How Are Voice Bots in the Banking Sector Redefining Customer Service

Table of Contents

Subscribe To Our Newsletter

Banking, as we knew it, has transformed—and so have the expectations tied to it. Customers no longer tolerate to hold for long times or being transferred from department to department to get a simple question answered. Nowadays, digital-first interaction, 24*7 support and hyper-personalization are major points.

Salesforce revealed that 88% of customers believe the experience a company provides is equally as important as its products and services. This discovery has pushed towards using voice technology in banking, particularly via AI-powered voice assistants.

Voice bots are not the robotic voice menus of the past. These modern tools understand context, adapt tone, and offer support that feels genuinely human. They’re helping banks respond faster, serve smarter, and scale efficiently—all while keeping customers engaged.

“In a world where experience is the product, voice AI gives banks a chance to make every customer interaction count.”

What Is Voice AI in Banking?

Voice AI in banking is voice-enabled artificial intelligence including Agent AI, that allows customers to interact with users to interact with them using natural spoken language. These assistants leverage Conversational AI, driven by Natural Language Processing (NLP) and Machine Learning to deliver smart and human-like interactions.

Unlike old-school IVR systems that followed rigid scripts, today’s voice bots understand user intent. They don’t just hear “transfer money”—they understand which account, how much, and if it’s recurring.

Example: NatWest’s Cora is a conversational AI that engages in over 10 million conversations a year, providing dynamic responses and escalating complex queries to human agents.

How voice bots differ from chatbots:

- Voice bots process spoken words, emotional tone, and intent.

- They often integrate with voice biometrics for secure authentication.

- Voice enables faster access for people with disabilities or senior users.

Ready to Automate Your Bank’s Customer Service?

Cut costs, enhance customer experience, and boost loyalty with intelligent voice bots—deployed in weeks, not months. Let’s talk to our AI experts.

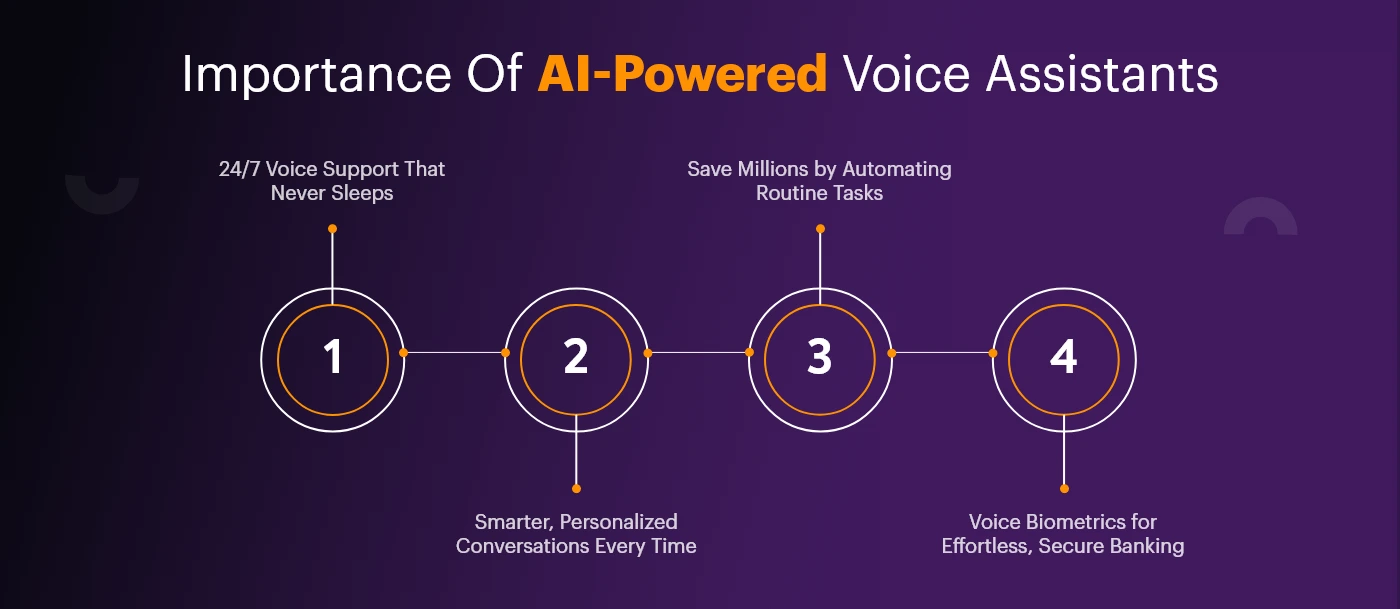

What Makes AI-Powered Voice Assistants a Game-Changer?

