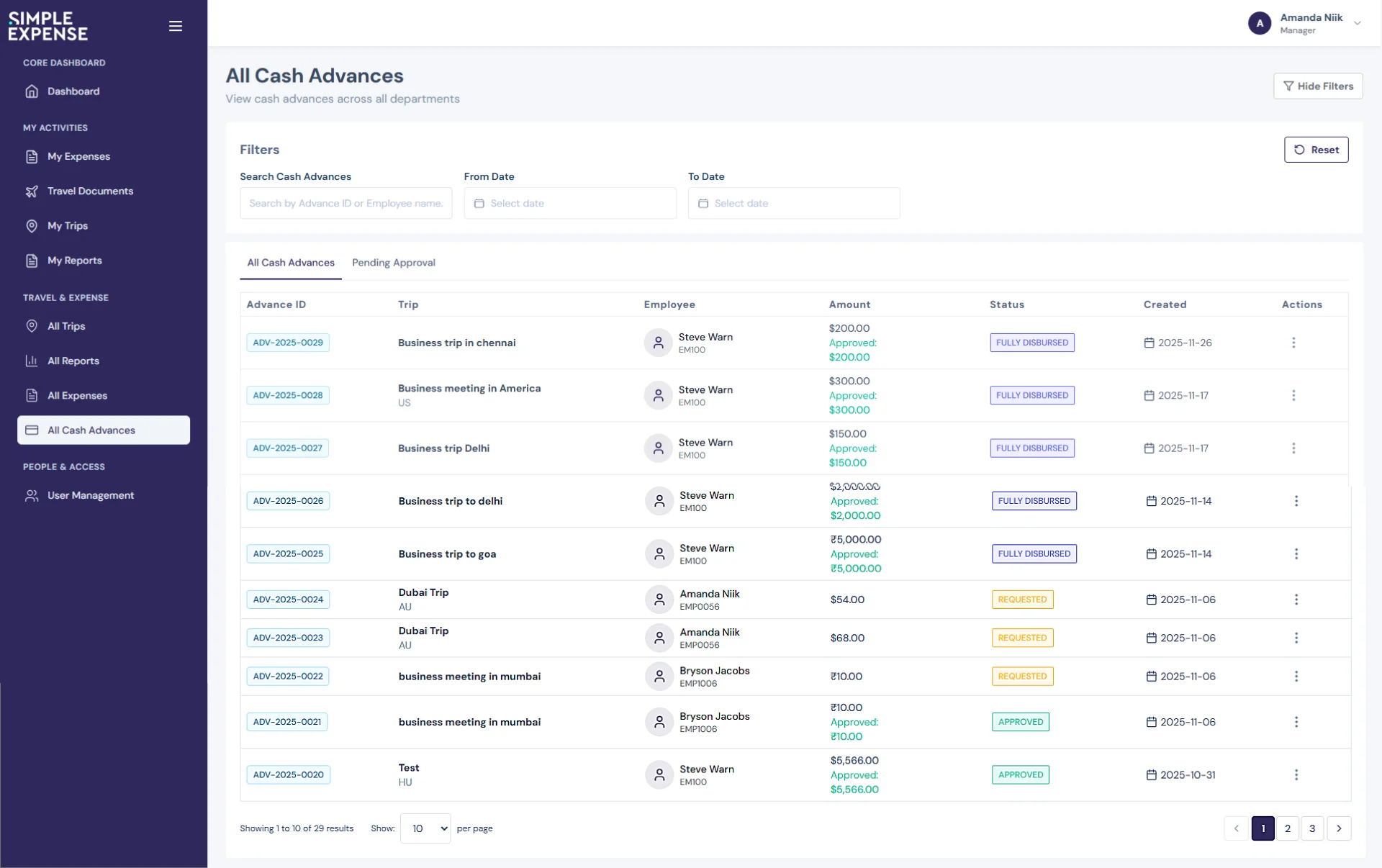

5. Cash Advances Tracking

Manages cash advance requests, approvals, and reconciliations from start to finish.

6. User Management

Controls employee accounts, roles, departments, and permissions through a structured user directory.

7. Secure Data Encryption

Ensures all company-wide financial data is stored and accessed using encrypted, secure systems.

High fidelity designs

Development

React JS

React JS Flutter

Flutter MySQL

MySQL Figma

Figma Illustrator

Illustrator Photoshop

Photoshop Node.js

Node.js Redis

Redis Prisma ORM

Prisma ORM AWS

AWS OpenAI

OpenAI Gemini

Gemini Express JS

Express JS Tailwind CSS

Tailwind CSSThe result

The final release of Simple Expense delivered a unified, automation-first system that transformed how individuals and teams manage daily expenses. The product consolidated fragmented workflows into a single, predictable process, reducing manual effort, improving reporting accuracy, and giving organizations real-time visibility into spending behavior. With streamlined submissions, intelligent categorization, and structured approval paths, users experienced faster turnaround times and lower administrative overhead.

Cross-platform availability on iOS, Android, and PWA ensured broad accessibility and quicker user adoption. The intuitive interface cut onboarding time significantly, enabling employees to become fully productive within minutes instead of hours. Automated checks and consolidated dashboards strengthened financial oversight, helping managers make timely decisions and maintain compliance without operational friction.

Early usage patterns indicate measurable improvements: a 38% reduction in time spent creating reports, a 42% faster approval cycle, and a 25% decrease in reimbursement delays. These efficiencies translated into better employee satisfaction and more predictable expense governance across departments.

Simple Expense now serves as a scalable foundation for modern expense operations—reducing effort, increasing accuracy, and enabling organizations to operate with clarity and control.