AI Voice bots are redefining the level of customer interaction in the banking industry. Here are the primary ways they’re changing the way bank works from reactive to proactive.

Always-On Banking Support

Banking is no longer 9 to 5. Voice bots deliver 24/7 assistance, managing tasks such as balance requests, transaction summaries and lost card reports immediately. There is no more waiting in lines and on-demand banking.

Brand in Action: Capital One’s Eno manages both chat and voice communications, providing customers with fast assistance across various channels 24/7.

Customized Proactive Chats on Every Visit

Voice bots equipped with AI customer service solutions consider past interactions, tone, and preferences in order to provide a more personalized service. Telling you when it’s time to make the next student loan payment or suggesting which credit cards to use because of your spending habits, they read as human only with much better memory.

Reduced Operational Costs

Juniper Research says banks could save $7.3 billion worldwide by 2026 with the use of voice assistants. By automating tier-1 duties, such as FAQs, status updates and application tracking, live agents are available for higher-value engagements.

Safety-First, Without the Hassle

AI-enabled voice assistants now incorporate voice biometric where users are identified by their voice. For instance, HSBC is taking voice authentication to the next level to identify customers based on more than hundred vocal features, preventing fraud and ensuring seamless logins.

How Voice AI Bots Work in Banking?

Voice AI bots in banking use a combination of Natural Language Processing (NLP), machine learning, and speech recognition to understand spoken queries, detect intent, and respond conversationally.

They connect securely to core banking systems to fetch real-time account data, authenticate users via voice biometrics, and continuously learn from interactions—becoming smarter, faster, and more intuitive with every customer conversation.

Read more: Which is Better for Your Business in 2025- Chatbots or Conversational AI?

Where Voice Bots Are Already Making Waves

Here’s a quick snapshot of how leading banks are leveraging voice AI today to improve everyday banking experiences. These real use cases prove how AI in banking customer service has deeply embedded voice bots have become in the banking ecosystem.

1. Balance Checks and Transaction History

Instead of navigating mobile banking apps, users can ask, “What was my last transaction?” and get an instant reply hands-free.

2. Loan and Credit Card Applications

Bots assist with eligibility checks, gather documentation, and even send application updates. Erica, Bank of America’s voice assistant, simplifies credit applications and savings advice in a single interface.

3. Fraud Alerts and Blocking

When suspicious activity is detected, bots instantly notify users and guide them to freeze cards, verify purchases, or escalate fraud claims.

4. Complaint Resolution and Escalations

Voice bots resolve basic complaints (like incorrect charges or password resets) and seamlessly hand off to agents when human judgment is needed.

5. Smart Financial Advice

AI bots analyze financial behavior and suggest smarter investment options, saving plans, or offers—like an intelligent financial coach.

Voice AI vs Traditional AI Help Desk Systems

This comparison breaks down the unique advantages of voice-driven experiences versus traditional help desk systems. If you’re planning to invest in a solution, this quick overview will help guide your decision.

| Feature | Voice AI | Traditional Help Desk AI |

| Mode of Interaction | Spoken, hands-free | Text-based, typed |

| Accessibility | Ideal for seniors & visually impaired | Less accessible |

| Response Speed | Real-time voice responses | Delayed by typing |

| Best Use Cases | FAQs, transactions, balance checks | Document-heavy queries, technical cases |

| Integration with IoT/Devices | High (smartphones, smart speakers) | Moderate |

“Voice is becoming the new computing interface.” — Satya Nadella

Banks that recognize this shift early will remain steps ahead in customer experience.

What Powers Conversational AI in Banking?

Conversational AI is reshaping banking industry. The intelligence of voice bots comes from a blend of technologies:

- Natural Language Processing (NLP): Understands grammar, context, and intent

- Machine Learning: Learns from each interaction to improve future conversations

- Voice Biometrics: Authenticates users securely using vocal signatures

- CRM Integration: Pulls user data for personalized service

- Banking Core Integration: Accesses real-time account and transaction data

Popular platforms:

- Google Dialogflow – Used by HDFC and many Tier-1 banks

- Amazon Lex – Powering Capital One’s voice assistant

- IBM Watson – Deployed by Royal Bank of Scotland (RBS)

Banks Using Conversational AI Have Seen Upto 35% Drop in Support Costs and 2x Faster Query Resolution.

Codiant Can Help You Achieve These Results. Book Free AI Consultation Today

Challenges and Considerations During Implementation of Voice Bots in Banking

Even with all its advantages, implementing voice bots in banking comes with real-world challenges:

- Accent and Language Variations: Regional accents and multilingual populations can reduce recognition accuracy. Ongoing NLP training is required.

- Data Privacy: Voice recordings need secure handling to comply with GDPR, HIPAA, or local banking norms.

- Legacy System Integration: Old core banking systems may not integrate easily with modern voice APIs.

- User Trust: Some customers are hesitant to share sensitive data with bots. Trust-building UX and human fallback is essential.

Voice AI Success Stories in Real World

| S.No. | Bank | Voice AI Tool | What It Does | Customer/Business Impact |

| 1 | Bank of America | Erica | Offers balance updates, bill reminders, and credit score insights. | Over 1 billion interactions. 12% rise in customer satisfaction. |

| 2 | NatWest | Cora | Handles 10M+ conversations/year and escalates to humans when needed. | Reduced call center costs by 20%. |

| 3 | HSBC | Voice ID | Verifies 15M+ customers using voice biometrics. | Blocked $400M+ in fraud. Faster login and support experience. |

| 4 | Capital One | Eno | Sends instant fraud alerts and transaction updates via chat and voice. | 35% drop in credit card-related support calls. |

What’s Next for Voice Bots in Banking?

The future of banking belongs to institutions that embrace smart automation. Banks leading the voice and AI revolution are not only building stronger customer loyalty but also redefining industry benchmarks. The next generation of customer service powered by AI will be multilingual, emotionally aware, and proactive, anticipating needs before customers even voice them. By integrating Conversational AI for Banking, financial institutions can deliver seamless, personalized experiences while streamlining operations and staying ahead in an increasingly competitive landscape.

- Gen AI Integration: AI writing impactful responses instead of selecting from scripts.

- Multilingual Support: Conversations in 10+ languages for broader audiences reach.

- Emotion Analysis: Identification of stress, urgency or satisfaction in voice tone.

- Proactive Outreach: Voice bots that remind you to pay bills, alert you of fraud exposure, or offer better loan terms.

Ready to Build Your Own Voice Bot? Partner with Codiant

Great tech is built with foresight. If you’re a bank or financial service provider looking to unlock the full potential of voice AI in banking, Codiant is your trusted technology partner. From defining your automation strategy to building a secure, scalable solution—our AI development team can help you bring your vision to life.

We specialize in:

- Voice AI bot development (NLP, ML, biometrics)

- Custom banking integrations

- UX-focused design for trust and ease

- End-to-end deployment and maintenance

Conclusion

Voice technology is no longer just a futuristic concept—it’s a practical solution driving measurable results in banking. AI-powered voice assistants enable banks to provide faster support, reduce operational costs, and deliver personalized experiences that enhance customer satisfaction and loyalty.

Codiant specializes in BFSI software solutions, helping financial institutions harness the full potential of voice technology. From streamlining customer service to automating routine tasks, these intelligent solutions empower banks to improve efficiency while creating meaningful, human-like interactions. In today’s competitive landscape, adopting AI-driven voice tools is not just an advantage—it’s a necessity for banks aiming to scale and stand out.

Frequently Asked Questions

A chatbot communicates through text and a voice bot uses spoken language. Voice bots also understand tone, emotion and vocal cues and provide a more natural, more at ease experience

The majority of the bots rely on voice biometrics, encryption and multi-factor authentication to secure the interactions and remain compliant with global regulations including but not limited to GDPR and PCI DSS.

Absolutely. Several banking bots now accommodate different languages including Spanish, Hindi, Arabic, etc. A boost from multilingual NLP models, making banking inclusive.

Voice bots can help with balance checks, transaction history inquiries, bill payments, credit applications, fraud alerts, complaint resolution and even financial advice.

Basic prototypes can be launched in 2-4 weeks and integration in core banking systems in 8-12 weeks (subject to complexity and platform).

No. They complement them. Voice bots take care of mundane questions; for more complicated or emotionally loaded situations, you’re still going to want a human on the line.

Featured Blogs

Read our thoughts and insights on the latest tech and business trends

Top iPhone App Development Companies in USA in 2026

- February 18, 2026

- Mobile App Development

In a Nutshell The USA remains one of the strongest hubs for premium iPhone app development in 2026, especially for fintech, healthcare, retail, and SaaS brands. Choosing the right iOS partner goes beyond portfolios; the... Read more

How to Choose the Right AI Development Partner in the USA (Enterprise Guide 2026)

- February 12, 2026

- Artificial Intelligence

In a Nutshell Enterprise AI success starts with clear business goals, not vague plans like “we need AI.” The best AI development partners deliver real production systems, not just impressive demos or prototypes. Industry alignment... Read more

How AI Is Transforming Transport & Logistics Operations in Real Time

- February 10, 2026

- Artificial Intelligence Logistics & Transportation

In a Nutshell: AI in transport & logistics is enabling faster, smarter decision-making across fleets, warehouses, and supply chains. Real-time logistics optimization improves route planning, dispatching, and delivery efficiency as conditions change. AI-driven forecasting and... Read more